The Middle East is home to 371 million people1. It has a huge economy, with a GDP of $5.08 trillion (nominal) and $7.04 trillion (PPP) in 20231. The region’s economy is growing fast, at 3.2% in 20231. This makes it a great place for investors and businesses looking to grow.

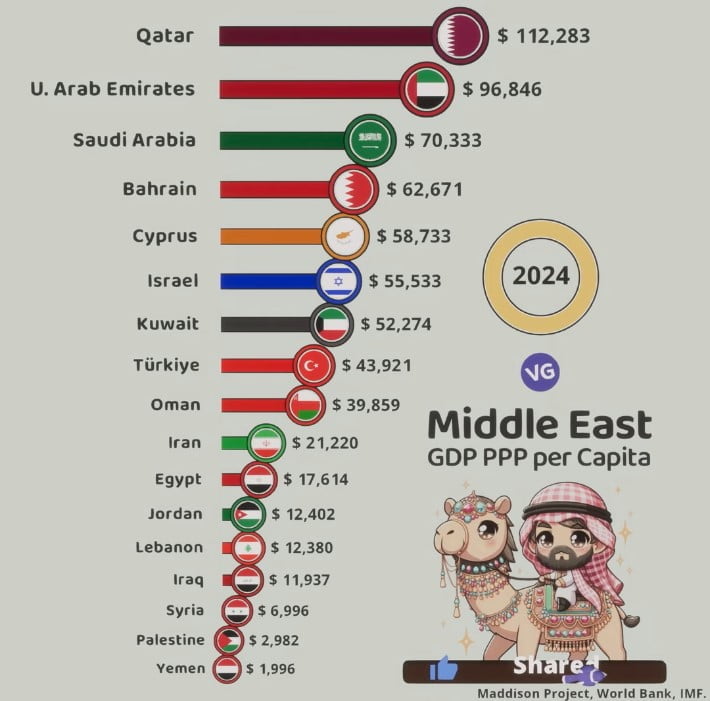

| Flag | Country | GDP PPP per Capita |

|---|---|---|

| 🇶🇦 | Qatar | $112,283 |

| 🇦🇪 | United Arab Emirates | $96,846 |

| 🇸🇦 | Saudi Arabia | $70,333 |

| 🇧🇭 | Bahrain | $62,671 |

| 🇨🇾 | Cyprus | $58,733 |

| 🇮🇱 | Israel | $55,533 |

| 🇰🇼 | Kuwait | $52,274 |

| 🇹🇷 | Türkiye | $43,921 |

| 🇴🇲 | Oman | $39,859 |

| 🇮🇷 | Iran | $21,220 |

| 🇪🇬 | Egypt | $17,614 |

| 🇯🇴 | Jordan | $12,402 |

| 🇱🇧 | Lebanon | $12,380 |

| 🇮🇶 | Iraq | $11,937 |

| 🇸🇾 | Syria | $6,996 |

| 🇵🇸 | Palestine | $2,982 |

| 🇾🇪 | Yemen | $1,996 |

Key Takeaways

- The Middle East is home to some of the wealthiest nations in the world, with a GDP per capita of $19,860 (nominal) and $27,520 (PPP) as of 20231.

- Qatar, the United Arab Emirates (UAE), and Saudi Arabia are the top three richest countries in the Middle East based on GDP per capita2.

- Qatar leads the region with a GDP per capita of around $118,150, followed by the UAE with $53,230 and Saudi Arabia with $71,37012.

- The Middle East’s wealth is largely driven by its substantial oil and gas reserves, which have fueled economic growth and development in the region1.

- Despite the region’s economic prowess, challenges such as high unemployment rates (10.6% in 2021)1 and geopolitical tensions continue to shape the dynamics of the Middle Eastern economies.

Richest Countries in the Middle East

GDP per Capita (PPP) in Middle Eastern Countries

Source: IMF World Economic Outlook (October 2023)

The Middle East is known for its vast oil and gas resources. These resources have greatly helped the economies of several countries in the region grow and create wealth. The International Monetary Fund (IMF) lists the top richest countries in the Middle East by GDP per capita in 2022 as:

- Qatar:3 $235.5 billion GDP, $81,968 GDP per capita4. Qatar is expected to have a GDP per capita of over $92,000 in 2024, making it the richest country in the Middle East5. Qatar has a GDP of $166.9 billion, a population of about 2.5 million, and a GDP per capita of $129,700.

- United Arab Emirates (UAE):3 $509.179 billion GDP, $50,602 GDP per capita4. The UAE is set to have a GDP per capita surpassing $70,000 in 20245. The UAE’s GDP per capita is $67,700, and it has a population estimated to be about 9.3 million.

- Kuwait:3 $159.687 billion GDP, $32,215 GDP per capita4. Kuwait projects its GDP per capita to exceed $71,000 in 20245. Kuwait’s GDP per capita is $71,300, and its oil reserves are estimated to be about 94 billion barrels.

- Saudi Arabia:3 $1,069.44 billion GDP, $32,586 GDP per capita4. Saudi Arabia aims for a GDP per capita of around $56,000 in 20245. Saudi Arabia’s GDP per capita is $54,100.

- Bahrain:3 $44.994 billion GDP, $28,464 GDP per capita4. Bahrain’s GDP per capita is estimated to be around $46,000 in 20245. Bahrain’s GDP per capita is $50,300.

- Oman:3 $108.282 billion GDP, $21,265 GDP per capita4. Oman is expected to post a GDP per capita of approximately $52,000 in 20245. Oman’s GDP per capita is $43,700.

- Lebanon:3 $21.78 billion GDP, $3,283 GDP per capita4. Lebanon’s GDP per capita potentially rebounds to $22,000 or more by 20245. Lebanon’s GDP per capita is $18,500.

- Libya:3 $40.194 billion GDP, $5,872 GDP per capita4. Libya aims for a GDP per capita of around $10,500 in 20245. Libya’s GDP per capita is estimated to be $10,500.

- Egypt:3 $398.397 billion GDP, $3,770 GDP per capita4. Egypt anticipates a GDP per capita of around $12,600 in 20245. Egypt’s GDP per capita is $12,100.

- Tunisia:3 $51.271 billion GDP, $4,190 GDP per capita.

These statistics show the big wealth differences in the Middle East. Countries like Qatar, the UAE, and Kuwait lead in GDP per capita. The oil and gas industry has boosted many economies. But, there are efforts to diversify and build more stable economies.

Gross Domestic Product (GDP) Rankings

The Middle East is rich thanks to its oil and gas. These resources have made some countries very wealthy6. But, the region doesn’t have many countries in the top global GDP ranks7.

Qatar: The Richest Nation

Qatar is the wealthiest in the Middle East, with a GDP of $235.5 billion6. It has a high GDP per capita of $81,9706. Qatar’s economy thrives on its huge natural gas reserves.

Saudi Arabia: Economic Diversification Efforts

Saudi Arabia is the biggest economy in the Middle East, with a GDP of $1.108 trillion7. It makes up about 1.10% of the world’s GDP7. The country is trying to grow its economy beyond oil, with a GDP per capita of $32,5906.

The Middle East shows a clear order in economic size and global impact. Its wealth is clear, but North America, Europe, and Asia lead the world7. Still, the Middle East is key to the global economy, with big potential for growth.

Oil and Gas Reserves Driving Wealth

The Middle East is rich in oil and gas, making many countries wealthy. Countries like Saudi Arabia, the UAE, Qatar, Kuwait, and Oman have huge oil and gas reserves. They produce a lot of the world’s oil and gas, making them key players in the global market8910.

Saudi Arabia leads with 11 million barrels of oil daily, which is 11% of the world’s oil8. Iraq is sixth in the world, producing 4.42 million barrels a day8. The UAE is eighth, making just over 4 million barrels daily8. Iran and Kuwait also rank high, each producing nearly 4 million and 3 million barrels a day, respectively8.

Together, the Middle East produces about 26% of the world’s oil8. Saudi Arabia has huge oil reserves, making it a top producer8. Iraq has seen big gains in production since 2005, despite challenges8. The UAE manages oil production across seven emirates, with most in Abu Dhabi8. Iran’s production is lower due to sanctions, and Kuwait faces issues with foreign investment and project delays8.

The Middle East has 836.1 billion barrels of oil, which is 48.3% of the world’s total9. Saudi Arabia has the most with 297.7 billion barrels, or 17.2% of the world’s oil9. Iran has the second-largest reserves, followed by Iraq, Kuwait, and the UAE9.

OPEC, with Gulf countries, controls oil production to keep prices stable and supply steady8. Major oil companies like Saudi Aramco and National Iranian Oil Company play a big role in the global energy scene89.

The Gulf region has over 30% of the world’s oil reserves and 20% of its natural gas reserves10. Countries like Saudi Arabia, Kuwait, and the UAE aim to use their oil wealth to support their economies and protect their interests10.

The International Energy Agency’s (IEA) World Energy Outlook looks at the Gulf states’ oil strategies for the future10.

Diversification Strategies for Sustainable Growth

The Middle East’s wealth from oil and gas has driven its economic growth. Now, many countries are working hard to reduce their oil and gas use. This is to ensure they grow and develop over the long term11. It’s important because the International Monetary Fund (IMF) says the Gulf Cooperation Council (GCC) countries will run out of saved wealth by 2034 without big changes11.

UAE’s Knowledge Economy Push

The United Arab Emirates (UAE) is leading in making its economy more diverse. It’s focusing on a knowledge-based economy11. The UAE uses the least oil and gas in its economy, at 30 percent, compared to Bahrain’s 18 percent11. This shows the UAE is doing well in moving away from oil and gas.

By investing in tech, innovation, and education, the UAE is becoming a center for talent and new businesses. This helps it rely less on oil and gas.

Oman’s Vision 2040

Oman has its own plan, “Vision 2040,” to change its economy and lessen its oil and gas use11. Oman’s oil will run out in about 25 years, making diversification urgent11. The plan focuses on growing sectors like tourism, logistics, and renewable energy. This will help drive sustainable growth and create jobs.

The UAE and Oman are part of a bigger trend in the Middle East. They aim to use less oil and gas and build economies based on knowledge12. But, some countries face challenges like poor governance, not enough incentives, and not enough skilled people12. Overcoming these issues and creating a good environment for businesses and foreign investment is key to the region’s future success.

Economic Hubs and Regional Powers

The Middle East is known for its oil wealth, but it also has economic hubs and powers. These places are key to the region’s economy and connect it to the world. They offer unique opportunities for trade and growth.

Bahrain’s Financial Services Niche

Bahrain stands out as a top financial services hub in the Middle East13. It’s a go-to place for banking, asset management, and Islamic finance. Its location, friendly business policies, and strong rules help it shine as a top financial center in the Middle East.

Finance makes up a big part of Bahrain’s economy. The country keeps investing in its knowledge economy and fintech to stay ahead14. Its work on innovation, drawing in foreign investment, and making finance more accessible has made it a middle east economic hub with a focus on finance.

“Bahrain’s financial sector has long been a key driver of its economy, and the country continues to invest heavily in developing its capabilities in this area. As a regional financial center, Bahrain plays a crucial role in connecting the Middle East to global financial markets.”

Bahrain’s success in finance has helped the whole region grow and diversify15. As the Bahrain financial services hub does well, it shows the Middle East’s skill in making special economic areas. These areas meet the needs of investors and businesses131415.

Challenges and Opportunities

The Middle East’s wealthiest nations have thrived, but some countries face big economic and political hurdles. Lebanon is one such country, struggling with a severe economic crisis for years16.

Lebanon’s Resilience Amid Crises

Lebanon’s economy has hit hard times, with its GDP falling by 86% in the fourth quarter of 202316. Yet, the Lebanese people have shown great resilience. They’ve adapted to the tough economic conditions and found ways to get through the crisis.

The MENA region has both challenges and chances for growth. It’s expected to grow by 2.7% in 2024, up from 1.9% the year before16. GDP per capita growth is also forecasted to be 1.3% in 202416. But, the region’s debt-to-GDP ratios have risen sharply over the last decade, especially for oil importers16.

The MENA region faces many economic hurdles, like high youth unemployment17. It also needs more transparency and accountability in the public sector17. Geopolitical tensions can also affect trade and investment17. Yet, there are chances for growth in digital finance, economic diversification, and better global connections17.

Global powers like China are making a big mark on the Middle East through investments, especially with the Belt and Road Initiative (BRI)18. As the region deals with these challenges and chances, it’s key for policymakers to make big reforms. This will help drive sustainable economic growth.

“The Middle East’s economic landscape is further shaped by the growing influence of global powers, such as China’s significant investment in the region through the Belt and Road Initiative (BRI).”

Non-Oil Economies and Development

Egypt’s Vision 2030

Egypt is a key example of a country in the Middle East focusing on its non-oil sectors. It aims to diversify its economy19. With over 100 million people, Egypt is the most populous Arab country. Its economy is now growing beyond oil and gas.

The Vision 2030 plan is a big step towards making Egypt a knowledge-based economy20. It aims to make Egypt a top spot for investment and innovation. The plan includes modernizing infrastructure, improving human skills, and boosting entrepreneurship with digital tech.

- Egypt plans to increase the non-oil sector’s GDP share to 65% by 203019.

- The government is focusing on sectors like manufacturing, agriculture, tourism, ICT, and renewable energy20.

- Improving the business climate, drawing in foreign investment, and backing SMEs are key to diversifying the economy19.

Egypt’s economy has faced hurdles, like high unemployment and the COVID-19 pandemic19. Yet, Vision 2030 could open new growth paths. This could make Egypt a leading non-oil economy in the Middle East20.

“Egypt’s Vision 2030 is a transformative roadmap that aims to diversify the nation’s economy, foster innovation, and enhance its global competitiveness.”

| Indicator | Value |

|---|---|

| Population | Over 100 million |

| Non-oil sector contribution to GDP (target) | 65% by 2030 |

| Key focus sectors | Manufacturing, agriculture, tourism, ICT, renewable energy |

Wealth Distribution and Inequality

The Middle East is home to some of the wealthiest nations but struggles with big wealth inequality and income inequality. The oil-rich Gulf Cooperation Council (GCC) states have high incomes but large gaps between the rich locals and migrant workers22.

This region is the most unequal globally, with 56% of income going to the top 10% and just 12% to the bottom 50%22. Gulf countries have seen rising inequality over decades, with 54% of income to the top 10%22. In 2021, the top 10% earned 56% of the income, while the bottom 50% got about 10%23.

The wealth distribution is very uneven, with the top 1% owning 23% of income in 2019, almost double the bottom 50%’s share22. By 2021, the top 1% earned twice as much as the bottom 50%, and the top 10% earned 28 times more23.

Inequality has stayed high, with a slight drop in the top 10% share from 60% in 2019 to 56% in 202122. The top 10% income share in the Middle East varied from 47% to 60% between 1990 and 2021, while the bottom 50% share was between 8% and 15%23.

The wealth inequality in the Middle East might be underestimated due to limited data quality and gaps in survey years22. Gulf countries are more unequal than non-Gulf ones, as seen from 1990 to 201922. In countries like Qatar, the top 10% earned 29 times more than the bottom 50% in 202123.

The Middle East is the most unequal region, with the top 10% taking about 64% of the income24. This highlights the need for more investments in health, education, and infrastructure to reduce inequality24.

Improved data and transparency are key to accurately measuring income and reducing inequality in the Middle East23. Better data helps improve transparency, accountability, and tackles income inequality effectively24.

Major Economic Reforms and Initiatives

To tackle economic challenges, Middle Eastern countries have started big reform plans and development projects25. Kuwait’s Vision 2035 is one such plan. It aims to make Kuwait a key financial and commercial center.

Kuwait’s Vision 2035

Kuwait launched Vision 2035 in 2017, aiming to lessen its oil dependence25. This plan has strategic goals like building a knowledge-based economy and boosting the private sector. It also aims to improve public services.

Investing in infrastructure and technology is a big part of Vision 203526. Kuwait wants to upgrade its transport, logistics, and digital networks to draw more foreign investment. It also plans to grow sectors like tourism, healthcare, and renewable energy.

Kuwait has made economic reforms to meet these goals25. These include cutting subsidies, privatizing state companies, and introducing new taxes. These steps aim to make the economy more sustainable and encourage private sector growth25.

The success of Kuwait’s Vision 2035 is key for the country’s economic change and for the Middle East’s economic reforms25. Kuwait’s experience can offer valuable lessons for other Middle Eastern countries facing similar challenges25.

“Kuwait’s Vision 2035 is a bold plan to change the country’s economy and lessen oil dependence. If it works, it could inspire other Middle Eastern nations to diversify their economies and grow sustainably.”

The economic reforms in the Middle East, like Kuwait’s Vision 2035, show a shift towards adapting to global economic changes252627.

Geopolitical Factors and Regional Dynamics

The Middle East’s economy is deeply affected by its complex politics and changing dynamics28. Political instability, religious tensions, and rivalries often disrupt trade and investment. This has made economic cooperation hard in the region.

The Arab countries in the Middle East have a lot of the world’s oil and gas, holding 55.2% of global oil and 27.5% of natural gas reserves28. This makes the region crucial for global politics, with big powers fighting for influence and access to these resources.

When looking at the economic performance of Middle Eastern countries, the 2016-2017 Global Competitiveness Report shows big differences28. The UAE and Qatar are among the top 20 most competitive economies worldwide. But countries like Egypt and Yemen are much behind, showing the region’s economic gaps.

Income inequality is a big issue in the Middle East, with the top 10% getting 61% of the income and the top 1% getting over 25%28. This unequal wealth distribution leads to social and political tensions and limits economic chances for many people.

The demographics of the Middle East also shape its politics28. Young Arabs, aged 15-29, make up nearly a third of the population. They are better educated and healthier than before but face high unemployment and limited economic chances.

Conflicts and rivalries in the Middle East have big economic effects29. The Ukraine war has hit countries like Egypt and Lebanon hard, as they rely on imports from Russia and Ukraine. This has led to high food prices and inflation, making economic problems worse.

Geopolitical risks, like the threat of more conflicts and election uncertainty, are big threats to the region’s economy30. Experts worry about a deeper Russia-Ukraine war and more tensions between Israel and Hamas. These could hurt the Middle East’s economy.

In conclusion, the Middle East’s economy is closely tied to its complex politics282930. To improve the economy, the region needs to work together, reform policies, and focus on diversifying and sustainable development.

Conclusion

The Middle East is a place of big contrasts. It has some of the wealthiest nations and also faces big economic and political issues31. Countries like Qatar, the UAE, and Saudi Arabia have used their oil and gas to grow their economies31. They’re working hard to grow other sectors, such as finance, tech, and tourism, to lessen their oil dependence.

While some countries in the Middle East are doing well, others are facing big challenges32. Qatar stands out as a leader, with the highest income per person and the safest place in the world32. Saudi Arabia is also making big changes, focusing on growing non-oil sectors and encouraging private investment33. Yet, the journey to lasting success is tough, needing constant innovation, skill development, and a good business climate.

The Middle East must keep finding ways to use its strengths to move forward31. The wealthy countries in the region can lead the way in sustainable growth. This could help create a brighter future for everyone.

FAQ

What are the richest countries in the Middle East?

The International Monetary Fund (IMF) says the top rich countries in the Middle East are Qatar, the United Arab Emirates (UAE), Saudi Arabia, and Kuwait. They have the highest GDP per capita in 2022.

What is the richest country in the Middle East?

Qatar is the richest country in the Middle East. It has a GDP per capita of over ,000 in 2022. This makes it one of the wealthiest nations globally.

What factors drive the wealth of Middle Eastern countries?

The wealth of the Middle East comes mainly from its oil and gas. These resources let many countries have high GDP per capita. Countries like Saudi Arabia, the UAE, Qatar, Kuwait, and Oman have huge oil and gas reserves.

They are a big part of the world’s hydrocarbon production and exports.

How are Middle Eastern countries diversifying their economies?

The Middle East’s wealth from oil and gas has boosted its economy. Now, many countries are working to diversify their economies. This is to lessen their dependence on hydrocarbons and ensure sustainable growth.

The UAE is focusing on its knowledge economy. Oman has a Vision 2040 plan to diversify its economy.

What are some of the economic hubs and regional powers in the Middle East?

Besides the oil-rich Gulf states, the Middle East has economic hubs and regional powers. Bahrain is a strong financial services sector. It’s seen as a regional financial center.

What are the challenges and opportunities facing Middle Eastern economies?

The Middle East’s wealthy nations have thrived, but some face big economic and political challenges. These challenges have slowed their development. Yet, the region offers chances for growth, like developing non-oil sectors and implementing reforms.

How is wealth distributed in the Middle East?

The Middle East has a lot of wealth but also a big income gap. The oil-rich Gulf Cooperation Council (GCC) states have high per capita incomes. However, there’s a big wealth gap between the rich locals and the large migrant worker population.

How are geopolitical factors influencing the economic dynamics in the Middle East?

The Middle East’s economy is also affected by its complex geopolitical situation. Political instability, sectarian tensions, and regional rivalries can disrupt trade, investment, and cooperation in the region.

Source Links

- https://en.wikipedia.org/wiki/Economy_of_the_Middle_East

- https://worldexcellence.com/the-10-richest-countries-in-the-middle-east/

- https://en.wikipedia.org/wiki/List_of_Arab_League_countries_by_GDP_(nominal)

- https://medium.com/@blogreaders/top-15-richest-arabic-countries-in-2024-6d12af7c2ff5

- https://www.worldatlas.com/articles/the-richest-and-poorest-economies-in-the-middle-east.html

- https://economymiddleeast.com/news/biggest-economies-mena/

- https://www.worldometers.info/gdp/gdp-by-country/

- https://www.investopedia.com/articles/investing/101515/biggest-oil-producers-middle-east.asp

- https://www.nsenergybusiness.com/analysis/countries-oil-reserves-middle-east/

- https://www.bakerinstitute.org/research/how-economic-and-political-factors-drive-oil-strategy-gulf-arab-states

- https://www.brookings.edu/articles/economic-diversification-in-the-gulf-time-to-redouble-efforts

- https://www.sciencedirect.com/science/article/abs/pii/S2214790X19303375

- https://www.pbs.org/wgbh/globalconnections/mideast/questions/resource/index.html

- https://carnegieendowment.org/2018/10/09/arab-political-economy-pathways-for-equitable-growth-pub-77416

- https://www.imf.org/en/Publications/REO/MECA

- https://www.worldbank.org/en/region/mena/publication/middle-east-and-north-africa-economic-update

- https://www.imf.org/en/Blogs/Articles/2023/08/31/time-to-tap-growth-opportunities-in-the-middle-east-and-north-africa

- https://carnegieendowment.org/research/2024/03/the-geopolitics-of-economic-development-in-the-middle-east?center=middle-east

- https://www.imf.org/external/pubs/ft/mena/04econ.htm

- https://www.csis.org/analysis/new-revolution-middle-east

- https://www.imf.org/external/pubs/ft/med/2003/eng/fasano/

- https://wid.world/news-article/income-inequality-in-the-middle-east/

- https://wid.world/document/income-inequality-in-the-middle-east-world-inequality-lab-issue-brief-2022-06/

- https://cepr.org/voxeu/columns/inequality-middle-east

- https://carnegieendowment.org/2023/08/30/reform-or-recklessness-which-path-for-arab-region-pub-90459

- https://www.pwc.com/m1/en/blog/five-economic-themes-to-watch-2024-gcc.html

- https://www.brookings.edu/articles/economic-diversification-in-the-gulf-time-to-redouble-efforts/

- https://www.e-ir.info/2019/05/24/geography-resources-and-the-geopolitics-of-middle-east-conflicts/

- https://carnegieendowment.org/research/2024/01/misfortune-to-marginalization-the-geopolitical-impact-of-structural-economic-failings-in-egypt-tunisia-and-lebanon?center=middle-east

- https://www.economicsobservatory.com/how-are-geopolitical-risks-affecting-the-world-economy

- https://gfmag.com/data/worlds-richest-and-poorest-countries/

- https://www.rasmal.com/qatar-the-richest-country-in-middle-east/

- https://www.imf.org/en/News/Articles/2023/09/28/cf-saudi-arabias-economy-grows-as-it-diversifies