The global inflation rate shows a mix of economic strength and challenges. The International Monetary Fund (IMF) says global inflation will drop to 5.8% in 2024. Less than 50 countries will still face high inflation compared to before.

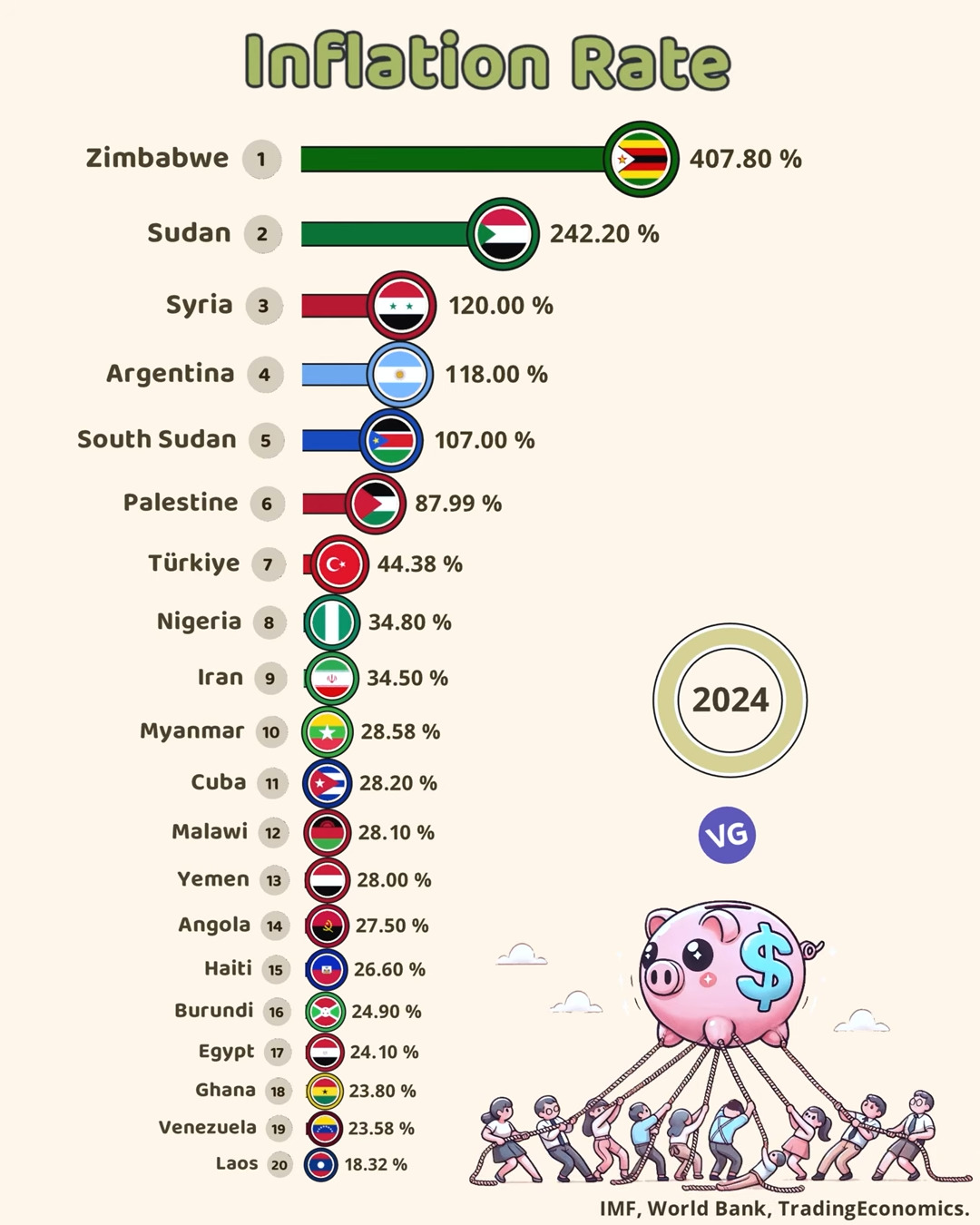

Highest Inflation Rates Worldwide (2024)

| Rank | Country | Inflation Rate (%) |

|---|---|---|

| #1 | 🇿🇼Zimbabwe | 407.80% |

| #2 | 🇸🇩Sudan | 242.20% |

| #3 | 🇸🇾Syria | 120.00% |

| #4 | 🇦🇷Argentina | 118.00% |

| #5 | 🇸🇸South Sudan | 107.00% |

| #6 | 🇵🇸Palestine | 87.99% |

| #7 | 🇹🇷Türkiye | 44.38% |

| #8 | 🇳🇬Nigeria | 34.80% |

| #9 | 🇮🇷Iran | 34.50% |

| #10 | 🇲🇲Myanmar | 28.58% |

| #11 | 🇨🇺Cuba | 28.20% |

| #12 | 🇲🇼Malawi | 28.10% |

| #13 | 🇾🇪Yemen | 28.00% |

| #14 | 🇦🇴Angola | 27.50% |

| #15 | 🇭🇹Haiti | 26.60% |

| #16 | 🇧🇮Burundi | 24.90% |

| #17 | 🇪🇬Egypt | 24.10% |

| #18 | 🇬🇭Ghana | 23.80% |

| #19 | 🇻🇪Venezuela | 23.58% |

| #20 | 🇱🇦Laos | 18.32% |

The highest inflation rates are key indicators of the world’s economic health. Many factors, like the pandemic and global tensions, affect these rates. These changes show the complex recovery of the global economy.

Looking at inflation rates requires a detailed view. Some countries face double-digit inflation, while others keep their economies stable. The median global inflation has fallen from 8.7% in Q3 2022 to 3.1% in Q2 2024.

Economists and leaders watch these trends closely. They see inflation as a key sign of economic health. The differences in inflation rates highlight the global economic forces, supply chains, and money policies at work.

Exploring the world’s highest inflation rates offers a full view of 2024’s economic scene. It shows both the challenges and chances in the global financial world.

Understanding Global Inflation in the Post-Pandemic Era

The world’s economy has changed a lot since COVID-19. Inflation is now a big problem for governments and banks everywhere. The US and India have seen big changes in their inflation rates, showing how complex the post-pandemic economy is.

In July 2022, global inflation hit its highest level since the 1990s. Many things have caused this, like oil price changes and global demand.

Core Inflation vs Overall Inflation

It’s important to know the difference between core and overall inflation:

- Core inflation doesn’t count food and energy prices

- Overall inflation is the total price increase for all goods and services

- Core inflation gives a clearer view of long-term price trends

Impact of Supply Chain Disruptions

Supply chain problems have greatly affected global inflation. During the pandemic, these problems caused about 13 percent of inflation changes. This shows how connected our modern economy is.

| Period | Global Supply Shock Contribution |

|---|---|

| 1970-1985 | 25% |

| 1986-2000 | 25% |

| 2001-2022 | 13% |

Role of Central Banks

Central banks play a key role in fighting inflation. For example, the Federal Reserve raised interest rates by 525 basis points from March 2021 to August 2023 to fight rising prices.

“The global economic landscape requires adaptive and responsive monetary policies to manage inflationary pressures.” – Economic Research Institute

In the US, core Consumer Price Index (CPI) inflation was 3.3 percent year-over-year in September 2024. This shows the ongoing challenge of keeping prices stable.

Here are some key points about global inflation in 2024:

- Global inflation is expected to be 5.9% in 2024

- Advanced economies will likely see 2.6% inflation

- Developing economies will face higher inflation rates

“Inflation is taxation without legislation” – Milton Friedman

The United States has seen a drop in inflation. It went from 8% in 2022 to 2.9% in December 2024. This change is thanks to smart money policies and economic efforts.

Emerging markets, however, still face big challenges. Central Asia saw prices rise by up to 38.8%. East Asia, on the other hand, had the lowest inflation rate at 1%. This shows how different economic performances are across regions.

Zimbabwe’s Hyperinflation Crisis and Economic Challenges

Zimbabwe has faced severe economic problems, including a high inflation rate. This has badly hurt its financial situation. It shows how inflation can destroy an economy if not controlled.

Historical Context and Economic Trajectory

Zimbabwe’s economy has seen a lot of ups and downs. It faced extreme inflation, with rates that were hard to believe:

- Inflation peaked at nearly 25,000% in 2007

- By mid-November 2008, monthly inflation hit 79.6 billion percent

- The year-on-year inflation rate reached an incomprehensible 89.7 sextillion percent

Impact on Currency Value

The high inflation hurt Zimbabwe’s currency a lot. In April 2009, the government stopped printing money. This showed that their money policy had failed.

“Zimbabwe’s economic crisis represents a critical case study in the dangers of uncontrolled monetary expansion.”

Economic Recovery Efforts

There are signs of a slow recovery:

| Economic Indicator | 2022 | 2023 | 2024 Projection |

|---|---|---|---|

| GDP Growth Rate | 6.1% | 5.3% | 2% |

| Agricultural Output | 11.1% | 11.1% | -17% |

The IMF expects inflation to be 560.981% in 2024. This shows the economy still faces big challenges. Problems in the agricultural sector, like droughts, could make things worse.

South American Inflation Hotspots: Argentina and Venezuela

The economic situation in South America is dire, with Argentina and Venezuela at the forefront of the crisis in 2024. These countries face severe economic troubles that threaten their financial and social systems.

Argentina’s inflation rate has skyrocketed to 150%, putting a huge strain on the economy. The country has seen a political shift with President Javier Milei introducing radical economic reforms. This is a big change from past economic strategies.

“Hyperinflation is not just an economic problem, but a social catastrophe that undermines national stability,” – Economic analyst from Buenos Aires

Venezuela’s inflation is even worse, expected to hit 1,500% in 2024. The country is under President Nicolás Maduro’s rule, which has failed to stop the economic decline.

| Country | Inflation Rate 2024 | Political Leadership |

|---|---|---|

| Argentina | 150% | Javier Milei |

| Venezuela | 1,500% | Nicolás Maduro |

The inflation problems in these countries are much worse than in the US. Several factors contribute to their economic woes, including:

- Persistent political instability

- Weak monetary policies

- Massive currency devaluation

- External economic pressures

The economic outlook for Latin America is not bright. GDP is expected to grow by 2.5% in 2025. These inflation rates highlight the severe economic challenges South America faces in 2024.

Middle Eastern and African Nations’ Inflation Struggles

The economies of Middle Eastern and African countries face big challenges from inflation. These areas have some of the most unstable economies worldwide. High inflation rates affect people’s daily lives and the overall economy.

Inflation in these regions shows deep economic problems. It’s not just about money. It helps us understand how the world’s economies are connected.

Sudan’s Economic Turmoil

Sudan is in a severe economic crisis. Its inflation rate is expected to hit 157.9% in 2024. The main reasons are:

- Prolonged political uncertainty

- Severe currency devaluation

- Disrupted agricultural production

- Limited international trade relationships

Egypt’s Rising Prices

Egypt is also seeing high inflation, with rates at 35.8% in 2024. The Central Bank of Egypt has raised deposit rates to 27.75%. They’re trying to stabilize the economy.

“Inflation is not just a number — it’s a lived experience that impacts every citizen’s purchasing power,” said an economic analyst from Cairo.

Nigeria’s Monetary Challenges

Nigeria is facing big monetary issues. Its inflation rate is expected to jump from 24.5% in 2023 to 29.1% in 2024. This shows ongoing economic stress.

While inflation rates change globally, these African countries often have the highest rates. They need strong monetary reforms and smart economic planning to overcome these challenges.

Corporate Consolidation and Market Concentration Effects

The story of inflation in the US is complex. Companies use inflation to make more money than expected. This is called greedflation. It shows how big companies can set high prices because they control the market.

“Pricing power has become a critical lever in corporate financial strategies during inflationary periods.”

Recent studies show how profits affect prices:

- Profit margins hit 21.1% in Q2 2021

- The average profit share was 11.5%

- From Q4 2019 to mid-2022, profits led to 40% of price hikes

| Period | Profit Contribution | Economic Significance |

|---|---|---|

| 1979-2019 Average | 11.5% | Stable Long-term Trend |

| Q2 2021 | 94.55% | Unprecedented Price Growth |

| Q2 2024 | 19.5% | Gradual Normalization |

Corporate consolidation lets companies set prices that go beyond costs. For example, asthma inhalers went from $10 to $100. This shows how market control can greatly affect prices.

Global Economic Recovery and Inflation Forecasts

The world’s economy in 2024 is slowly getting better but still faces many hurdles. International groups have shared important insights about the future of the economy.

Important trends are starting to show how the economy will recover in 2024. The inflation rates in the US and India are key signs of the economy’s health.

IMF Projections for 2024

The International Monetary Fund (IMF) has made crucial predictions for the global economy:

- Global growth is expected to stay at 2.6% in 2024.

- Developing economies should grow by 4% on average.

- Advanced economies are forecasted to grow at 1.5%.

- Global inflation is predicted to drop to 3.5%.

Regional Economic Trends

| Region | Growth Projection 2024 | Growth Projection 2025 |

|---|---|---|

| East Asia and Pacific | 4.8% | 4.2% |

| Europe and Central Asia | 3.0% | 2.9% |

| Latin America | 1.8% | 2.7% |

| Middle East and North Africa | 2.8% | 4.2% |

The recovery is not even across the globe. About 80% of the world’s people will see slower growth than before COVID.

“The path to economic recovery is complex and requires sustained global cooperation.” – International Economic Expert

Despite progress, many challenges remain, especially for developing countries. The inflation rates in the US and India will be key in shaping the global economy.

Conclusion

The world’s economy in 2024 shows a mix of inflation rates. Countries like South Sudan and Zimbabwe face extreme inflation. Meanwhile, developed economies deal with more manageable rates.

Central banks and leaders have a tough job controlling these high inflation rates. The Federal Reserve aims for a 2% inflation rate. This shows the fine line between growth and price control.

Prices have dropped from 9.1% in mid-2022 to 2.9% in July 2024. This shows the power of careful money management.

Dealing with inflation needs a detailed plan. Things like supply chain issues, government spending, and global tensions affect prices. It’s key for businesses, leaders, and people to keep up with these changes.

As we look ahead, we must stay alert. Managing inflation will need teamwork from all over the world. The lessons from 2024 will help us build stronger economies for the future.

FAQ

What are the highest inflation rates in the world for 2024?

Countries like Zimbabwe, Venezuela, Argentina, Sudan, and Nigeria are facing the worst inflation in 2024. Their economies are struggling due to political and economic issues. These problems have greatly affected their money value and stability.

How does inflation differ between core inflation and overall inflation?

Core inflation looks at prices of goods and services without food and energy. Overall inflation includes all prices. Knowing the difference helps understand economic trends and central bank actions.

What role do central banks play in managing inflation?

Central banks, like the Federal Reserve, use tools to control inflation. They adjust interest rates and manage money supply. Their goal is to keep prices stable and support growth.

How has the COVID-19 pandemic impacted global inflation?

The pandemic has disrupted global supply chains, causing production issues and higher costs. Government stimulus and changes in spending have also pushed inflation up worldwide.

Why are countries like Zimbabwe experiencing hyperinflation?

Hyperinflation in places like Zimbabwe comes from political instability and poor economic management. Excessive money printing and structural issues also play a part. These factors lead to a fast decline in currency value and prices.

What is “greedflation” and how does it relate to inflation?

“Greedflation” is when companies raise prices more than their costs, making extra profits. This has been seen in many industries, adding to high inflation.

How are global inflation rates expected to change in 2024?

The IMF says global inflation will likely drop in 2024. Developed countries like the U.S. might see stable inflation. But, emerging markets could still face big challenges.

What impact does high inflation have on everyday citizens?

High inflation reduces how much money you can buy with your money. It makes living costs go up and can cause economic instability. People in countries with high inflation struggle with rising prices and lower income.

How do supply chain disruptions contribute to inflation?

Disruptions in supply chains lead to higher costs for raw materials and manufacturing. These costs are then passed on to consumers, causing prices to rise and adding to inflation.

Which regions are most affected by high inflation in 2024?

Africa (Sudan, Nigeria), South America (Venezuela, Argentina), and some Middle Eastern countries are hit hard. Political instability, poor management, and external pressures are major factors.

Source Links

- Global Inflation Tracker

- Global Inflation in 2025: Key Trends and Projections

- What Explains Global Inflation

- International factors broadly explain postpandemic inflation

- 25 Countries With the Highest Inflation in the World

- List of countries by inflation rate

- UK inflation rate: How quickly are prices rising?

- Overview

- Hyperinflation in Zimbabwe

- What Will Be Latin America’s Political Hot Spots in 2024? – Inter-American Dialogue

- Four Trends That Will Define Latin America in 2025

- IMF predicts inflation woes to linger in Africa and the Middle East

- Central Banker Report Cards 2024: Africa And The Middle East

- World’s Highest And Lowest Inflation Rates 2024 – Global Finance Magazine

- Profits and price inflation are indeed linked

- Global Growth Is Stabilizing for the First Time in Three Years

- Global inflation forecast: Will prices come down in 2024?

- Global economic outlook, January 2024

- What is Inflation and Why Does it Matter?

- Analysis: Assessing Inflation’s Impact | U.S. Bank

- Hyperinflationary economies as at December 2024