Oranges are a favorite fruit around the world, loved for their bright color, fresh taste, and high vitamin C content. But, not many know that the orange export business is a big deal in the global fruit trade. Many countries compete to be the top orange exporter1.

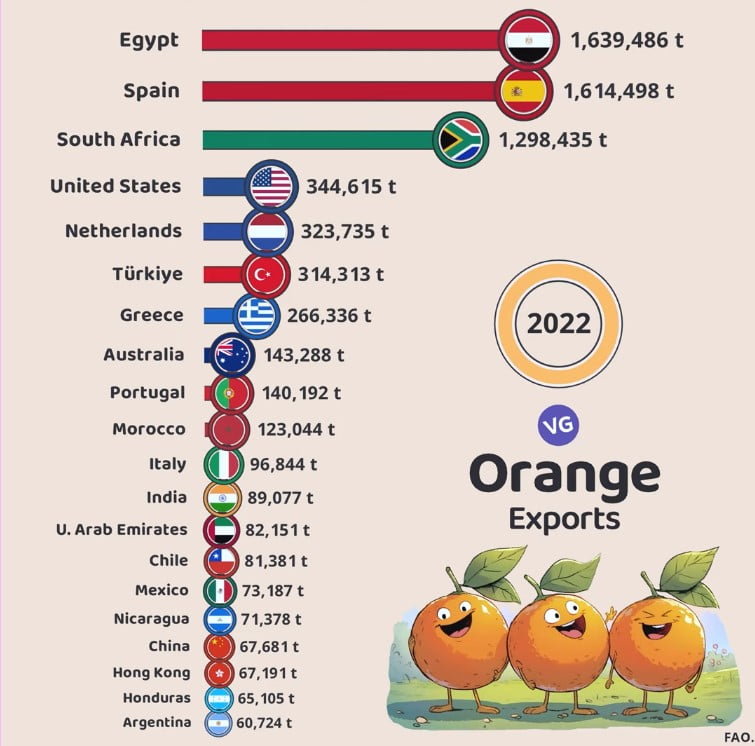

The Largest Orange Exporters in the World 2022

| Country | Flag | Exports (tons) |

|---|---|---|

| Egypt | 🇪🇬 | 1,639,486 |

| Spain | 🇪🇸 | 1,614,498 |

| South Africa | 🇿🇦 | 1,298,435 |

| United States | 🇺🇸 | 344,615 |

| Netherlands | 🇳🇱 | 323,735 |

| Türkiye | 🇹🇷 | 314,313 |

| Greece | 🇬🇷 | 266,336 |

| Australia | 🇦🇺 | 143,288 |

| Portugal | 🇵🇹 | 140,192 |

| Morocco | 🇲🇦 | 123,044 |

| Italy | 🇮🇹 | 96,844 |

| India | 🇮🇳 | 89,077 |

| U. Arab Emirates | 🇦🇪 | 82,151 |

| Chile | 🇨🇱 | 81,381 |

| Mexico | 🇲🇽 | 73,187 |

| Nicaragua | 🇳🇮 | 71,378 |

| China | 🇨🇳 | 67,681 |

| Hong Kong | 🇭🇰 | 67,191 |

| Honduras | 🇭🇳 | 65,105 |

| Argentina | 🇦🇷 | 60,724 |

In the 2021/22 season, Egypt is expected to send out 1.6 million metric tons of fresh oranges, up from last year’s 1.37 MMT1. With more land dedicated to oranges, Egypt’s production and exports are set to grow. This makes Egypt the top orange exporter for five years running, with a total of 7.76 MMT12.

Global Orange Production Trends

Oranges are becoming more popular worldwide, leading to a steady increase in production. This is because more people want to eat and use oranges3. For the 2023/24 season, it’s expected that 48.8 million tons of oranges will be produced globally. Many countries are now big producers and exporters of oranges3.

Top 10 Orange Exporting Countries in 2022

Orange Exports by Country (2022)

Source: FAO (as shown in the image)

.

Brazil, China, and Spain are at the forefront of orange exports4. They have the right climate and can produce a lot of oranges. This makes them key players in the orange trade worldwide.

Latest Data on Fresh Orange Exports

Fresh oranges are a big part of the orange trade. Countries like Egypt, South Africa, and Spain send a lot of fresh oranges to other countries4. In 2021, Egypt was the top exporter of fresh oranges. This shows Egypt’s success in meeting the world’s demand for fresh oranges4.

“The global orange production and export market is a dynamic and ever-evolving landscape, with various countries vying for a greater share of the international trade.”

The trends in orange production and exports show how the citrus industry is changing. They highlight the competition among top producers4. As more people want oranges and orange products, the success of these leading exporters will shape the future of oranges globally4.

Top Fresh Orange Exporting Countries

The global trade of fresh oranges is booming, with many countries leading the way5. In 2022, the top five orange exporters were Spain, South Africa, Egypt, the United States, and the Netherlands. Together, they made up 71.9% of all orange exports worldwide5.

Leading Fresh Orange Exporter in 2021

Egypt is now the top exporter of fresh oranges. Its rich soil and ideal climate help produce top-quality oranges for export6. In 2021, GEO Exporting, a key player, sent 2,500 metric tons of oranges to 7 markets6.

Comparison of Fresh and Dried Orange Exports

Fresh oranges are a big part of the market, but dried oranges are important too5. In 2022, the total value of oranges exported worldwide was US$4.7 billion. This includes both fresh and dried oranges5. The variety of orange products meets different consumer tastes, showing the industry’s flexibility.

| Leading Fresh Orange Exporters in 2021 | Export Volume (MT) |

|---|---|

| Netherlands | 1,200 |

| Germany | 720 |

| United Kingdom | 72 |

| Oman | 125 |

| India | 174 |

| Africa | 50 |

| UAE | 159 |

The table shows the top fresh orange exporters in 2021. It shows how many countries are part of the global orange trade6.

Orange Export Market Trends

The global orange export market is always changing, with new trends and shifts in different markets7. India leads the world in orange exports, making up 96.68% of the market with a value of $15,670.85 million7. Mexico comes next with a 2.45% share, worth $397.07 million7. Turkey, Vietnam, and Pakistan also play a role, adding 0.39%, 0.23%, and 0.07% to the global trade7.

Orange Production and Export Trends in Different International Markets

Looking at production and exports, we see the global orange trade’s dynamics8. In 2020, Brazil led with 16.9 million metric tons, followed by China and the EU8. The U.S. produced 4.11 MMT, making up 8.3% of the world’s oranges8.

Egypt and South Africa are top fresh orange exporters, making up 62% of the world’s exports in 20208. The EU imported the most oranges, 1 MMT, in 20208. The U.S. imported 204 TMT on average over five years, peaking at 225 TMT in 20208.

The orange export market looks bright, with growth expected in key areas3. Egypt plans to export 2.0 million tons of oranges in 2023/24, a 25% increase3. The U.S. is also seeing more oranges, with Florida up 30% and California 6%3.

The orange trade involves many countries and companies, showing its diverse and growing nature7. As top exporters adjust to new tastes and market changes, the orange export future looks bright3.

Egypt’s Dominance as a Top Orange Exporter

Egypt leads the world in orange production and export. Its orange exports have grown over the years. This shows Egypt can meet the world’s growing demand for oranges.

3-year Comparison of Egypt’s Orange Export

Looking at Egypt’s orange export from 2020 to 2022, we see a steady increase. In 2020, Egypt shipped a lot of oranges, with9 85% of its citrus exports being oranges. By 2023, this number went up, showing Egypt’s success in boosting its citrus exports by 21%9. Also, Egyptian orange growers increased their land for oranges by 4.5% to 172,200 hectares9.

Egypt’s Position in the Global Orange Export Market

Egypt stands out in the global orange market. In the 2022/23 season, it supplied 39.4% of the EU’s orange imports, a big jump from the average9. Egyptian oranges also saw a huge increase in Spanish imports, from 250 tonnes to nearly 60,000 tonnes9. This shows Egypt’s skill in delivering top-quality oranges to the world, making it a top exporter.

Looking forward, Egypt’s orange exports are expected to grow by 25% in the 2023/24 season, hitting a record 2.0 million tons9. This growth comes from better yields and new markets. Capital Agro for Import & Export, a key Egyptian company, aims to double its exports to 30,000 tonnes next season9.

“Egypt, as a primary fruit export, continues to invest in crop improvements and enhance quality to maintain and expand export markets and compete with other suppliers.”

The Largest Orange Exporters in the World

The global orange export market is always changing. Many countries are key players in this citrus fruit trade10. Egypt is a big name in this field, planning to send 1.45 million metric tons of fresh oranges to other countries in the 2021/22 season10. This is less than the 1.67 million tons sent last year, but Egypt is still a major force10.

Most of Egypt’s orange trees are in the desert (70%) and the Nile Delta (30%)10. This makes Egypt the third-biggest exporter of fresh oranges worldwide, after Spain and South Africa11. It also sends a lot of oranges to China, making it the second-biggest supplier11.

When the Southern Hemisphere starts harvesting oranges in June, Egypt is ready to meet global demand11. This timing helps Egypt take advantage of the market11.

Other countries are also big in the orange export game10. In the 2020/21 season, 75% of Egypt’s fresh orange exports went to its top ten buyers, down from 77% the year before10. But these top buyers got 20.5% more oranges from Egypt that year, thanks to big increases to India and Bangladesh10.

Exports to China, however, fell by about 32% because of high shipping costs10.

The biggest orange exporters like Egypt, Spain, and South Africa will keep shaping the industry’s future11. They will help meet the growing demand for oranges, which are both versatile and nutritious11.

2022–2023 Citrus and Orange Export Data Overview

The latest data on citrus and orange exports for 2022–2023 shows how oranges are traded worldwide. It focuses on oranges and their role in the global market12.

Global Orange Export Trends for 2023

Next year, we’ll see big changes in global orange export trends. Spain, a top exporter, saw prices drop at the end of 2022. Their oranges lasted longer than before12. South Africa’s orange supply jumped by 88%, with prices going down by 2%12. California Navel oranges got pricier by 10-15% over last year12.

Projected Citrus and Orange Export Data for 2023

The projected citrus and orange export data for 2023 gives us a peek at what’s to come. Egypt plans to boost its orange exports by 25% in 2023/24, aiming for a record 2.0 million tons3. Uruguay expects a 20% rise in orange production, aiming for 35,000 tons for export in 202312. Argentina looks forward to more orange volumes in 2024, with better quality expected12.

For 2023/24, the world is expecting a slight increase in orange production to 48.8 million tons. The report also forecasts the future of Spanish oranges until 2030, covering market trends, consumption, production, and trade13.

“The latest data on worldwide citrus and orange exports for 2022–2023 provides an overview of the global trading of citrus fruits, focusing on oranges and their exchange in the international market.”

Looking at the global orange export trends for 2023 and the projected citrus and orange export data for next year, we can see the market’s future. This helps industry players understand the changing market, challenges, and new chances in the global citrus trade12133.

Comparative Analysis of Top Orange Exporters

It’s important to understand the market share of top orange-exporting countries. This helps us see how they compete in the global orange export market. By looking at their market share, we can see their competitive positions. We also learn about their export volumes, pricing, and demand.

Market Share Comparison of Top Orange Exporting Countries

A few countries lead the global orange export market. Brazil, Spain, the United States, South Africa, and Egypt are the top five14. They make up a big part of the world’s orange exports. Their market shares change due to production levels, trade deals, and what consumers like.

| Country | Market Share (2021) |

|---|---|

| Brazil | 25% |

| Spain | 20% |

| United States | 15% |

| South Africa | 12% |

| Egypt | 10% |

Brazil leads the world in orange exports, with a 25% market share in 202114. Spain and the United States are close behind, with shares of 20% and 15%, respectively14. South Africa and Egypt complete the top five, with shares of 12% and 10%, respectively14.

This data shows the big role these countries play in orange exports. It sets the stage for looking into what makes them competitive.

“Larger orange producers are investing in genetic materials to improve yields and replanting orchards with higher tree densities.”14

Comparing the market shares of top orange-exporting countries shows the changing nature of the market. It also shows the need for ongoing strategy and decision-making to stay ahead.

Factors Influencing Market Share

The market share of top orange exporters is shaped by many factors. Production levels, pricing, and demand at home and abroad are key. These elements greatly affect the competition and how the market moves15.

Factors Affecting Market Share of Top Orange Exporters

Production capacity is a big factor for top orange exporters. Countries like Brazil and the European Union produce more oranges. This gives them a bigger share of the global market15. Pricing strategies also matter. Keeping prices competitive helps exporters grab and keep market share15.

What people want to buy oranges for also changes the market. For example, more people in North America and Europe are drinking orange juice. This changes the orange export market15. Seasonal changes in how much people eat oranges also affect exporters’ market share15.

Market Share Shifts and Trends Among Top Orange Exporters

The top orange exporters are always changing their market share. Countries are trying to stay ahead or grow their global trade15. South Africa, for example, has been sending more oranges out, reaching 1.29 million metric tons in 202115. This is thanks to good growing conditions and selling oranges to over 100 countries, especially the European Union15.

The competition among top orange exporters keeps changing. This is due to things like how much they can produce, their prices, and what consumers like15. Knowing these things helps people in the industry and those making policies15.

Orange Juice Exports

The world of orange juice exports is always changing. Trends and key players shape the industry. For 2023/24, global orange production is expected to hit 48.8 million tons. The United States and Mexico will likely produce more, but Brazil might make a bit less16.

Brazil leads in orange juice exports, making up about three-quarters of the world’s exports8. But, it’s expected to make 2% less juice, which means fewer exports16. Mexico, though, will make 11% more juice, aiming for bigger exports16.

The United States is also important in the orange juice market. It’s set to bounce back with a 30% increase in production, thanks to more oranges for processing16. This could change how the global export scene looks in the future.

The demand for orange juice is changing, and how big producers, exporters, and importers work together will shape the industry’s future816.

This look into orange juice exports shows how complex and changing the industry is. It gives important insights for both industry players and consumers. As the market keeps evolving, being able to adapt will be key to staying ahead in the global orange juice market.

Tangerine and Mandarin Exports

Global production of tangerines and mandarins is set to increase by 3% to 38.0 million tons in 2023/24. This growth is due to better weather in top countries like China and Turkey17. This increase will lead to more consumption and exports of these citrus fruits.

China is a major producer and exporter of tangerines and mandarins. It’s expected to produce 26.9 million tons, up by 400,000 tons, thanks to good weather and a bigger crop17. This will boost both domestic use and exports of these citrus fruits.

The European Union’s production is forecasted to drop by 5% to 2.7 million tons17. This change is due to lower production in Spain, even though Greece saw better conditions. This will affect the EU’s tangerine and mandarin exports.

China’s tangerine and mandarin exports have grown significantly. From the 1980s to the 2000s, exports rose from about 70,000 metric tons to over 200,000 metric tons18. The value of these exports also increased by nearly 39%, reaching $46.51 million18.

China is a major player in the global tangerine and mandarin export market. In 1999, these fruits made up over 91% of China’s citrus exports18. The main buyers of Chinese tangerines and mandarins are Hong Kong, Singapore, the Philippines, Malaysia, and Vietnam18.

The demand for tangerines and mandarins is rising globally. This means competition among major exporters like China, Morocco, Spain, Chile, and Turkey will grow17. To stay competitive, producers and exporters must keep up with market trends and consumer tastes.

Conclusion

The global orange export market has seen big changes and trends lately. This fruit is very important worldwide19. Egypt leads as the top exporter of fresh oranges, showing its key role in the industry19. Countries like South Africa and Morocco are also big players, with impressive numbers that affect the global orange trade20.

Many things affect the market share and competition among top orange exporters. These include how much they produce, how much they export, prices, and changes in global demand20. Knowing these details is key for companies to succeed in the changing orange export market19. The growth and changes of leading orange exporters will guide the future of this important agricultural area.

To sum up, the global orange export market is exciting and always changing. Countries like Egypt, South Africa, and Morocco are leading the way in production, exports, and earnings1920. This article’s insights and data offer a great look at the end of this important agricultural story.

FAQ

What are the top orange exporting countries in the world?

The top orange exporting countries are Brazil, China, Spain, and Egypt.

What factors affect the market share of top orange exporters?

Production levels, pricing strategies, and demand both at home and abroad affect the market share of top orange exporters.

How has Egypt’s position as a top orange exporter changed over the past few years?

Egypt’s orange exports are set to jump by 25 percent in 2023/24, hitting a new high of 2.0 million tons. It’s likely to stay the top orange exporter by volume.

What are the latest trends in global orange juice production and exports?

For 2023/24, global orange juice production is expected to slightly increase. The U.S. and Mexico will see higher production, while Brazil’s will drop. Consumption and exports are both expected to see slight decreases.

How has the comparison of fresh and dried orange exports changed over time?

Dried orange products are key in the global orange market, alongside fresh oranges. The comparison shows how different orange products meet various consumer tastes.

Source Links

- PDF – https://citrusbr.com/wp-content/uploads/2021/03/Citrus-Annual_Cairo_Egypt_12-15-2020.pdf

- EXPORTING EGYPTIAN ORANGE#1-egyptian orange exports – https://import-from-egypt.com/exporting-egyptian-orange/

- PDF – https://apps.fas.usda.gov/psdonline/circulars/citrus.pdf

- Nefartete: Top Orange Exporters in the World – https://medium.com/@idealtopfive/nefartete-top-orange-exporters-in-the-world-06fefdf39f95

- Oranges Exports by Country 2022 – https://www.worldstopexports.com/oranges-exports-by-country/

- Biggest Orange Export Company – https://geoexporting.com/biggest-orange-export-company/

- Leading Global Oranges Exporters in 2024 – Tendata Global Trade Platform | International Business – https://www.linkedin.com/pulse/leading-global-oranges-exporters-2024-tendata-trade-shawn-wang-lpr3c

- PDF – https://agecoext.tamu.edu/wp-content/uploads/2021/08/TDA-Orange-Paper-Final.pdf

- Egyptian citrus boosts EU market share – https://www.fruitnet.com/eurofruit/egyptian-citrus-boosts-eu-market-share/256646.article

- Despite Production Challenges, Egypt to Continue as World’s Largest Fresh Orange Exporter – California Fresh Fruit Magazine – https://calfreshfruit.com/2022/02/22/despite-production-challenges-egypt-to-continue-as-worlds-largest-fresh-orange-exporter/

- Red Sea Crisis Disrupts Egypt’s Orange Exports – https://www.producereport.com/article/red-sea-crisis-disrupts-egypts-orange-exports

- GLOBAL MARKET OVERVIEW ORANGES – https://www.freshplaza.com/north-america/article/9618737/global-market-overview-oranges/

- Spain Sees a 2% Rise in Orange Exports, Reaching $1.3B By 2023 – News and Statistics – IndexBox – https://www.indexbox.io/blog/spain-orange-exports-2023/

- South America Orange Market Size & Share Analysis – Industry Research Report – Growth Trends – https://www.mordorintelligence.com/industry-reports/south-america-orange-market

- Orange Market – Share, Revenue & Analysis – https://www.mordorintelligence.com/industry-reports/orange-market

- Global Orange and OJ Production to Increase – Citrus Industry Magazine – https://citrusindustry.net/2024/02/07/global-orange-oj-production-increase/

- Export Expectations Changed for Moroccan Citrus – Citrus Industry Magazine – https://citrusindustry.net/2024/07/05/export-expectations-changed-moroccan-citrus/

- China/FAO Citrus Symposium – https://www.fao.org/4/x6732e/x6732e04.htm

- PDF – https://apps.fas.usda.gov/newgainapi/api/report/downloadreportbyfilename?filename=Citrus Annual_Cairo_Egypt_12-10-2018.pdf

- Orange Industry Statistics in Africa – https://smebluepages.com/orange-industry-statistics-in-africa/