In today’s interconnected world, understanding the distribution of global economic power provides critical insights for investors, policymakers, and business leaders alike. Recent 2024 data from the World Bank and IMF reveals a fascinating picture of the world’s economic landscape, highlighting significant shifts and enduring patterns in global GDP distribution.

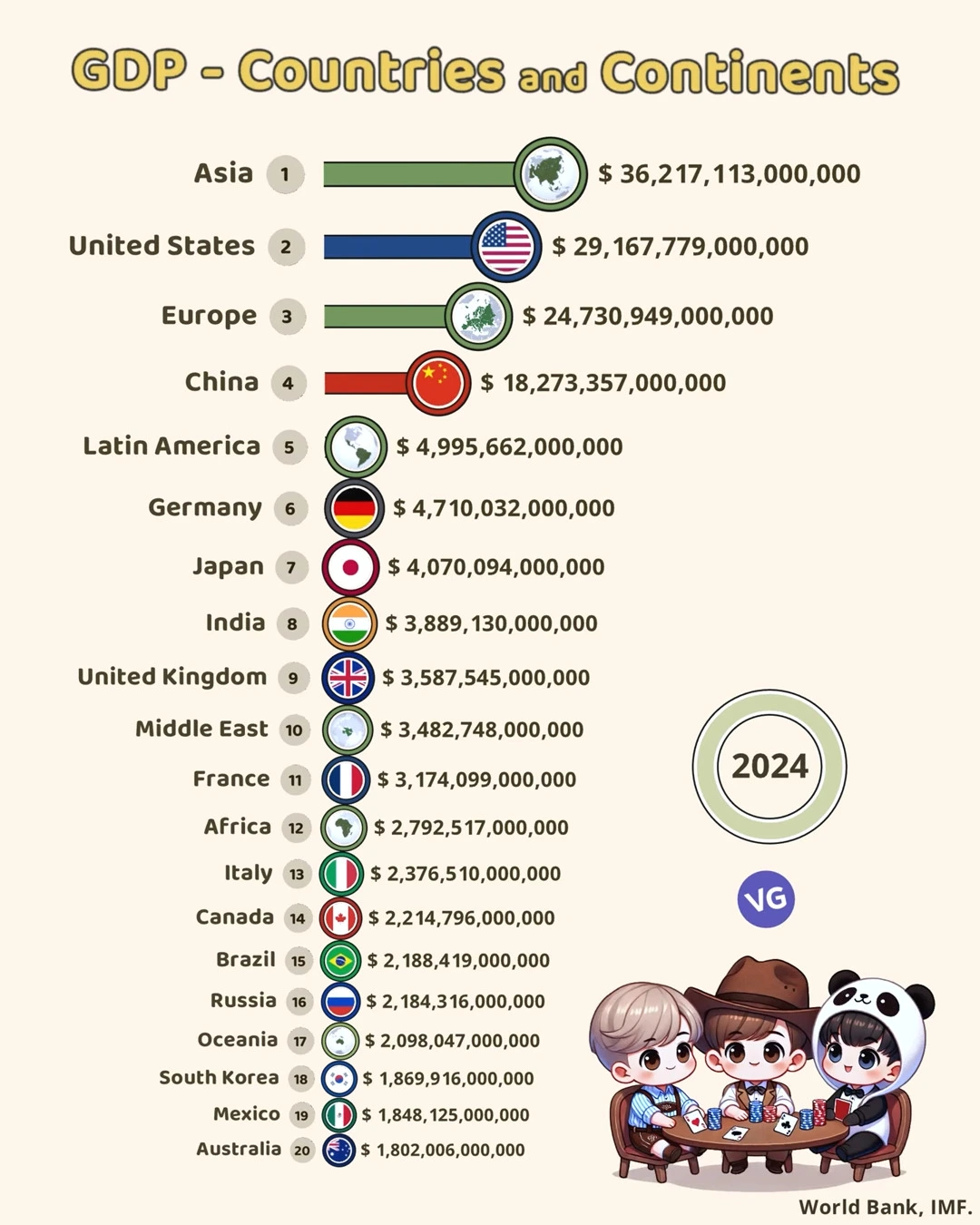

📊 GDP by Region & Country (2024, World Bank & IMF)

| Rank | Country/Continent | GDP (USD) |

|---|---|---|

| 1️⃣ | 🌏 Asia | $36.2 trillion |

| 2️⃣ | 🇺🇸 United States | $29.1 trillion |

| 3️⃣ | 🌍 Europe | $24.7 trillion |

| 4️⃣ | 🇨🇳 China | $18.3 trillion |

| 5️⃣ | 🌎 Latin America | $4.99 trillion |

| 6️⃣ | 🇩🇪 Germany | $4.71 trillion |

| 7️⃣ | 🇯🇵 Japan | $4.07 trillion |

| 8️⃣ | 🇮🇳 India | $3.89 trillion |

| 9️⃣ | 🇬🇧 United Kingdom | $3.59 trillion |

| 🔟 | 🌍 Middle East | $3.48 trillion |

| 11 | 🇫🇷 France | $3.17 trillion |

| 12 | 🌍 Africa | $2.79 trillion |

| 13 | 🇮🇹 Italy | $2.38 trillion |

| 14 | 🇨🇦 Canada | $2.21 trillion |

| 15 | 🇧🇷 Brazil | $2.19 trillion |

| 16 | 🇷🇺 Russia | $2.18 trillion |

| 17 | 🌍 **Oceania | $2.09 trillion |

| 18 | 🇰🇷 South Korea | **$1 |

| 19 | 🇲🇽 Mexico | $1.85 trillion |

| 20 | 🇦🇺 Australia | $1.80 trillion |

The Continental Powers: Asia Takes the Lead

Perhaps the most striking revelation from the data is Asia’s clear economic dominance, with a staggering GDP of $36.2 trillion. This represents a significant milestone in the global economic narrative, firmly establishing Asia as the world’s economic center of gravity. Europe, despite its mature economies, now sits in third place with $24.7 trillion, behind the United States but ahead of individual Asian nations.

The United States: A Nation Competing with Continents

With a GDP of $29.2 trillion, the United States remains an exceptional economic force, producing more output than entire continents like Latin America ($5.0 trillion), Africa ($2.8 trillion), and Oceania ($2.1 trillion) combined. This reality underscores America’s continued economic influence despite relative decline compared to Asia’s collective might.

China’s Economic Position: A Nation Apart

China stands as a unique case in the global economy. At $18.3 trillion, it represents approximately half of Asia’s total GDP and significantly outpaces other major nations. This positioning reflects China’s remarkable growth story and its evolving role in the global economic order as it continues to close the gap with the United States.

The G7 Nations: Enduring Influence

Despite shifts in the global economic landscape, traditional economic powers maintain significant influence. Germany ($4.7 trillion), Japan ($4.1 trillion), the United Kingdom ($3.6 trillion), France ($3.2 trillion), Italy ($2.4 trillion), and Canada ($2.2 trillion) all rank among the top 15 economies, collectively representing substantial economic weight and influence in global economic governance.

Emerging Powers: India’s Rise

India’s $3.9 trillion economy positions it as the 8th largest economic entity, ahead of established powers like the United Kingdom and France. This placement reflects India’s growing economic significance and potential for further expansion given its demographic advantages and ongoing development trajectory.

Regional Clusters and Competitors

Several interesting competitive clusters emerge from the data:

- Brazil, Russia, and Canada all hover around the $2.2 trillion mark, representing a distinct tier of large, resource-rich economies

- South Korea, Mexico, and Australia form another competitive cluster in the $1.8-1.9 trillion range

- The Middle East’s collective $3.5 trillion economy highlights its significant economic weight beyond individual nation considerations

The Global South: Untapped Potential

Perhaps most striking is Africa’s position, with its $2.8 trillion GDP representing significant untapped economic potential given the continent’s vast resources and young population. Latin America’s $5.0 trillion similarly suggests room for further economic development and integration.

Implications for the Future

This GDP distribution carries several important implications:

- Multipolar Economic Reality: The data confirms a multipolar economic world where no single entity can dominate global economic governance unilaterally.

- Regional Integration Matters: Continental economic integration appears increasingly important for global influence, as evidenced by Asia’s collective strength.

- Developed-Emerging Balance Shifting: The traditional distinction between developed and emerging economies continues to blur, with emerging powers gaining greater economic weight.

- Investment Implications: For global investors, this distribution suggests the importance of significant exposure to Asian markets while maintaining positions in traditional economic centers.

As we navigate through 2024 and beyond, this economic distribution will continue evolving, shaped by technological innovation, demographic shifts, geopolitical developments, and environmental challenges. Understanding these patterns provides essential context for navigating our complex global economy and anticipating the opportunities and challenges that lie ahead.

Sources: Data compiled from the World Bank and International Monetary Fund (IMF) as of 2024. Analysis based on official GDP metrics measuring total economic output in US dollars.

For more detailed data and methodology, visit:

- World Bank Data Portal: https://data.worldbank.org/indicator/NY.GDP.MKTP.CD

- IMF World Economic Outlook Database: https://www.imf.org