The 2024 global iron production data reveals fascinating patterns about one of our economy’s most fundamental metals. Iron, as the primary component of steel, remains essential for infrastructure development, manufacturing, construction, and countless other industries. This analysis examines the distribution of iron production worldwide, highlighting key players, regional strengths, and strategic implications.

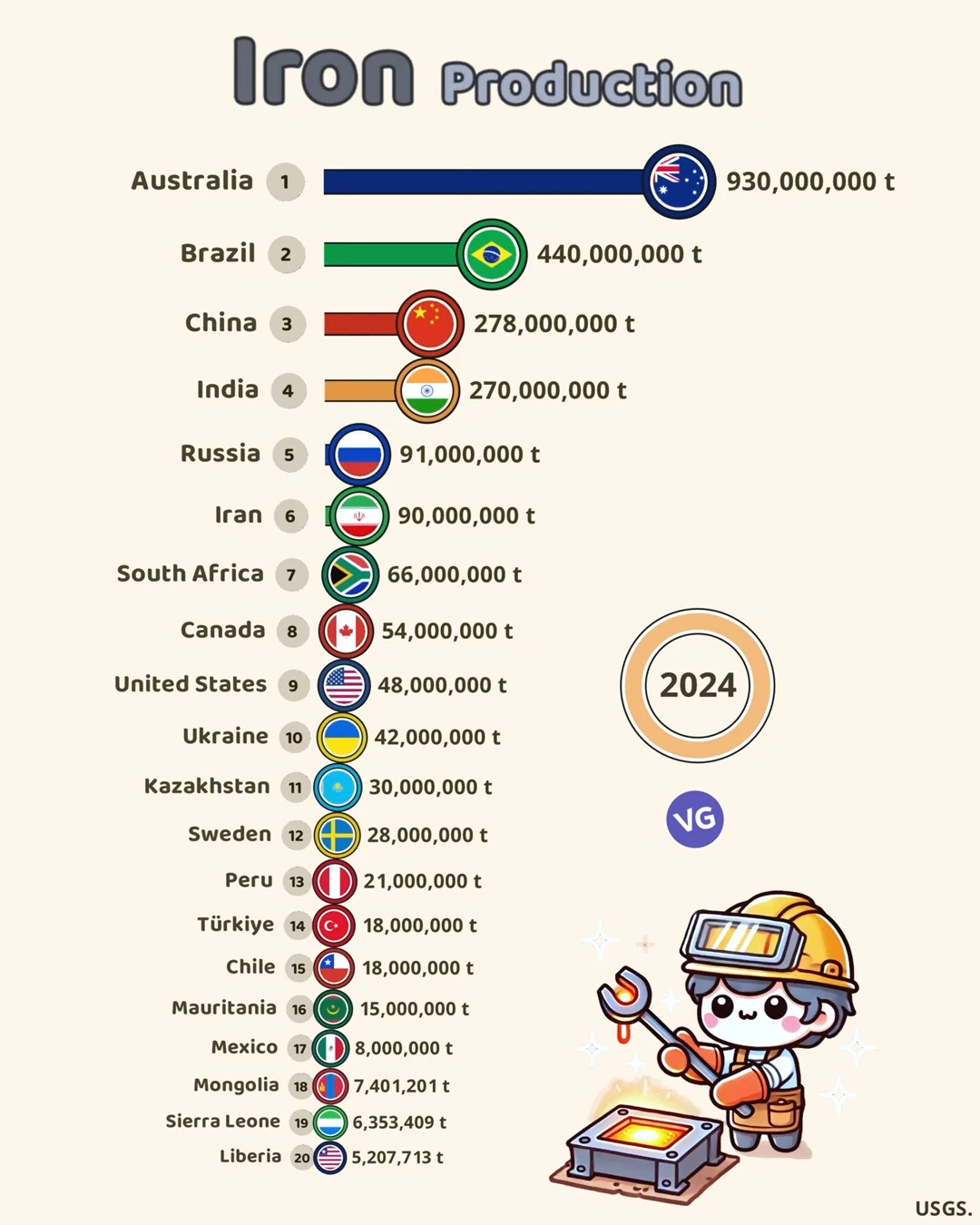

Iron Production (2024)

| Rank | Country | Production (t) |

|---|---|---|

| 1 🇦🇺 | Australia | 930,000,000 |

| 2 🇧🇷 | Brazil | 440,000,000 |

| 3 🇨🇳 | China | 278,000,000 |

| 4 🇮🇳 | India | 270,000,000 |

| 5 🇷🇺 | Russia | 91,000,000 |

| 6 🇮🇷 | Iran | 90,000,000 |

| 7 🇿🇦 | South Africa | 66,000,000 |

| 8 🇨🇦 | Canada | 54,000,000 |

| 9 🇺🇸 | United States | 48,000,000 |

| 10 🇺🇦 | Ukraine | 42,000,000 |

| 11 🇰🇿 | Kazakhstan | 30,000,000 |

| 12 🇸🇪 | Sweden | 28,000,000 |

| 13 🇵🇪 | Peru | 21,000,000 |

| 14 🇹🇷 | Türkiye | 18,000,000 |

| 15 🇨🇱 | Chile | 18,000,000 |

| 16 🇲🇷 | Mauritania | 15,000,000 |

| 17 🇲🇽 | Mexico | 8,000,000 |

| 18 🇲🇳 | Mongolia | 7,401,201 |

| 19 🇸🇱 | Sierra Leone | 6,353,409 |

| 20 🇱🇷 | Liberia | 5,207,713 |

The Dominant Producers: A Tale of Resource Wealth

Australia stands as the undisputed leader in iron production, with an extraordinary 930 million tonnes in 2024. This staggering figure – more than double its nearest competitor – reflects Australia’s exceptional iron ore deposits, particularly in the Pilbara region of Western Australia. Brazil follows with 440 million tonnes, leveraging its vast natural resources and established mining infrastructure.

China and India occupy the third and fourth positions with 278 million and 270 million tonnes respectively. This proximity in production figures is notable given both nations’ massive domestic steel industries and growing infrastructure needs.

Regional Distribution and Strategic Implications

The data reveals several interesting patterns:

Resource-Rich Nations Dominate

Countries with extensive natural iron ore deposits predictably lead production. The top four producers – Australia, Brazil, China, and India – account for approximately 1.9 billion tonnes, or roughly 85% of the production among the top 20 countries.

Diverse Geographic Representation

Iron production spans multiple continents, with significant contributions from:

- Oceania (Australia)

- South America (Brazil, Peru, Chile)

- Asia (China, India, Kazakhstan, Mongolia)

- North America (Canada, United States, Mexico)

- Europe (Sweden, Ukraine)

- Africa (South Africa, Mauritania, Sierra Leone, Liberia)

- Middle East (Iran)

The Second Tier of Producers

After the dominant top four, we see a significant drop to Russia (91 million tonnes) and Iran (90 million tonnes), followed by a more gradual decline through other producers. These middle-tier countries often leverage iron production for both domestic industrialization and export revenue.

Economic and Geopolitical Significance

The distribution of iron production carries important implications:

- Supply Chain Resilience: With production spread across multiple regions, the global iron supply chain demonstrates some natural resilience against regional disruptions.

- Strategic Resource Security: Major steel-producing nations that lack sufficient domestic iron ore (like Japan) must secure reliable import sources, creating strategic dependencies.

- Economic Development Correlations: Iron production often correlates with industrial development strategies, as seen in the presence of both industrialized nations and emerging economies in the ranking.

Environmental Considerations

The massive scale of iron production – with the top 20 producers collectively outputting over 2.2 billion tonnes – raises important sustainability questions:

- Energy consumption and carbon emissions from mining and processing

- Land use and ecosystem impacts from extensive mining operations

- Water management challenges in processing operations

- Potential for more sustainable mining practices and increased recycling

Looking Forward: Future Trends

Several factors will likely influence future iron production patterns:

- Green Steel Initiatives: Efforts to decarbonize steel production may impact iron ore demand and processing methods

- Resource Depletion Concerns: Some regions may face declining ore quality or accessibility over time

- Technological Innovations: Advances in mining technology and ore processing efficiency

- Circular Economy Emphasis: Increased steel recycling could moderate demand for newly-mined iron ore

- Geopolitical Considerations: Trade policies, resource nationalism, and regional conflicts may impact global supply chains

Conclusion

The 2024 iron production data illustrates Australia’s remarkable dominance in this sector, while highlighting the global distribution of this vital resource. As the world continues to urbanize and develop infrastructure, while simultaneously pursuing sustainability goals, the patterns of iron production will likely evolve to reflect changing technological, economic, and environmental priorities.

For policymakers, industry stakeholders, and investors, understanding these production patterns provides crucial context for strategic decisions related to steel production, infrastructure development, and resource security in an increasingly complex global marketplace.