The global cobalt market is led by a few countries, with the Democratic Republic of Congo (DRC) at the top. It produces a huge 70% of the world’s cobalt1. In 2023, mines like Kisanfu and Metalkol RTR in the DRC made over 134 thousand tonnes of cobalt2. Other big producers include Russia, Australia, the Philippines, and Canada, all key in meeting global demand.

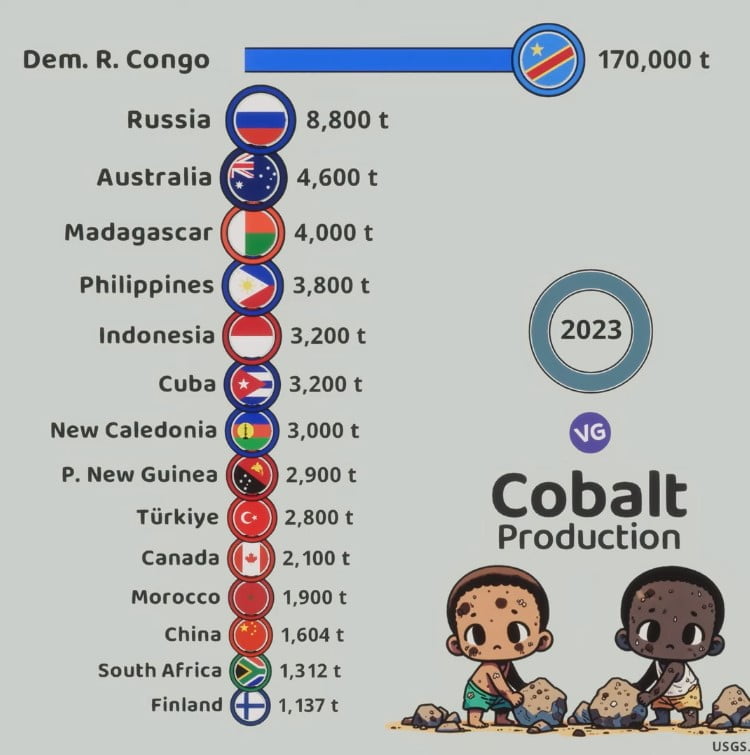

Biggest Cobalt Producers in the World 2023

| Flag | Country/Region | Cobalt Production (tonnes) |

|---|---|---|

| 🇨🇩 | Democratic Republic of Congo | 170,000 |

| 🇷🇺 | Russia | 8,800 |

| 🇦🇺 | Australia | 4,600 |

| 🇲🇬 | Madagascar | 4,000 |

| 🇵🇭 | Philippines | 3,800 |

| 🇮🇩 | Indonesia | 3,200 |

| 🇨🇺 | Cuba | 3,200 |

| 🇳🇨 | New Caledonia | 3,000 |

| 🇵🇬 | Papua New Guinea | 2,900 |

| 🇹🇷 | Türkiye | 2,800 |

| 🇨🇦 | Canada | 2,100 |

| 🇲🇦 | Morocco | 1,900 |

| 🇨🇳 | China | 1,604 |

| 🇿🇦 | South Africa | 1,312 |

| 🇫🇮 | Finland | 1,137 |

Key Takeaways

- The Democratic Republic of Congo (DRC) dominates the global cobalt production, accounting for over 70% of the world’s supply.

- Major cobalt mines in the DRC, such as Kisanfu, Metalkol RTR, and Tenke Fungurume, produced over 134 thousand tonnes of cobalt in 2023.

- Other significant cobalt producers include Russia, Australia, the Philippines, Cuba, Madagascar, Papua New Guinea, and Canada.

- Cobalt is a critical metal used in the manufacture of electronics and electric vehicle batteries, making the top producing countries crucial players in the global supply chain.

- Understanding the distribution of cobalt production globally is essential for businesses and industries reliant on this strategic mineral.

Democratic Republic of Congo: The Cobalt Powerhouse

The Democratic Republic of Congo (DRC) is the top producer of cobalt, making over 70% of the world’s supply3. The cobalt industry in the DRC is worth billions of dollars and is set to grow even more by 20303. This growth is mainly because of the increasing demand for electric vehicles, which need cobalt for their batteries3.

Cobalt Production in 2023 (tonnes)

Source: USGS

.

Largest Cobalt Mines and Operations

In the DRC, some of the biggest cobalt mines are found, like the Kisanfu Mine, Metalkol RTR Project, and Tenke Fungurume Mine3. These mines play a big role in the DRC’s leading position in the global cobalt market, meeting a lot of the world’s cobalt needs.

Artisanal Mining and Its Challenges

The DRC also has a big artisanal mining sector, making up 15-30% of its cobalt production3. But, this sector faces big challenges like dangerous working conditions, low pay, and exposure to harmful substances. It often takes advantage of the economic struggles of Congolese people3.

China’s Influence on Congolese Cobalt Trade

China plays a big role in the DRC’s cobalt trade, aiming to get a steady supply for its battery industry3. The low cobalt prices are partly due to the use of forced labor in the DRC’s cobalt mines3.

The DRC’s cobalt is crucial for the global shift to green energy. But, its mining sector has faced conflict, instability, and human rights issues. These problems need to be solved for a fair and sustainable cobalt supply chain4.

“The lives of Congolese individuals working in the cobalt industry are often marked by hazardous conditions, low wages, and exposure to toxic substances.”

Russia: A Distant Second

The Democratic Republic of Congo (DRC) leads the world in cobalt production. Russia comes in second, producing about 4% of the world’s cobalt in 2019, or 6,100 metric tons5. Most of Russia’s cobalt is found in the Altai Republic, especially in the Karakul deposit, one of its biggest sources5.

Norilsk Nickel is Russia’s top cobalt producer5. The company mines in the Norilsk region, a key mining area in Siberia, greatly adds to Russia’s cobalt output5.

Major Cobalt Deposits and Mines

- Karakul Cobalt Deposit: A major cobalt source in Russia, found in the Altai Republic.

- Norilsk Nickel Cobalt Operations: The company’s work in the Norilsk region is a big part of Russia’s cobalt production.

“Russia’s cobalt production, while significant, remains dwarfed by the DRC’s dominance in the global market. The country’s mining industry continues to explore and develop new cobalt projects to enhance its position in the growing demand for this critical metal.”

| Mine | Cobalt Production (thousand tonnes, 2020) |

|---|---|

| Metalkol RTR Project, DRC | 42.576 |

| Mashamba East Mine, DRC | 18.2756 |

| Sicomines Copper-Cobalt Mine, DRC | 16.8966 |

| KOV Mine, DRC | 16.4796 |

| Tenke Fungurume Mine, DRC | 15.4366 |

Australia: Tapping into Significant Reserves

Australia is a key player in the cobalt mining world, ranking third globally and having the second-largest cobalt reserves7. In 2019, it produced 5,100 metric tons, or 3.6%, of the world’s cobalt7. With vast reserves of 1.2 million metric tons, Australia is set to boost its cobalt production in the future7.

The demand for cobalt is expected to grow fourfold by 2040, showing huge potential in this field7. To hit the 2050 target, we’ll need 17 new cobalt mines worldwide7. Australia’s rich reserves and investments in critical minerals make it a key player in meeting this demand7.

Today, Australia has 81 major critical mineral projects worth up to $42 billion, showing its commitment to its reserves7. Processing more of these resources could boost the economy by $133.5 billion and create 262,600 jobs by 20408.

But, Australia faces hurdles, like China’s control of rare earths and its large purchase of Australian spodumene last year, up 28.5% from before7. Developing domestic processing is key for Australia to use its cobalt reserves and grow economically8.

As global demand for critical minerals grows, Australia’s cobalt reserves and strategic position offer a big chance for it to lead in the cobalt mining industry78.

Glencore’s Murrin-Murrin: Australia’s Cobalt Giant

Glencore’s Murrin-Murrin mine is in Western Australia and is the biggest cobalt mine there. In 2023, it made about 13.87 thousand metric tons of cobalt. This makes it a big part of Australia’s cobalt production9. Glencore runs the mine and follows the OECD’s rules for responsible minerals9.

The mine uses a special way to get cobalt from pyrite. This method cuts costs and helps the environment by not making acidic waste10. This method is unique because most cobalt isn’t taken out as the main product10.

About 16% of the world’s cobalt is in Australia, but it only makes 5% of the world’s cobalt10. Australia wants to be a big player in the cobalt market. It plans to refine cobalt from different projects, like the Broken Hill area. This area will make about 4,000 tonnes of cobalt a year for over 20 years10.

| Metric | Value |

|---|---|

| Cobalt makes up of the earth’s crust | 0.001% |

| GM’s planned EV production capacity by 2025 | 1 million units |

| Glencore’s net zero emissions target | 2050 |

| Glencore’s global workforce (including contractors) | 135,000 people |

Glencore’s Murrin-Murrin shows Australia’s growing role in the cobalt industry. By refining cobalt locally, Australia aims for ethical sourcing and clear supply chains10.

“Glencore is a leading producer, recycler, and supplier of future-facing commodities like cobalt.”

Philippines: A Cobalt Mining Hotspot

The Philippines is a big name in global cobalt mining, ranking fourth in the world11. In 2017, it produced 4,000 metric tons of cobalt, making up 3.3% of global production11. It also has the fourth-largest cobalt reserves, with 260,000 metric tons11.

Key Cobalt Projects and Exploration Activities

The Philippines is home to major cobalt projects and exploration efforts. The Adlay-Cagdianao-Tandawa Project and the Agata DSO open-cut project stand out11. These projects, along with others, are making the Philippines a key spot for cobalt mining11.

Recently, cobalt production in the Philippines saw a slight drop in 2017. This was due to environmental concerns leading to mine closures11. Yet, the country’s large cobalt reserves and ongoing exploration hint at a bright future for the industry11.

“The Philippines’ cobalt mining industry is poised for growth, with key projects and exploration activities driving the country’s position as a global cobalt producer.”

The growing need for cobalt, fueled by electric vehicles and renewable energy, puts the Philippines in a strong spot12. It’s well-placed to meet the world’s increasing demand for cobalt.

Cuba: Nickel and Cobalt Tandem

Cuba is the fifth-largest cobalt producer worldwide, making 3,500 metric tons or 2.5% of the world’s total in 201913. It has the third-largest cobalt reserves, with 500,000 metric tons mainly in the Moa region13.

The Moa Region: Cuba’s Cobalt Heartland

The Moa region is in northeast Cuba and is key to its cobalt production. Sherritt International and Cuba’s General Nickel Company work together here. They mine cobalt and nickel1314.

Cobalt is vital for rechargeable batteries, making up 56% of global use in 202114. With more electric vehicles and gadgets needed, Cuba’s cobalt is becoming more important14.

Global cobalt production jumped over seven times from 2008 to 201513. Cuba is set to play a bigger role in the cobalt market as demand grows14.

Madagascar: The Ambatovy Project

Madagascar is a key player in global cobalt production. In 2019, it produced 3,300 metric tons of cobalt, making up 2.4% of the world’s total15. The Ambatovy nickel and cobalt project is central to this success. It’s a joint effort by Japanese and Korean companies, the biggest investment in Madagascar16.

The Ambatovy mine is in central-eastern Madagascar. It’s a huge project, costing over £6 billion ($8 billion). It can produce 60,000 tonnes of nickel, 5,600 tonnes of cobalt, and 210,000 tonnes of fertilizer every year16. The mine has huge reserves, with 152.1 million tonnes of minerals. This includes 1.42 million tonnes of nickel and over 120,000 tonnes of cobalt16.

Ambatovy has a big impact on Madagascar’s economy. It made up 35% of the country’s foreign investment from 2006 to 201215. In 2022, it paid $44 million in taxes and spent $340 million locally, boosting the economy15. The mine also employs 10,000 people, with 8,000 being locals, and gives 27% of the country’s tax revenue15.

However, the project faces challenges. It has affected 1,600 hectares of rainforest, showing the need for balance between growth and protecting nature15. Ambatovy is working to offset the environmental impact, making it a leader in sustainable mining15.

The Ambatovy project is vital for Madagascar’s cobalt production and showcases the country’s mineral riches. It’s committed to sustainability and has a big economic impact, setting a standard for responsible mining in the area151617.

Papua New Guinea’s Ramu Nickel and Cobalt Operation

Papua New Guinea is known for its rich natural resources. The Ramu nickel and cobalt operation is a big part of this. It’s a joint effort between China’s Metallurgical Corporation (MCC) and Canada’s Nickel 28 Capital Corp. This project is important in the global market for cobalt and nickel.

In 2023, the Ramu operation made 33,604 tonnes of nickel and 3,072 tonnes of cobalt. This was more than its design capacity for the seventh year in a row18. But, the operation faced problems in the second half of the year. Earthquakes caused over seven lost production days18.

For 2024, the Ramu project plans to make about 30,000 tonnes of nickel and 2,700 tonnes of cobalt in MHP18. To boost production and reliability, MCC will spend $33-million on upgrades in 2024. This will mean a 30-day plant shutdown in September18.

Nickel 28 Capital Corp, the Canadian partner, owns an 8.56% stake in the Ramu Nickel-Cobalt Operation18. The company expects to produce 30,000 tonnes of contained nickel in MHP in 2024. They plan for cash costs between $2.50-$3.50 per pound of nickel. Nickel prices are expected to stay at or above $8.00 per pound for the year19.

The success of the Ramu project shows the value of the partnership between MCC and Nickel 28. They aim to improve production and overcome challenges18. With its large reserves of nickel and cobalt, the Ramu project is set to meet global demand for these minerals20.

“The Ramu operation has been a reliable and consistent contributor to Papua New Guinea’s mineral production, and we are committed to ensuring its long-term sustainability and growth.”

– A spokesperson from the Metallurgical Corporation of China

Canada: Seeking Domestic Cobalt Supply

The demand for cobalt is rising fast, thanks to electric vehicles21. Canada is becoming a key player in the cobalt market. It has big cobalt reserves, making it a great place for investment22.

Major Cobalt Mines and Projects

Canada’s cobalt comes from big mines like Glencore’s Voisey’s Bay, Raglan, Thompson, and Fraser21. These mines help Canada rely less on foreign cobalt. This move is key to having a steady supply of this important mineral23.

The Voisey’s Bay mine in Newfoundland is a big part of Canada’s cobalt production. It also gets nickel21. The Raglan mine in Quebec, the Thompson mine in Manitoba, and the Fraser mine in Ontario are also vital. They help grow Canada’s cobalt reserves and production21.

By 2030, the world will need more cobalt, with electric vehicles using 40% of it21. Canada is focusing on its cobalt to support the clean energy shift22.

“Canada’s Critical Minerals Strategy, started in December 2022, has $3.8 billion in federal funding. It aims to speed up regulations and ensure mining is done sustainably.”22

Canada is stepping up its game in cobalt production with strategic investments and policies23. This makes Canada a key player in the global cobalt market.

biggest cobalt producers in the world

The Democratic Republic of Congo (DRC) leads the world in cobalt production, producing 73% of the world’s cobalt in 2022, about 145,000 tonnes24. This country is crucial for the electric vehicle (EV) industry, which uses about 40% of the world’s cobalt2425.

Russia is the second-biggest producer, making 6,100 tonnes, or 4.4% of the world’s cobalt24. Australia comes next with 5,100 tonnes, followed by the Philippines, Cuba, Madagascar, and Papua New Guinea24.

Indonesia is growing fast, increasing its cobalt production to nearly 9,500 tonnes in 2022, up from 2,700 tonnes the year before24. This growth has made Indonesia a key player in the global cobalt market, with plans to expand even more by 203024.

The demand for cobalt is expected to double by 2030, reaching 388,000 tonnes2425. This increase is mainly because of the EV industry. This will change the cobalt market, bringing new challenges and opportunities for producers and consumers2425.

| Country | Cobalt Production (Metric Tons) | Percentage of Global Production |

|---|---|---|

| Democratic Republic of Congo | 145,000 | 73% |

| Russia | 6,100 | 4.4% |

| Australia | 5,100 | 3.6% |

| Philippines | 4,600 | 3.3% |

| Cuba | 3,500 | 2.5% |

| Madagascar | 3,300 | 2.4% |

| Papua New Guinea | 3,100 | 2.2% |

| Canada | 3,000 | 2.1% |

“Cobalt is expected to stay important in battery production, despite efforts to use less because of human rights issues in the DRC.”24

The cobalt market is complex and changing fast. The DRC’s lead, Indonesia’s growth, and the industry’s expansion will shape the future of cobalt242526.

Conclusion

Cobalt is a key metal as we move towards more electric and renewable energy27. Most cobalt comes from the Democratic Republic of Congo (DRC), which has a lot of cobalt reserves27. By 2035, cobalt use is expected to jump from 100,000 tons to 660,000 tons, mainly for electric vehicle batteries27.

The DRC, Russia, Australia, Philippines, Cuba, Madagascar, and Papua New Guinea are big cobalt producers28. Over 70 percent of global cobalt comes from the DRC, with a big part coming from small-scale mining28. Knowing who makes the world’s cobalt is key as demand keeps going up.

This article talked about the challenges in getting cobalt, like human rights issues in the DRC and unclear rules for small-scale mining28. Working together and setting clear standards is important for ethical cobalt production and trade28. As we use more cobalt, getting it in a sustainable and ethical way is crucial for our energy future29.

FAQ

What are the top cobalt-producing countries in the world?

The top cobalt producers are:

– Democratic Republic of Congo

– Russia

– Australia

– Philippines

– Cuba

– Madagascar

– Papua New Guinea

– Canada

What is the Democratic Republic of Congo’s role in global cobalt production?

The Democratic Republic of Congo (DRC) leads in cobalt production, making over 70% of the world’s cobalt. Key mines include the Kisanfu Mine, Metalkol RTR Project, and Tenke Fungurume Mine.

What are the challenges associated with cobalt mining in the DRC?

The DRC’s artisanal mining adds 15-30% to cobalt production, raising safety and environmental concerns. China is a big player in the Congolese cobalt trade, aiming to secure supplies for its battery industry.

How does Russia rank among the world’s cobalt producers?

Russia is a major producer, after the DRC, making about 4% of the world’s cobalt in 2019. Most of its cobalt is found in the Altai Republic, especially in the Karakul deposit.

What is Australia’s position in the global cobalt landscape?

Australia is the third largest producer, making 5,100 metric tons or 3.6% of the world’s cobalt in 2019. It has the second largest cobalt reserves at 1.2 million metric tons.

What is the significance of Glencore’s Murrin-Murrin mine in Australia?

Glencore’s Murrin-Murrin mine in Western Australia is a key cobalt producer. It produced 13.87 thousand metric tons of cobalt in 2023, boosting Australia’s cobalt output significantly.

How does the Philippines rank among the world’s cobalt producers?

The Philippines is the fourth largest producer, making 4,600 metric tons or 3.3% of the world’s cobalt in 2019. Key projects include the Adlay-Cagdianao-Tandawa Project and the Agata DSO open-cut project.

What is Cuba’s role in the global cobalt market?

Cuba is the fifth largest producer, making 3,500 metric tons or 2.5% of the world’s cobalt in 2019. Most of its cobalt reserves are in the Moa region, with 500,000 metric tons.

What is the significance of the Ambatovy project in Madagascar?

Madagascar is a significant producer, making 3,300 metric tons of cobalt in 2019. The Ambatovy project is a major mining venture, a joint effort by Japanese and Korean companies.

How does Papua New Guinea contribute to global cobalt production?

Papua New Guinea is the seventh largest producer, making 3,100 metric tons of cobalt in 2019. The Ramu nickel and cobalt operation is its main source, run by China’s Metallurgical Corporation and Canada’s Nickel 28.

What is Canada’s role in the global cobalt market?

Canada is the eighth largest producer, making 3,000 metric tons of cobalt in 2019. Despite having 230,000 metric tons of reserves, major mines like Glencore’s Voisey’s Bay and Raglan are key contributors.

Source Links

- Profiling the world’s eight largest cobalt-producing countries – https://www.nsenergybusiness.com/analysis/top-cobalt-producing-countries/

- The world’s ten largest cobalt mines – https://www.mining-technology.com/marketdata/ten-largest-cobalts-mines/

- The fight for Congo’s cobalt – https://www.npr.org/2024/04/26/1247561392/the-fight-for-congos-cobalt

- In Congo, Peace Means a Halt to ‘Brutal, Illegal Mining’ – https://www.usip.org/publications/2024/03/congo-peace-means-halt-brutal-illegal-mining

- Global cobalt mining: an outlook to 2030 – Mine | Issue 139 | April 2024 – https://mine.nridigital.com/mine_apr24/cobalt-mining-outlook-2030

- World’s ten largest cobalt mines in 2020 – https://www.mining-technology.com/marketdata/ten-largest-cobalts-mines-2020-2/

- Leveraging Australia’s alliances on critical minerals | The Strategist – https://www.aspistrategist.org.au/leveraging-australias-alliances-on-critical-minerals/

- From ground to growth: Australia’s strategic stake in the world’s critical minerals supply – https://www.csiro.au/en/news/All/Articles/2024/March/Critical-Minerals-Hub-update

- GM and Glencore Enter Multi-Year Cobalt Supply Agreement – https://news.gm.com/newsroom.detail.html/Pages/news/us/en/2022/apr/0412-glencore.html

- Australia cashes in on cobalt – https://www.mining-technology.com/features/australia-cashes-in-on-cobalt/

- Top Cobalt Production by Country – https://web.i2massociates.com/resource_detail.php?resource_id=8306

- Green Conflict Minerals – https://www.iisd.org/story/green-conflict-minerals/

- How the race for cobalt risks turning it from miracle metal to deadly chemical – https://www.theguardian.com/global-development/2019/dec/18/how-the-race-for-cobalt-risks-turning-it-from-miracle-metal-to-deadly-chemical

- Cobalt industry to get a big boost from the shift to a green economy – report – https://www.mining.com/cobalt-industry-to-get-a-big-boost-from-the-shift-to-a-green-economy-report/

- Ambatovy mine – https://en.wikipedia.org/wiki/Ambatovy_mine

- Ambatovy Nickel-Cobalt Project – https://www.nsenergybusiness.com/projects/ambatovy-nickel-cobalt-project/

- Major Mines & Projects | Ambatovy Mine – https://miningdataonline.com/property/1000/Ambatovy-Mine.aspx

- Nickel 28 Capital produces 33,604 tonnes nickel in 2023 at Ramu, Papua New Guinea – Resource World Magazine – https://resourceworld.com/nickel-28-capital-produces-33604-tonnes-nickel-in-2023-at-ramu-papua-new-guinea/

- Nickel 28 Releases Ramu Q1 2024 Operating Performance – https://www.juniorminingnetwork.com/junior-miner-news/press-releases/2736-tsx-venture/nkl/160911-nickel-28-releases-ramu-q1-2024-operating-performance.html

- Major Mines & Projects | Ramu Mine – https://miningdataonline.com/property/3323/Ramu-Mine.aspx

- PDF – https://www.cobaltinstitute.org/wp-content/uploads/2023/05/Cobalt-Market-Report-2022_final-1.pdf

- Hot rocks: Advancing Canada’s Critical Minerals Strategy – Connect2Canada – https://connect2canada.com/2024/02/advancing-canadas-critical-minerals-strategy/

- Building Larger and More Diverse Supply Chains for Energy Minerals – https://www.csis.org/analysis/building-larger-and-more-diverse-supply-chains-energy-minerals

- Ranked: The world’s top cobalt producing countries – https://www.mining.com/web/ranked-the-worlds-top-cobalt-producing-countries/

- 10 Largest Cobalt Mining Companies and Their Mines in the World – https://finance.yahoo.com/news/10-largest-cobalt-mining-companies-211117824.html

- PDF – https://www.land-links.org/wp-content/uploads/2021/11/USAID_GM_Cobalt.pdf

- Infrastructure Podcast | Cobalt and the Energy Transition – https://www.worldbank.org/en/news/podcast/2022/04/13/cobalt-market-dynamics-and-the-energy-transition

- Why Cobalt Mining in the DRC Needs Urgent Attention – https://www.cfr.org/blog/why-cobalt-mining-drc-needs-urgent-attention

- PDF – https://www.cobaltinstitute.org/wp-content/uploads/2021/05/CobaltInstitute_Market_Report_2020_1.pdf