The global chocolate trade presents a fascinating picture of how traditional expertise, industrial capacity, and market demand intersect in the modern world. According to 2023 data from the FAO, the chocolate export landscape reveals some intriguing patterns about which nations dominate this sweet industry.

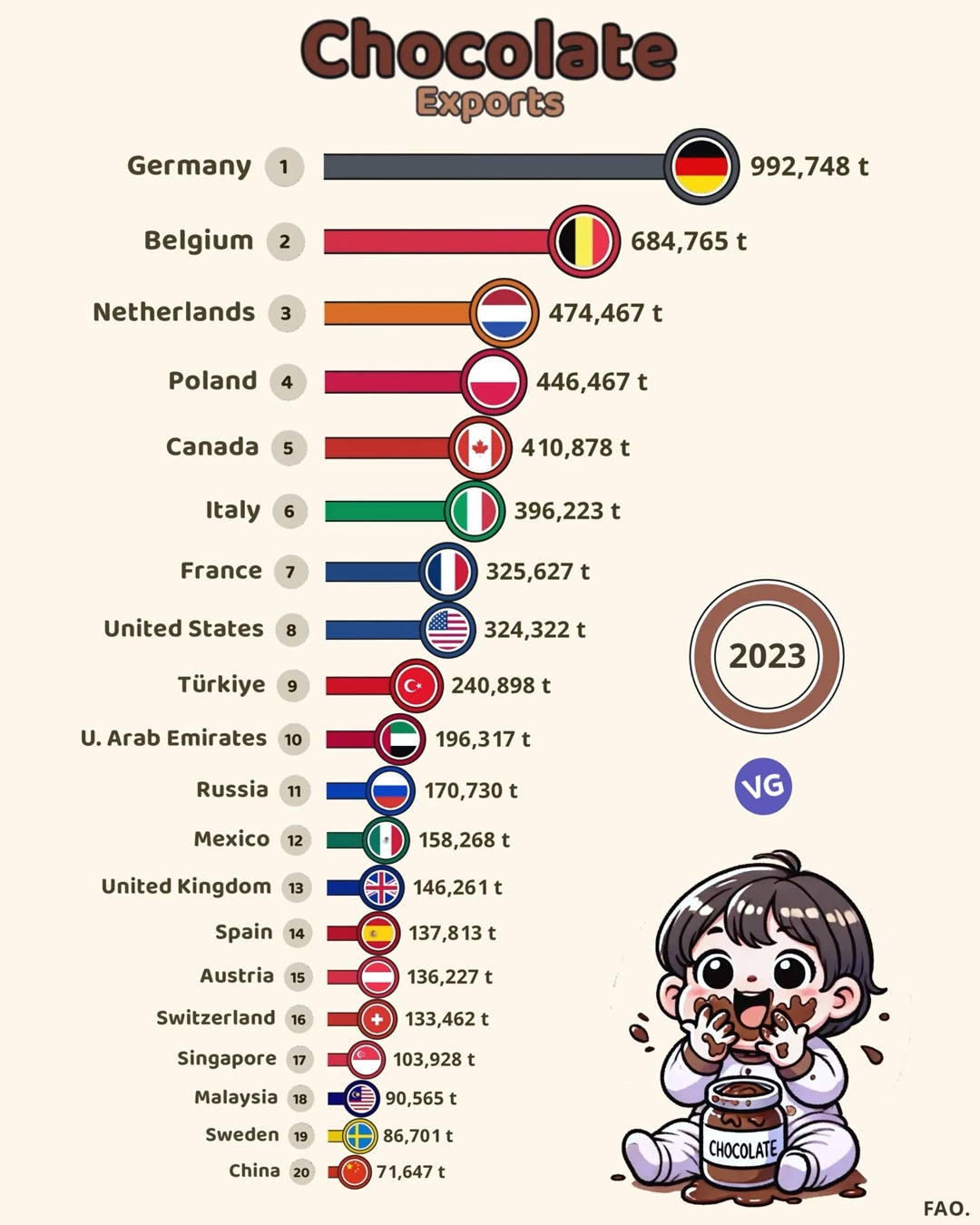

Chocolate Exports 2023

| Rank | Country | Exports (tonnes) |

|---|---|---|

| 1 | 🇩🇪 Germany | 992,748 |

| 2 | 🇧🇪 Belgium | 684,765 |

| 3 | 🇳🇱 Netherlands | 474,467 |

| 4 | 🇵🇱 Poland | 446,467 |

| 5 | 🇨🇦 Canada | 410,878 |

| 6 | 🇮🇹 Italy | 396,223 |

| 7 | 🇫🇷 France | 325,627 |

| 8 | 🇺🇸 United States | 324,322 |

| 9 | 🇹🇷 Türkiye | 240,898 |

| 10 | 🇦🇪 U. Arab Emirates | 196,317 |

| 11 | 🇷🇺 Russia | 170,730 |

| 12 | 🇲🇽 Mexico | 158,268 |

| 13 | 🇬🇧 United Kingdom | 146,261 |

| 14 | 🇪🇸 Spain | 137,813 |

| 15 | 🇦🇹 Austria | 136,227 |

| 16 | 🇨🇭 Switzerland | 133,462 |

| 17 | 🇸🇬 Singapore | 103,928 |

| 18 | 🇲🇾 Malaysia | 90,565 |

| 19 | 🇸🇪 Sweden | 86,701 |

| 20 | 🇨🇳 China | 71,647 |

European Dominance

Germany: The Chocolate Powerhouse

Leading the pack by a significant margin, Germany exported an impressive 992,748 tonnes of chocolate in 2023. This dominance reflects Germany’s sophisticated food processing industry and strategic position within the European market. The country’s output nearly equals the combined exports of Belgium and the Netherlands, the second and third-ranked exporters respectively.

The Chocolate Triangle

Belgium (684,765t) and the Netherlands (474,467t) complete what could be called Europe’s “Chocolate Triangle.” Belgium’s reputation for premium chocolate production is reflected in its strong second-place position, while the Netherlands leverages its historic trading expertise and port facilities to maintain significant export volumes.

Regional Distribution

North American Presence

Canada ranks surprisingly high at fifth place with 410,878 tonnes, outperforming the United States (324,322t) which sits at eighth position. This difference might reflect Canada’s strong food processing industry and favorable trade agreements with various partners.

Emerging Players

The presence of the UAE (196,317t) in the top 10 demonstrates how strategic location and investment in food processing can create new hubs for chocolate trade. Similarly, Asian nations like Singapore (103,928t) and Malaysia (90,565t) show the growing importance of the Asia-Pacific region in global chocolate commerce.

Market Insights

Traditional Producers

Switzerland (133,462t), despite its reputation for premium chocolate, ranks 16th in export volume. This suggests that reputation for quality doesn’t necessarily correlate with export quantity. Similarly, Belgium’s high ranking shows how it successfully combines both quality reputation and volume production.

Notable Observations

China’s position at 20th place (71,647t) is particularly interesting, given its massive manufacturing capacity in other sectors. This might indicate an opportunity for growth in the Chinese chocolate manufacturing sector, especially considering the size of its domestic market.

Future Outlook

The data suggests that while traditional European producers maintain their dominance, new players are emerging, particularly in Asia and the Middle East. The global chocolate trade appears to be evolving, with strategic location and processing capability playing increasingly important roles alongside traditional expertise.

As consumer preferences continue to evolve and new markets develop, we might see significant changes in these rankings in the coming years. The emergence of new processing hubs and changing consumption patterns in developing markets could reshape the global chocolate export landscape significantly.

The 2023 data not only reflects current market dynamics but also hints at potential future shifts in this sweet sector of global trade. What remains clear is that chocolate exports continue to be a significant part of the global food trade, with both traditional and emerging players competing for their share of this delectable market.