The European inflation scene has seen a big change in 2024. The euro area’s inflation rate went up from 1.7% to 2.0% in October. This small but important change shows how the economy is changing and affecting people’s lives.

The inflation rates in Europe in 2024 show a complex economic picture. The European Union’s inflation rate went from 2.1% to 2.3% in October. This shows the economy is still adjusting. Compared to last year, prices are not rising as fast, which is a good sign.

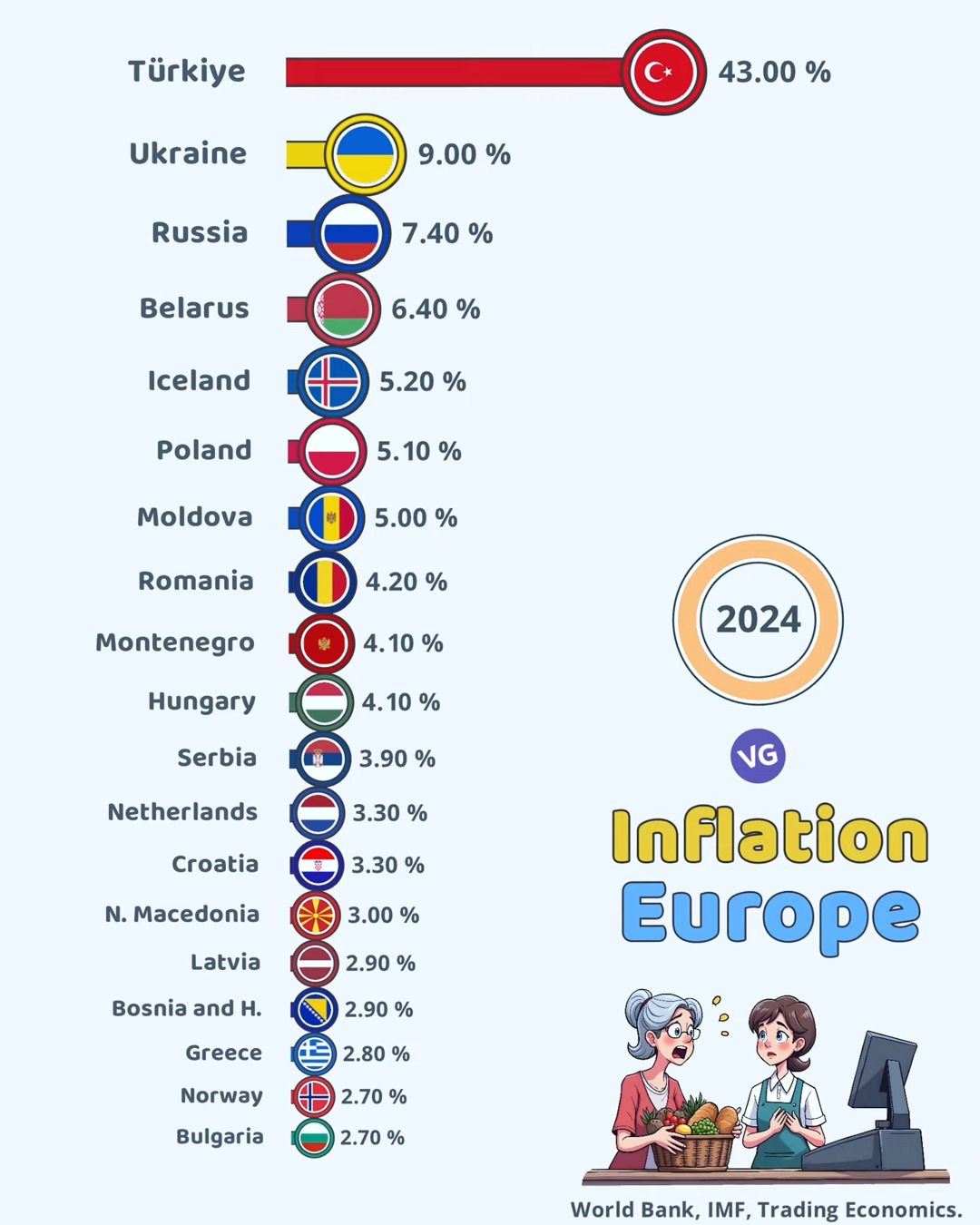

European Inflation Rates (2024)

| Flag | Country | Inflation Rate |

|---|---|---|

| 🇹🇷 | Türkiye | 43.00% |

| 🇺🇦 | Ukraine | 9.00% |

| 🇷🇺 | Russia | 7.40% |

| 🇧🇾 | Belarus | 6.40% |

| 🇮🇸 | Iceland | 5.20% |

| 🇵🇱 | Poland | 5.10% |

| 🇲🇩 | Moldova | 5.00% |

| 🇷🇴 | Romania | 4.20% |

| 🇲🇪 | Montenegro | 4.10% |

| 🇭🇺 | Hungary | 4.10% |

| 🇷🇸 | Serbia | 3.90% |

| 🇳🇱 | Netherlands | 3.30% |

| 🇭🇷 | Croatia | 3.30% |

| 🇲🇰 | N. Macedonia | 3.00% |

| 🇱🇻 | Latvia | 2.90% |

| 🇧🇦 | Bosnia and H. | 2.90% |

| 🇬🇷 | Greece | 2.80% |

| 🇳🇴 | Norway | 2.70% |

| 🇧🇬 | Bulgaria | 2.70% |

Looking at different parts of Europe, we see a varied picture. Some places, like Slovenia, had no inflation at all. But others, like Romania, saw prices go up by 5.0%. This shows how different the economic situations are in different areas.

Looking at what drives inflation, we find interesting facts. Services had the biggest impact, adding 1.77 percentage points to inflation. Food, alcohol, and tobacco added 0.56 percentage points. Non-energy industrial goods added a small 0.13 percentage points.

The data shows a lively economic scene where inflation rates are always changing. This brings both challenges and chances for those making economic decisions. It’s important to understand these changes to plan and make smart choices.

Current State of European Inflation in 2024

The European inflation scene in 2024 shows a mix of economic health across countries. Knowing these inflation rates helps us see how well the continent’s economy is doing and how much people can buy.

Euro Area Annual Inflation Overview

The euro area saw inflation rates slowly drop in 2024. Here are some important numbers:

- September 2024 annual inflation rate: 1.7%

- August 2024 annual inflation rate: 2.2%

- September 2023 inflation rate: 4.3%

EU Member States Inflation Variations

| Lowest Inflation Rates | Highest Inflation Rates |

|---|---|

| Ireland: 0.0% | Romania: 4.8% |

| Lithuania: 0.4% | Belgium: 4.3% |

| Slovenia: 0.7% | Poland: 4.2% |

Key Contributing Factors to Inflation Rates

Several sectors played a big role in European inflation in 2024:

- Services: Contributed +1.76 percentage points

- Food, Alcohol & Tobacco: Added +0.47 percentage points

- Non-Energy Industrial Goods: Contributed +0.12 percentage points

- Energy: Decreased inflation by -0.60 percentage points

“The diversity of European inflation rates underscores the complex economic dynamics across different member states.” – Economic Research Institute

The data shows a trend of stabilizing inflation, with most countries seeing rates go down in 2024.

European Inflation Rates 2024: Country-by-Country Analysis

The European inflation rates in 2024 show a mix of highs and lows across countries. It’s important to understand these differences to grasp the economic situation in the region.

Let’s look at the inflation rates in European countries:

- Romania has the highest rate at 4.8%

- Belgium is close behind with 4.3%

- Poland keeps a steady 4.2% rate

Some countries have very low inflation rates:

- Ireland has a surprising 0.0% rate

- Lithuania has 0.4%

- Slovenia and Italy both have 0.7%

| Country | Inflation Rate (%) | Trend |

|---|---|---|

| Germany | 2.6 | Slight Increase |

| France | 1.3 | Stable |

| Italy | 0.7 | Decreasing |

| Spain | 2.8 | Moderate Growth |

The European Central Bank keeps a close eye on these changes. They understand the different economic situations in each country.

“Inflation rates show the unique economic challenges each country faces in 2024” – European Economic Analysis Group

Looking at European inflation rates in 2024, we see big differences. While 20 countries saw inflation go down, 5 saw it go up. The euro area’s inflation rate fell to 1.7% in September 2024, down from 2.2% in August.

Impact of Energy Prices on European Inflation

Energy prices are a big deal in shaping European inflation rates in 2024. The energy market’s ups and downs affect the whole economy and prices for consumers in the euro area.

Energy Price Fluctuations

In April 2024, energy prices saw a big drop, falling by -0.6%. This change shows how global politics, supply chains, and economic plans can change energy costs in Europe.

- Energy prices showed a lot of change in 2024

- The drop in energy prices means people are spending less on energy

- Global politics still affect energy markets

Contribution to Overall Inflation Rate

Energy prices have a big say in European inflation. In October 2024, energy prices cut down the euro area’s inflation rate by about -0.45 percentage points. This shows how much energy prices matter for the economy.

| Period | Energy Inflation Rate | Impact on Overall Inflation |

|---|---|---|

| August 2023 | Positive | Inflationary Pressure |

| April 2024 | -0.6% | Deflationary Trend |

Future Energy Price Projections

Experts say energy markets will stay uncertain. The euro area’s growth and energy costs are key to inflation forecasts. They think energy prices will be very important for inflation in 2025.

“Energy price volatility remains a key determinant of European inflation dynamics in 2024.” – European Economic Research Institute

Energy markets, global politics, and economic plans mean European inflation will keep changing in 2024.

Food and Consumer Goods Price Trends

In 2024, European inflation rates show big changes in food and consumer goods prices. In October 2024, food, alcohol, and tobacco added +0.53 percentage points to the euro area’s inflation rate. This shows how important these goods are to the economy.

Consumer goods prices have seen different changes in various categories:

- Total goods prices went up by 1.0% annually

- Non-durable goods prices rose by 0.9%

- Durable goods prices also increased by 1.0%

Food prices in 2024 showed different trends:

- Food prices overall went up by 2.0% from last year

- Edible fats and oils prices jumped by 10.3%

- Sugar, jam, and confectionery prices rose by 6.4%

- Dairy product prices actually fell by -2.1%

“Consumer goods pricing continues to be a critical indicator of economic health and purchasing power across European markets.” – European Economic Research Institute

The 2024 European inflation rates show that prices for consumer goods are always changing. These changes reflect the complex interactions of production costs, supply chain issues, and demand from consumers.

Services Sector Inflation Analysis

The services sector is a key player in European inflation rates for 2024. It brings complex economic issues that affect how people spend and the overall economy.

Service Price Increases

European inflation rates show a big challenge in the services sector. In October 2024, services were the main contributor to inflation, at +1.77 percentage points. The core services price inflation is expected to stay high, at a 4% annual rate in the first half of 2024.

- Services made up 70% of headline inflation since 2024’s start

- Current services inflation is more than twice the 1999-2019 historical average

- Continued high inflation momentum in services prices remains at an elevated rate of almost 5%

Regional Service Cost Variations

European regions show different patterns in service inflation. The euro zone core inflation is expected to stay above 2.5% in 2024. There are big differences in inflation rates across countries.

| Region | Services Inflation Rate | Key Characteristics |

|---|---|---|

| Germany | 2% | Cooled inflation on harmonized basis |

| Euro Zone | 4.2% | Highest level since October 2023 |

Impact on Consumer Spending

Rising service prices affect how people spend and their economic mood. Over 40% of people say inflation has gone up “a lot” in the last 12 months. This shows a big economic strain.

The persistent services inflation challenges household budgets and reshapes consumption patterns across Europe.

The European Central Bank keeps a close eye on these trends. They might adjust interest rates to control inflation in the services sector.

Comparative Analysis: Highest and Lowest Inflation Rates

The European inflation landscape in 2024 shows big differences between countries. These differences give us key insights into the EU’s economic health.

Countries with the highest annual inflation rates face unique economic hurdles:

- Romania leads with a 7.3% inflation rate

- Estonia follows at 5.0%

- Croatia records 4.8%

- Poland maintains 4.5%

On the other hand, countries with the lowest European inflation rates in 2024 show economic stability:

- Denmark and Italy at 0.9%

- Latvia, Lithuania, Finland at 1.1%

- Ireland recording an impressively low 0.0%

| Country | Inflation Rate | Economic Indicator |

|---|---|---|

| Romania | 7.3% | Highest Inflation |

| Ireland | 0.0% | Lowest Inflation |

| EU Average | 3.1% | Baseline Rate |

“The diversity in European inflation rates reflects the complex economic ecosystems across different member states.” – European Economic Research Institute

These differences come from many factors. These include monetary policies, local economic conditions, and global economic pressures. All these affect European inflation rates in 2024.

European Central Bank’s Monetary Policy Response

The European Central Bank (ECB) has a strategic plan to handle European inflation. They use careful monetary policy to tackle economic challenges. The bank has shown great flexibility in fighting inflation across the eurozone.

Policy Measures and Interventions

The ECB has taken big steps to keep inflation in check. They’ve done things like:

- Increased the deposit interest rate from -0.5% to 4% between July 2022 and September 2023

- Kept the rate at 4% for about ten months

- Lowered rates by 25 basis points in June, September, and October 2024

Interest Rate Decisions

The ECB’s interest rate strategy is complex. Headline inflation has dropped from 10.6% in October 2022 to 1.8% in September 2024. This shows their monetary policy is working well.

“Our goal is to maintain price stability while supporting economic growth,” stated an ECB spokesperson.

Future Policy Outlook

The ECB sees inflation stabilizing at or below 2% from Q4 2025. They predict:

- Headline inflation averaging 2.4% in 2024

- Core inflation falling to 2.3% in 2025

- Keeping a close eye on economic stability

The bank is dedicated to balancing monetary actions. They aim to support sustainable economic growth in Europe.

Conclusion

The European inflation story in 2024 is complex. Inflation rates have dropped a lot, from 10.6% in October 2022 to 2.6% in July 2024. But, prices at home keep going up, at 4.4%, mainly because of high service costs.

Services play a big role in inflation, making up 70% of it since early 2024. Prices in services are rising fast, at almost 5% a year. This shows the big challenge for those trying to keep prices stable in Europe.

The outlook is a bit hopeful. Inflation is seen going down, to 2.2% by 2025 and then to 1.9% by 2026. The European Central Bank is working hard to keep inflation in check while helping the economy grow.

As the European economy changes, we need to stay alert. Things like world tensions, supply chains, and wages will affect inflation. We must keep adapting and watching closely to keep the economy stable and growing.

FAQ

What is the current state of inflation in Europe for 2024?

In 2024, Europe’s inflation rates vary by country and sector. The euro area sees moderate inflation. Energy, food, and service costs are big contributors.

How are different European countries experiencing inflation differently?

Inflation rates differ across Europe. Some countries face higher inflation due to their economic situations. Others keep prices stable with smart policies.

What role do energy prices play in European inflation?

Energy prices are key in European inflation. They can change a lot, affecting prices. This volatility impacts both consumers and the economy.

How are food and consumer goods prices affecting inflation?

Food and goods prices are changing in 2024. This is due to farming, supply chains, and how people shop. These changes add to inflation in Europe.

What is the European Central Bank doing to address inflation?

The European Central Bank (ECB) is fighting inflation with smart money moves. They adjust interest rates and use special tools to keep prices stable and support growth.

Which European countries are experiencing the highest and lowest inflation rates?

Inflation rates vary across Europe. Some countries face high inflation due to their economies. Others keep prices low with good policies.

How are service sector prices impacting inflation in Europe?

The services sector is now a big part of inflation in 2024. Prices vary by region, affecting inflation rates and how people spend.

What can consumers expect regarding inflation in the near future?

Expect ongoing economic uncertainty. Inflation will likely be influenced by energy prices, global conditions, and the ECB’s policies.

How do inflation rates differ between the euro area and EU member states?

Inflation rates vary between the euro area and EU countries. Each faces unique challenges and uses different strategies to control prices.

What are the main factors contributing to inflation in Europe in 2024?

Main factors include energy price changes, food and goods costs, service sector shifts, global conditions, and the ECB’s policies.

Source Links

- Annual inflation up to 2.0% in the euro area

- Euro area annual inflation up to 2.4%

- Annual inflation down to 1.7% in the euro area

- Inflation Rate – By Country

- Inflation in the euro area

- Inflation down but euro area’s manufacturing still struggling with high energy costs – Bank of Finland Bulletin

- Annual inflation up to 2.2% in the euro area

- Inflation rate at +2.2% in 2024

- Global inflation forecast: Will prices come down in 2024?

- The euro area inflation outlook: a scenario analysis

- Euro zone inflation falls to 3-year low of 2.2%, backing September rate cut case

- Inflation in Europe: Which countries are hit the hardest?

- Country-Specific Effects of Euro-Area Monetary Policy: The Role of Sectoral Differences

- The euro area outlook and monetary policy

- Meeting of 11-12 December 2024

- Winter 2024 Economic Forecast: A delayed rebound in growth amid faster easing of inflation

- Inflation, growth and the outlook for the euro area