The global arms trade has seen big changes, with the United States leading the way in 2023. Despite a 3.3% drop in major arms transfers, the market remains strong. It plays a big role in world politics.

The arms export market is complex. It’s shaped by strategic alliances and global tensions. The United States stands out, making up 42% of global arms exports in 2023.

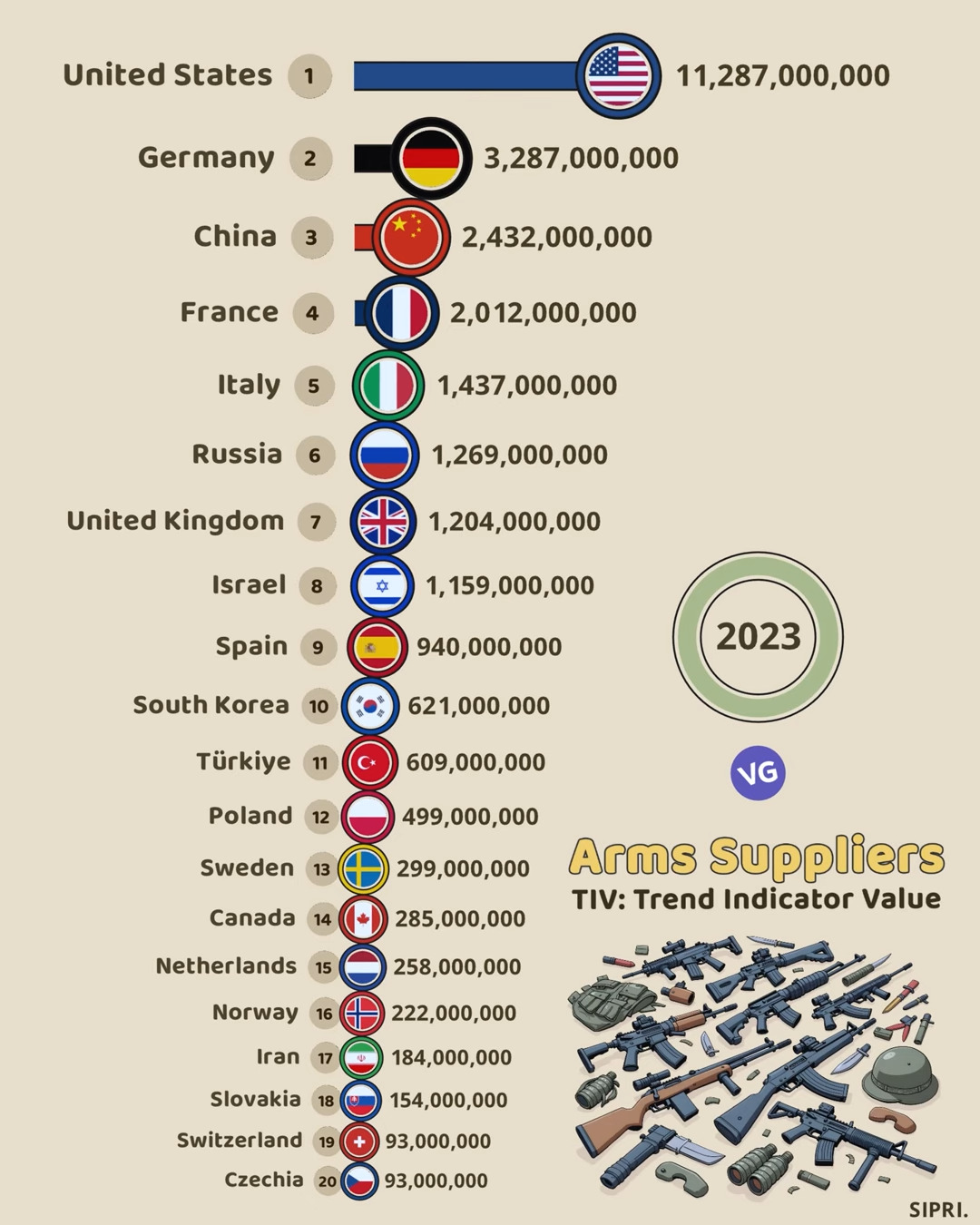

Top 20 Arms Suppliers (2023)

| Rank | Country | TIV Value |

|---|---|---|

| #1 | 🇺🇸United States | 11,287,000,000 |

| #2 | 🇩🇪Germany | 3,287,000,000 |

| #3 | 🇨🇳China | 2,432,000,000 |

| #4 | 🇫🇷France | 2,012,000,000 |

| #5 | 🇮🇹Italy | 1,437,000,000 |

| #6 | 🇷🇺Russia | 1,269,000,000 |

| #7 | 🇬🇧United Kingdom | 1,204,000,000 |

| #8 | 🇮🇱Israel | 1,159,000,000 |

| #9 | 🇪🇸Spain | 940,000,000 |

| #10 | 🇰🇷South Korea | 621,000,000 |

| #11 | 🇹🇷Türkiye | 609,000,000 |

| #12 | 🇵🇱Poland | 499,000,000 |

| #13 | 🇸🇪Sweden | 299,000,000 |

| #14 | 🇨🇦Canada | 285,000,000 |

| #15 | 🇳🇱Netherlands | 258,000,000 |

| #16 | 🇳🇴Norway | 222,000,000 |

| #17 | 🇮🇷Iran | 184,000,000 |

| #18 | 🇸🇰Slovakia | 154,000,000 |

| #19 | 🇨🇭Switzerland | 93,000,000 |

| #20 | 🇨🇿Czechia | 93,000,000 |

Power dynamics have shifted in the arms export world. Russia’s arms exports have plummeted, while France has surged. France’s arms exports jumped by 47%, making it a major player.

Looking at the top arms exporters in 2023 shows us a lot. It shows how security, technology, and partnerships work together. The United States, France, Russia, China, and Germany are key players in global defense.

Global Arms Trade Overview 2023

The global arms trade is changing fast. Leading countries are making big moves in the defense world. Recent data shows big changes in military spending and defense investments around the world.

Military spending has hit new highs, with a global total of $2.443 trillion in 2024. This is the biggest jump since 2009. It shows how tense the world is, pushing up arms trade.

Market Volume and Trends

The arms trade market is growing fast and getting more focused. Here are some key points:

- Top five arms exporting nations make up about 75% of global arms exports

- The total value of global arms trade is at least $95 billion

- The top 100 defense companies made $597 billion in 2022

Regional Distribution of Arms Sales

| Region | Arms Import Percentage |

|---|---|

| Asia and Oceania | 37% |

| Middle East | 30% |

| Europe | 21% |

| Americas | 5.7% |

| Africa | 4.3% |

Key Market Dynamics

The top arms suppliers are seeing big changes. New tech, global tensions, and partnerships are shaping defense plans everywhere.

“The global arms trade reflects complex international relationships and strategic defense priorities.” – Defense Industry Analyst

With more uncertainty in the world, countries are focusing on updating their militaries. This makes the arms trade key to keeping the world safe.

United States Dominance in Arms Exports

The United States is the clear leader in arms exports in 2023. It has a strong presence in the global market. The USA saw a 17% growth in arms exports from 2014-18 to 2019-23. This solidifies its top spot in the international arms trade.

Key highlights of US arms export dominance include:

- Increased global market share from 34% to 42%

- Arms deliveries to 107 different states

- Significant export of advanced weapon systems

Strategic implications of US arms exports extend far beyond mere economic transactions. The country’s weapon systems, like the advanced F-35 combat aircraft, are key to its influence. US arms exports help maintain strategic partnerships and support allies worldwide.

“The United States continues to be the preeminent global arms exporter, shaping international security dynamics through its sophisticated weapon technologies.”

The USA’s arms exports reach far and wide. The Middle East and Asia-Pacific are big markets. Countries like Saudi Arabia and Japan get a lot of US military equipment.

The United States keeps its lead in arms exports thanks to its tech and defense industry. This shows its economic power and strategic position.

Leading Countries in Arms Supply 2023

The world’s arms trade is changing fast. We see big changes in who sells arms and how much they sell. This shows how important arms sales are in world politics.

Top Five Arms Exporters

The top arms sellers show off their strong economies and tech skills. In 2023, the top five were:

- United States: Dominant market leader

- France: Significant rise in global rankings

- Russia: Experiencing substantial export decline

- China: Maintaining steady export levels

- Germany: Consistent performer in arms trade

Market Share Distribution

The arms export market gives us a peek into global defense strength. Here are some key numbers:

| Country | Market Share | Arms Revenues |

|---|---|---|

| United States | 42% | $317 billion |

| France | Ranked 2nd | Significant growth |

| Russia | Dropped to 3rd | 53% export decrease |

Year-over-Year Changes

2023 was a big year for the arms trade. Key observations include:

- US companies saw a 2.5% increase in arms revenues

- European arms revenues showed minimal growth at 0.2%

- Russian companies experienced a 40% revenue surge

“The arms trade reflects complex geopolitical relationships and technological capabilities.” – Defense Trade Analyst

These changes show how fast the arms trade is moving. They have big effects on world security and economies.

France’s Rise to Second Place

France has made a big leap in the global arms market, becoming a top exporter in 2023. Its defense industry has grown so much that it’s now the second-largest arms exporter. This is a huge jump from 2014, with exports up by 47%.

The French approach to arms exports is smart and global. Key points include:

- Impressive export distribution across critical regions

- 42% of exports to Asia and Oceania

- 34% directed to the Middle East

- India emerging as the largest recipient at nearly 30% of exports

France’s success comes from advanced weapons like the Rafale combat aircraft and strong military partnerships. The country has also boosted its defense manufacturing. By the end of 2023, defense orders were over €34 billion.

“France’s defense industry has transformed from a regional player to a global arms export powerhouse.”

France has invested a lot in its defense industry. For example, it plans to:

- Produce 40,000 155mm artillery shells annually

- Double AASM Hammer guided bomb production to 1,200 by 2025

- Increase long-range Aster missile orders to 400

This growth makes France a key player in the global arms trade. It shows France’s tech skills and its global defense partnerships.

Russia’s Declining Position in Arms Trade

The global arms trade has changed a lot. Russia’s exports have dropped a lot. This is because of political tensions and sanctions.

Russia’s arms sales have fallen sharply. In 2021, they made $14.6 billion. But by 2024, they expect to make less than $1 billion.

- 2021: $14.6 billion in arms exports

- 2022: Exports dropped to $8 billion

- 2023: Further reduced to $3 billion

- 2024 (projected): Less than $1 billion in exports

Export Volume Reduction

Russia’s arms trade has seen a huge drop. The Stockholm International Peace Research Institute (SIPRI) found a 53 percent reduction in exports. This shows big challenges for Russian defense makers.

Impact of International Sanctions

Sanctions have hurt Russia’s arms sales a lot. Fewer countries are buying Russian weapons now. High interest rates also make things harder for the defense industry.

Key Customer Base Changes

Old markets are moving away from Russia. India, for example, has bought fewer Russian arms. Some countries are looking at other suppliers:

- Serbia is buying French jets.

- India is making its own fighter jets.

- There are doubts about Russian weapons.

“The golden age of Russia’s arms trade has conclusively ended.” – Defense Trade Analyst

Rosoboronexport still has big orders, worth $55 billion in 2024. But, it looks like Russia will face a long time to get back to where it was.

European Arms Export Dynamics

The European arms export scene in 2023 is complex and changing fast. Germany became a major player, setting new records in military exports. Its strategy shows big changes in global defense trade.

- Germany authorized €11.7 billion in arms exports

- Weapons exports made up €6.1 billion of total authorization

- Exports to Ukraine were over €4.1 billion in 2023

The export destinations show strategic military ties across Europe and beyond. The top countries receiving these exports were:

| Country | Export Value (€ millions) |

|---|---|

| Ukraine | 4,100 |

| Norway | 1,200 |

| Hungary | 1,000 |

| United Kingdom | 655 |

| United States | 545 |

European defense companies showed strength in the global arms trade. The SIPRI Top 100 arms-producing companies saw total arms revenues of $632 billion. This is a 4.2% rise from the year before.

“The European arms export market continues to evolve, reflecting complex geopolitical dynamics and strategic defense investments.”

The data shows European nations play a big role in 2023’s arms exports. They are growing and diversifying their military exports.

Asia-Pacific Arms Trade Landscape

The Asia-Pacific region is a key player in the global arms trade. It has complex dynamics that shape the market. Strategic relationships and geopolitical tensions influence the region’s arms export landscape.

Major Regional Exporters

China is a major player in the arms export market. From 2010 to 2020, it exported nearly 16.6 billion TIV of conventional weapons worldwide. Key features of China’s arms exports include:

- 77.3% of exports directed to Asia

- 19.1% sent to African markets

- Averaged 1.5 billion TIV annually

Strategic Trade Relationships

The region’s arms trade is marked by complex partnerships. China’s most prominent arms export relationships include:

- Pakistan (63.4% of total sales)

- Bangladesh

- Myanmar

Market Growth Patterns

South Korea has also become a significant arms exporter, showing rapid growth. A notable example is their $13.7 billion arms deal with Poland, which included tanks, howitzers, and fighter jets.

“The Asia-Pacific arms trade reflects complex geopolitical strategies and economic opportunities” – Defense Trade Analyst

The region remains a dynamic marketplace for arms supply. Countries like China and South Korea are playing bigger roles in the global arms trade ecosystem.

Conclusion

The global arms trade in 2023 has seen big changes. The United States has become even more dominant, increasing its share from 33% to 40%. Meanwhile, Russia’s share dropped from 22% to 16%. France has also become a major player, growing its share from 7.1% to 11%.

Regional trends show big changes in the arms trade. European NATO states saw a 65% jump in arms imports. But, imports fell in Southeast Asia and sub-Saharan Africa. The Asia-Pacific region is still key, getting 41% of major arms transfers.

China is using arms sales more strategically. It’s now the top supplier to sub-Saharan Africa, beating Russia and the United States. This shows China’s growing role in the global defense market.

The future of the global arms trade looks set to change. It will be influenced by politics, new technologies, and economic partnerships. The balance between security, economy, and international relations will keep shaping arms export strategies worldwide.

FAQ

Who are the top arms exporters in 2023?

The United States leads in arms exports, followed by France. China and Germany are also major players. The US saw a 17% rise in exports, while France’s exports jumped by 47%.

How has Russia’s position in the global arms trade changed?

Russia’s exports fell by 53% due to sanctions after invading Ukraine. This big drop has hurt Russia’s role in the global arms market. Countries like India have been affected too.

What regions are the primary importers of arms in 2023?

The main arms importers are the Asia-Pacific, Middle East, and Europe. Countries like India, Australia, and Japan are buying more arms. This is because of security concerns and tensions.

How has France’s arms export strategy changed?

France has boosted its arms exports, especially with the Rafale aircraft. India is now France’s biggest customer. This has helped France become the second-largest arms exporter.

What factors influence the global arms trade?

Many things affect the arms trade. These include politics, technology, defense strategies, sanctions, and economics. New tech and shifting politics also play big roles.

What types of weapons are most commonly exported?

The most wanted exports are advanced fighter jets, missiles, naval gear, and defense tech. The US is known for its top-notch weapons and aerospace tech.

How has the COVID-19 pandemic affected the global arms trade?

The pandemic didn’t really disrupt the arms trade. In fact, some countries, like the US, saw their exports grow. Defense industries have found ways to keep up, using digital tools and new production methods.

What role does the Asia-Pacific region play in the global arms trade?

The Asia-Pacific is a big player in the arms trade. Countries like China and South Korea are big exporters. The region is also a key market for imports, with countries like India and Australia spending a lot on defense.

How do international sanctions impact arms exports?

Sanctions can greatly reduce a country’s arms exports, as seen with Russia. They limit market access and can disrupt contracts. Countries may then look for new trading partners.

What trends are emerging in the global arms trade for 2023?

The US will likely keep its lead, with France becoming more important. Russia’s share will probably drop. Europe will spend more on defense, and the Asia-Pacific will see more arms trade. There will also be a focus on advanced tech in weapons.

Source Links

- Trends in International Arms Transfers, 2023

- The World’s Top Arms Exporting Countries

- Fiscal Year 2023 U.S. Arms Transfers and Defense Trade – United States Department of State

- Arms industry

- Twelve billion bullets are produced every year.

- European arms imports nearly double, US and French exports rise, and Russian exports fall sharply

- U.S. Is Largest Arms Exporter in a Changing Market

- World’s top arms producers see revenues rise on the back of wars and regional tensions

- European arms imports nearly double while Russian exports plunge

- France threatens to strong-arm industry to boost missile output

- Russian Arms Exports Collapse by 92 Percent as Military-Industrial Complex Fails

- Russian arm trade tumbles

- Arms Trade Divorce — The Fletcher Forum of World Affairs

- German weapons exports reached record high in 2023

- The SIPRI Top 100 arms-producing and military services companies, 2023

- How Dominant is China in the Global Arms Trade? | ChinaPower Project

- South Korea’s Role in Countering Chinese and Russian Arms Sales in Latin America

- Surge in arms imports to Europe, while US dominance of the global arms trade increases

- Weapons of Influence: Unpacking China’s Global Arms Strategy