Aluminum, often called the “metal of the future,” plays a crucial role in numerous industries – from construction and automotive to packaging and electronics. The 2023 global aluminum production data reveals a fascinating picture of which nations dominate this vital sector and why. Let’s explore the key insights this data provides about the global aluminum landscape.

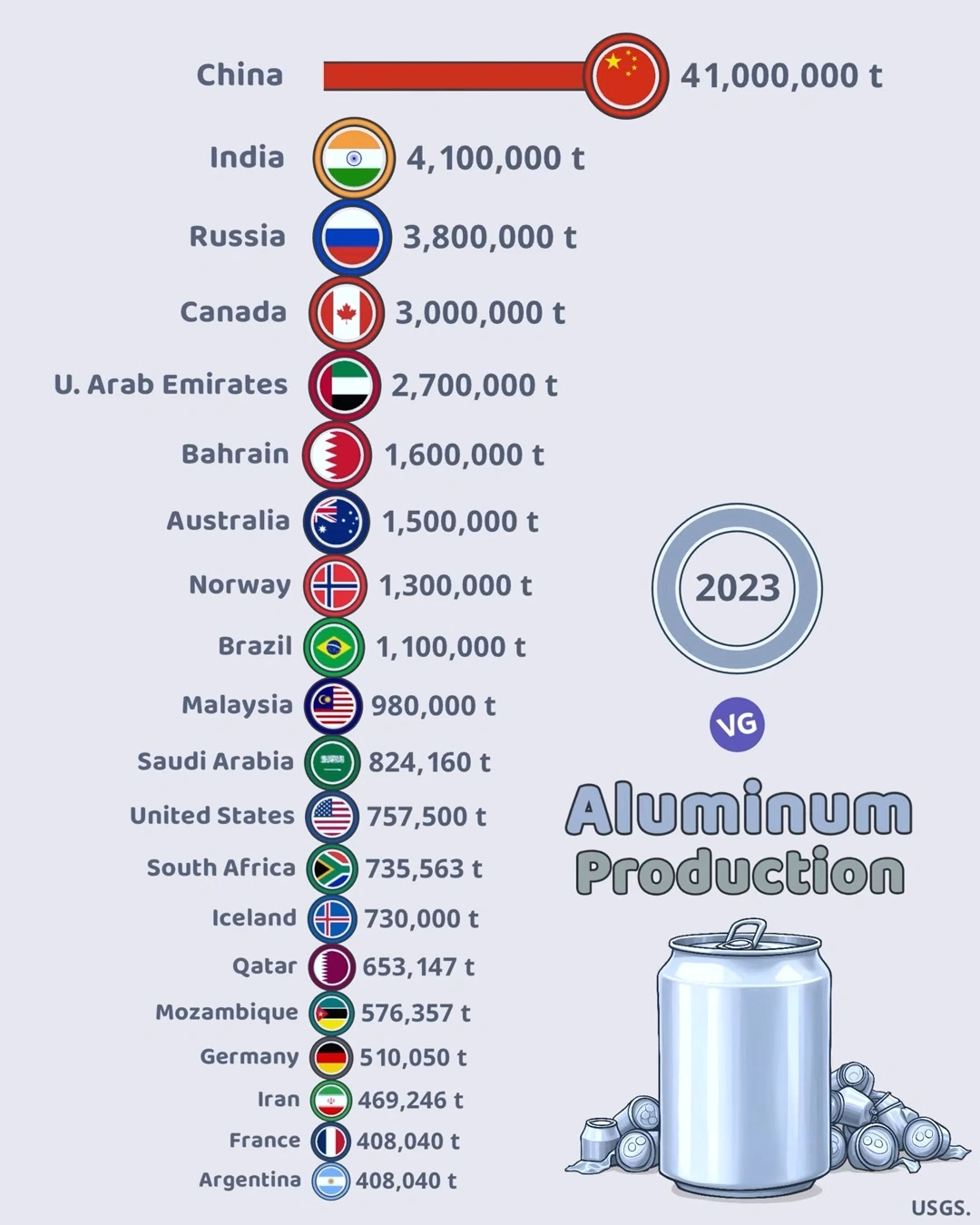

Aluminum Production (2023)

| Rank | Country | Production (t) |

|---|---|---|

| 1 🇨🇳 | China | 41,000,000 |

| 2 🇮🇳 | India | 4,100,000 |

| 3 🇷🇺 | Russia | 3,800,000 |

| 4 🇨🇦 | Canada | 3,000,000 |

| 5 🇦🇪 | U. Arab Emirates | 2,700,000 |

| 6 🇧🇭 | Bahrain | 1,600,000 |

| 7 🇦🇺 | Australia | 1,500,000 |

| 8 🇳🇴 | Norway | 1,300,000 |

| 9 🇧🇷 | Brazil | 1,100,000 |

| 10 🇲🇾 | Malaysia | 980,000 |

| 11 🇸🇦 | Saudi Arabia | 824,160 |

| 12 🇺🇸 | United States | 757,500 |

| 13 🇿🇦 | South Africa | 735,563 |

| 14 🇮🇸 | Iceland | 730,000 |

| 15 🇶🇦 | Qatar | 653,147 |

| 16 🇲🇿 | Mozambique | 576,357 |

| 17 🇩🇪 | Germany | 510,050 |

| 18 🇮🇷 | Iran | 469,246 |

| 19 🇫🇷 | France | 408,040 |

| 20 🇦🇷 | Argentina | 408,040 |

China’s Overwhelming Dominance

The most striking aspect of the 2023 aluminum production data is China’s extraordinary output – 41,000,000 tonnes. This represents approximately 60% of the total production among the top 20 producers listed. China’s dominance reflects decades of strategic investment in aluminum smelting capacity, access to affordable energy, and strong domestic demand from its manufacturing sectors.

The Second Tier: Significant But Distant

Following China are several nations with substantial but comparatively modest production figures:

- India (4,100,000 tonnes)

- Russia (3,800,000 tonnes)

- Canada (3,000,000 tonnes)

- United Arab Emirates (2,700,000 tonnes)

These countries produce roughly one-tenth of China’s output individually, highlighting the massive gap between the leader and everyone else. Each has developed aluminum production capacity based on different advantages – hydroelectric power in Canada, industrial policy in India, and energy resources in Russia and UAE.

Regional Production Hubs

The data reveals several interesting regional patterns:

Middle East: The Gulf region has become a major aluminum production hub, with UAE, Bahrain (1,600,000 tonnes), Saudi Arabia (824,160 tonnes), Qatar (653,147 tonnes), and Iran (469,246 tonnes) all featuring prominently. This reflects the region’s strategy to diversify beyond oil and leverage natural gas resources for energy-intensive industries.

Nordic Countries: Norway (1,300,000 tonnes) and Iceland (730,000 tonnes) demonstrate how access to clean, abundant hydroelectric power can support significant aluminum production despite smaller economies.

Resource-Rich Developing Nations: Countries like Brazil (1,100,000 tonnes), Malaysia (980,000 tonnes), and Mozambique (576,357 tonnes) show how aluminum production has spread to developing economies with access to either bauxite resources or affordable energy.

Strategic Implications

The distribution of aluminum production carries significant geopolitical and economic implications:

- Supply Chain Vulnerability: The heavy concentration in China creates potential supply risks for industries worldwide.

- Energy Transition Considerations: Aluminum is essential for many renewable energy technologies and electric vehicles, making production capacity strategically important.

- Environmental Concerns: With aluminum smelting being energy-intensive, the industry’s carbon footprint varies dramatically depending on energy sources – from coal-powered production in China to hydroelectric-powered smelters in Norway and Canada.

Future Outlook

Several factors will likely influence future aluminum production patterns:

- Decarbonization Pressure: Countries with access to renewable energy may gain advantage as carbon pricing mechanisms expand.

- Recycling Emphasis: Nations investing in aluminum recycling may reduce their need for primary production.

- Supply Chain Resilience: Strategic concerns may drive more diversified production geographically.

- Technological Innovation: Breakthroughs in smelting efficiency or alternative production methods could reshape the competitive landscape.

Conclusion

The 2023 aluminum production data reveals a world still heavily dependent on Chinese output, but with emerging production hubs diversifying the global supply picture. For industries reliant on this versatile metal, understanding these production patterns is essential for strategic planning, supply chain management, and sustainability initiatives.

As the world continues its transition toward cleaner energy and more sustainable materials use, aluminum’s importance will likely grow – making the evolution of global production capacity an important economic indicator to watch in the coming years.