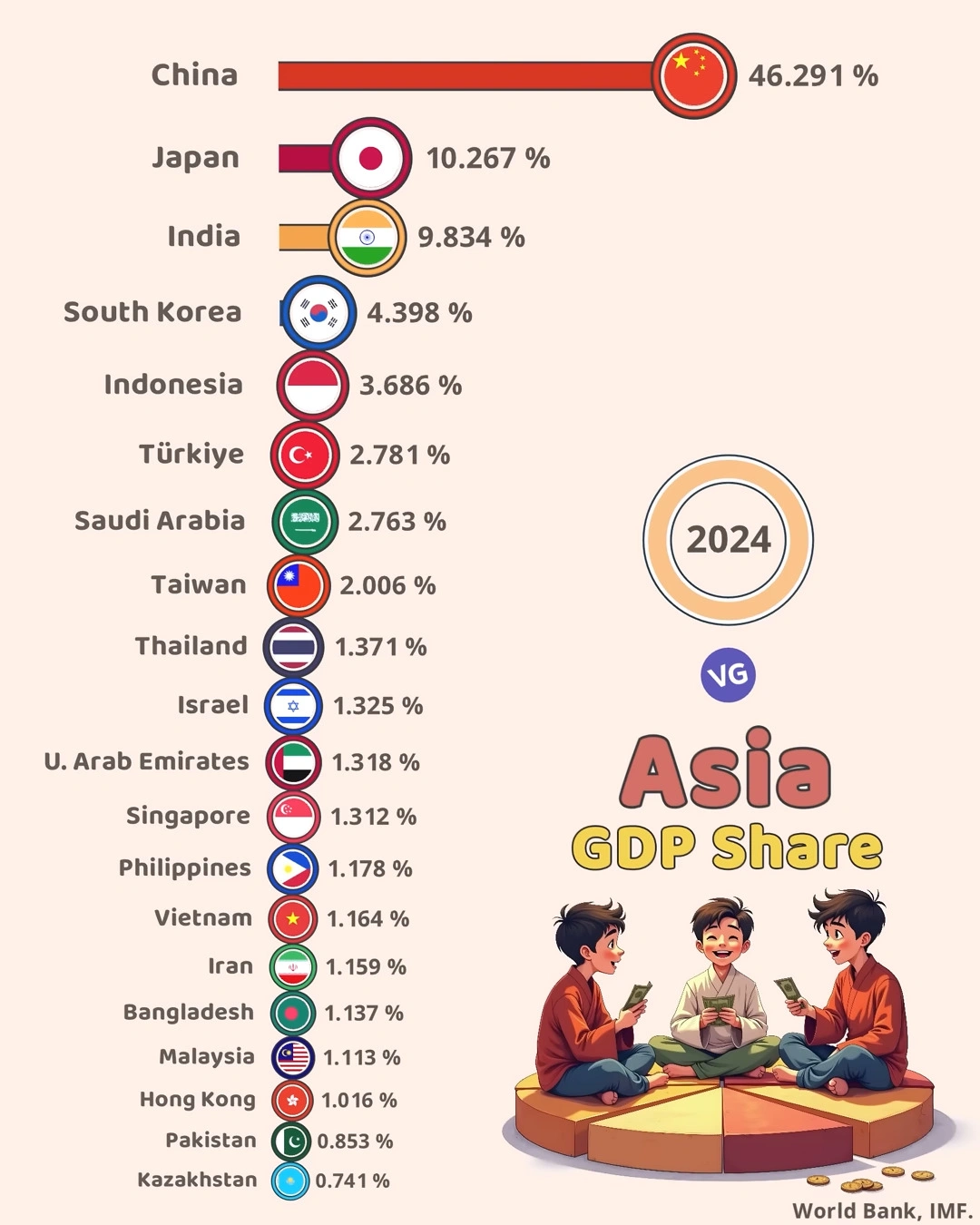

The economic landscape of Asia continues to evolve rapidly, with the region cementing its position as a critical driver of global economic growth. Recent data from the World Bank and IMF for 2024 provides a comprehensive view of how economic power is distributed across Asian nations. This analysis explores the current GDP share distribution and what it reveals about the changing dynamics of economic influence in the region.

Top 20 Largest Economies in Asia by GDP Share (2024)

| Country | Flag | GDP Share (%) |

|---|---|---|

| China | 🇨🇳 | 46.291% |

| Japan | 🇯🇵 | 10.267% |

| India | 🇮🇳 | 9.834% |

| South Korea | 🇰🇷 | 4.398% |

| Indonesia | 🇮🇩 | 3.686% |

| Türkiye | 🇹🇷 | 2.781% |

| Saudi Arabia | 🇸🇦 | 2.763% |

| Taiwan | 🇹🇼 | 2.006% |

| Thailand | 🇹🇭 | 1.371% |

| Israel | 🇮🇱 | 1.325% |

| UAE | 🇦🇪 | 1.318% |

| Singapore | 🇸🇬 | 1.312% |

| Philippines | 🇵🇭 | 1.178% |

| Vietnam | 🇻🇳 | 1.164% |

| Iran | 🇮🇷 | 1.159% |

| Bangladesh | 🇧🇩 | 1.137% |

| Malaysia | 🇲🇾 | 1.113% |

| Hong Kong | 🇭🇰 | 1.016% |

| Pakistan | 🇵🇰 | 0.853% |

| Kazakhstan | 🇰🇿 | 0.741% |

China’s Dominant Economic Position

China stands as the undisputed economic giant in Asia, commanding an impressive 46.291% of the region’s total GDP. This dominant position highlights China’s transformation over the past few decades from an emerging economy to the primary economic engine of Asia. With nearly half of the region’s economic output concentrated in a single country, China’s economic policies, growth trajectory, and trade relationships have profound implications not just for Asia but for the global economy.

The Established Economic Powers

Japan maintains its position as the second-largest economy in Asia with a 10.267% share of regional GDP. Despite decades of economic stagnation challenges, Japan remains a crucial player with significant influence in high-value industries, technological innovation, and international trade.

India follows closely behind Japan with a 9.834% share, reflecting its continued growth as an emerging economic powerhouse. The narrow gap between Japan and India suggests a potential shift in ranking in the coming years if current growth trajectories continue.

The Tiger Economies and Middle Powers

South Korea (4.398%), Indonesia (3.686%), Türkiye (2.781%), and Saudi Arabia (2.763%) represent the next tier of economic influence in Asia. These economies have established themselves as important regional players with significant industrial capacity, growing consumer markets, and increasing global economic integration.

Taiwan’s 2.006% share highlights its outsized importance in global supply chains, particularly in semiconductor manufacturing, despite its relatively small physical size compared to other economies on the list.

Emerging and Specialized Economies

The data reveals a cluster of countries with GDP shares between 1-2%, including Thailand (1.371%), Israel (1.325%), UAE (1.318%), and Singapore (1.312%). These economies have often specialized in specific sectors—from Thailand’s manufacturing and tourism to Singapore’s financial services and high-tech industries—allowing them to maintain significant regional influence despite smaller population bases.

The Growth Potentials

The lower portion of the list includes rapidly developing economies such as Vietnam (1.164%), Bangladesh (1.137%), and Pakistan (0.853%). These countries represent significant growth potential due to their large populations, increasing industrial capacity, and improving integration into global value chains.

Regional Implications and Future Outlook

The distribution of economic power across Asia reflects both historical development patterns and recent economic transformations. The concentration of nearly 70% of Asia’s GDP among just the top four economies (China, Japan, India, and South Korea) underscores the economic gravity these nations exert on regional and global affairs.

Looking forward, several trends merit attention. The continued rise of India, potential economic integration developments across Southeast Asia, and the economic impact of advanced technology sectors could all reshape this distribution in the coming decades. Additionally, countries focusing on sustainable development and digital economy transitions may find new avenues for economic growth that could alter their positions relative to more traditional industrial powers.

The 2024 GDP share distribution provides not just a snapshot of current economic realities in Asia but offers insights into how the world’s most populous and economically dynamic region continues to evolve in its economic influence and development.

Sources: World Bank, IMF