Do you know who leads the world in sugar exports? It’s Brazil, which sent out a whopping 28.2 million metric tons in 2022/2023. This number is huge compared to Thailand, the next biggest exporter, which sent around 11 million metric tons.1 The sugar trade worldwide is always changing. It’s influenced by how much sugar is made, what people want, and the state of the economy. Lots of countries are vital in making sure the world never runs out of its beloved sweet treat.

Key Takeaways

- Brazil is the world’s largest exporter of sugar, shipping approximately 28.2 million metric tons in 2022/2023.1

- Thailand is the second-largest sugar exporter, shipping around 11 million metric tons.1

- India, Australia, Colombia, Guatemala, Mexico, Dominican Republic, Cuba, and France are also among the top global sugar exporters.2

- The global sugar trade is a dynamic industry influenced by production patterns, market demand, and economic conditions.2

- Brazil exports nearly 49% of all sugar produced, making it the world’s top sugar exporter.1

Introduction to Global Sugar Trade

Sugar is a sweetener we all know and love. It’s huge in the world of trade.3 The export of sugar is influenced by how much is made, what folks want, and the money picture. This sweet material comes from plants like sugarcane and sugar beets and is made of glucose and fructose.3 Most of the world’s sugar (about 80%) is made from sugarcane. The top sugar-making countries are Brazil, India, EU-27, China, USA, Thailand, Russian Fed., Mexico, Pakistan, and Australia.3 It’s found in white and brown forms and occurs naturally in honey, fruits, veggies, and milk.

| Statistical Data Related to Global Sugar Trade |

|---|

|

Production:

Consumption:

International Trade:

World Sugar Economy:

Market Prices: |

Sugar production worldwide is set to rise to 186.0 million tons, up by 2.5 million tons.4 Brazil might see a slight drop in production, but Thailand, India, China, and Mexico will make more sugar.4 The U.S. expects to make 8.4 million tons, importing less. Consumption will stay the same.4 Brazil aims to make 44.0 million tons, facing challenges from the weather.4 Guatemala’s sugar exports might go down a bit. This is because sugarcane is yielding less.

Domestic sugar use in Guatemala is forecasted to rise, but stocks will fall sharply. This is due to more local demand.4 India is set to produce 34.5 million tons of sugar. This is because harvests are good and more people are using sugar during special events and in food.

Assessing Sugar Export Data: 2022-2023

Understanding Sugar HS Codes

Fully looking at sugar export stats helps traders guess wisely, see where the market is heading, and spot chances for growth. The data shows a global rise in sugar exports. More than 8.4 million shipments have been sent from many countries, involving over 123,000 exporters.5 The places bringing in the most sugar are the Netherlands, the United States, and Germany. They get a big chunk of the sugar that’s moving around the world. This comes in the form of different types, under HS codes like HSN Number 17049099 and others.

Top Sugar Exporting Countries

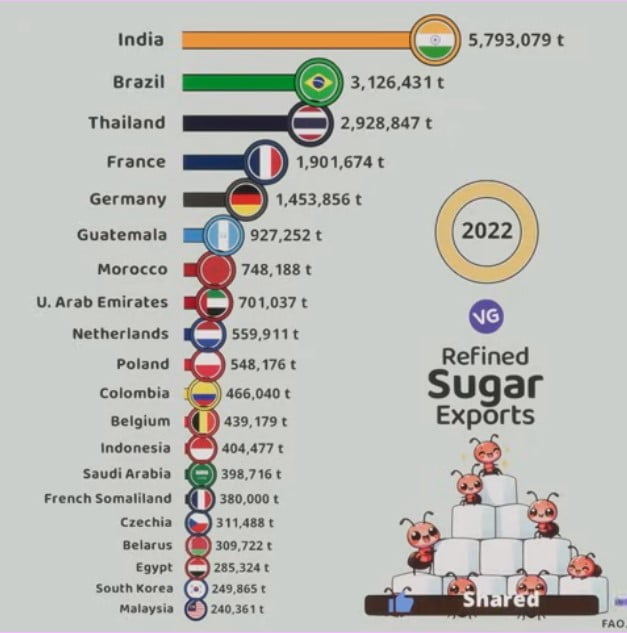

Refined Sugar Exports by Country (2022)

Source: FAO

Looking at the sugar data reveals the top countries sending out sugar in 2022/2023. Brazil is at the top with 28.2 million metric tons. Next are Thailand with 11 million and India with 7.7 million. Then, there’s Australia (4.2 million) and Colombia (3.7 million). Rounding out the top 10 are Guatemala, Mexico, Dominican Republic, Cuba, and France with various amounts.5

Brazil: The Heavyweight Champion

Brazil leads the world in sugar exports, sending out about 28.2 million metric tons in 2022/2023.6 It costs Brazil roughly $170-210 to produce a ton, making it top in trade.6 This high efficiency comes from a big ethanol industry, boosted by laws that mix ethanol into fuels.

Production Prowess

Brazil thrives in the sugar industry thanks to a great climate and farming conditions. It’s known as the biggest sugar exporter, with a forecast to send out 24 million tonnes from 2015 to 2016. This year might see less sugar due to bad weather, like drought, which can make sugar prices rise.

Export Volumes and Destinations

Being the top in sugar exports, Brazil’s supply is wanted around the globe. Mainly, Asia and Cuba look to Brazil for sugar.6 This shows Brazil’s strength in making sure different markets have the sugar they need.

Thailand: A Sweet Powerhouse

Thailand is now the world’s second-largest sugar exporter. It ships about 11 million metric tons, much less than Brazil. This was in 2022/2023.

It has become a big player in the global sugar market. This is essential to meet the growing need for sugar.

In the world, Thailand ranks second in sugar exports. This was seen in 2018 when it sent out 81% of its sugarcane.7 Sugarcane was grown over a vast area of land in 2017/18. Specifically, on 11,542,553 rai, which is about 18,468 km2, in Thailand.

Almost four percent of working Thais are in the sugarcane business.7 The sugar industry helps the country’s economy a lot. More than one percent of the total GDP and 16 percent of the agricultural sector’s GDP is from sugar.7

By 2016, Thailand made 3.5 times more sugar than it used.7 The majority of sugarcane, 71%, is grown in the Northeast and North areas.7 Much, about 67%, comes from small farmers in the Northeast. Since 2010, the amount of land dedicated to sugarcane has increased eight percent each year.7

| Metric | Value |

|---|---|

| Sugarcane grown on land | 11,542,553 rai or 18,468 km² |

| Working population in sugarcane industry | 4% |

| Contribution to total GDP | 1% |

| Contribution to agricultural GDP | 16% |

| Sugar production vs. consumption ratio | 3.5:1 |

| Sugarcane production from Northeast and North | 71% |

| Sugarcane from small landholders in Northeast | 67% |

| Annual growth in sugarcane cultivation area | 8% since 2010 |

In 1984, the Cane and Sugar Act started in Thailand. It helps both growers and companies have a stable income.7 The government there plans to have 53% more sugarcane land and 70% more sugar output by 2024.

But, Brazil, Guatemala, and the European Union have an issue. They complain to the WTO about how Thailand shares profits in its sugar industry.7

India’s Expanding Sugar Footprint

India is now a key player in the global sugar market thanks to its varied farm lands.8 With about 550 sugar mills, it supports over 7 million farmers and their families, as well as workers and business owners.8 The country’s need for sugar is huge, about 27 million tons a year. Yet, India’s sugar industry can make 370 to 400 million tons of sugarcane, 27 to 30 million tons of white sugar, and 6 to 8 million tons of jaggery and khandsari every year.8 India ranks third in the world for sugar exports, sending out around 7.7 million metric tons in 2022/2023.9

Domestic Consumption Vs Exports

To keep its own prices steady and ensure people have enough to eat, India limits sugar exports.10 A huge 11 million tons of sugar were sent overseas in the last export season ending Sept. 30, 2022. But, for this new season starting Oct. 1, 2022, that number dropped to 6.1 million tons that mills are allowed to export.10 Already, mills have plans to export about 5.6 million tons this year, and many hoped the government would agree to export 2 to 4 million tons more.10

Government Policies and Trade Restrictions

India has decided to keep a lid on sugar exports passed October 31, 2023.10 This ban covers raw sugar, white sugar, refined sugar, and organic types. It aims to prevent a jump in domestic sugar prices.10 Previously, India also stopped the export of non-basmati white rice to avoid a rise in prices at home and ensure food security.

Australia: Quality Over Quantity

Australia is the fourth-largest sugar exporter, sending about 4.2 million metric tons in 2022/2023.11 Its volume is lower than Brazil’s or Thailand’s. Still, it’s famous for high-quality sugar.11 Australia aims to meet the world’s needs with top-notch sugar.

The Australian sugar industry makes $1.1 billion yearly.11 Globally, Australia ranks 10th in sugar amounts, supplying just 3%. Yet, it’s the third top sugar exporter, mainly to Asia.11 This boosts the country’s economy, where food and drink sectors generate $104 billion and support 200,000 jobs annually.11

In FY2022-23, Australia got an extra 24,479 tonnes under the US’s raw cane sugar TRQ, 11% of the leftover quota.12 The US price for raw sugar has been consistently 75% higher than the global price for the last ten years.12 Despite Australia sending less than 2% of its sugar to the US, it’s a profitable market. As the fourth top raw sugar exporter, it ships 3—4 million tonnes yearly, worth $1.5 billion to $2.5 billion.12

In the past 5 years, Indonesia, Korea, and Japan took in 85% of Australia’s raw sugar.12 About 80% of Queensland’s sugar is sent out as raw bulk sugar. This trade is Queensland’s second main agricultural export.12 Annually, Australia sends about 100,000 tonnes of sugar to the US at a low tariff rate.12

The Largest Sugar Exporters in the World

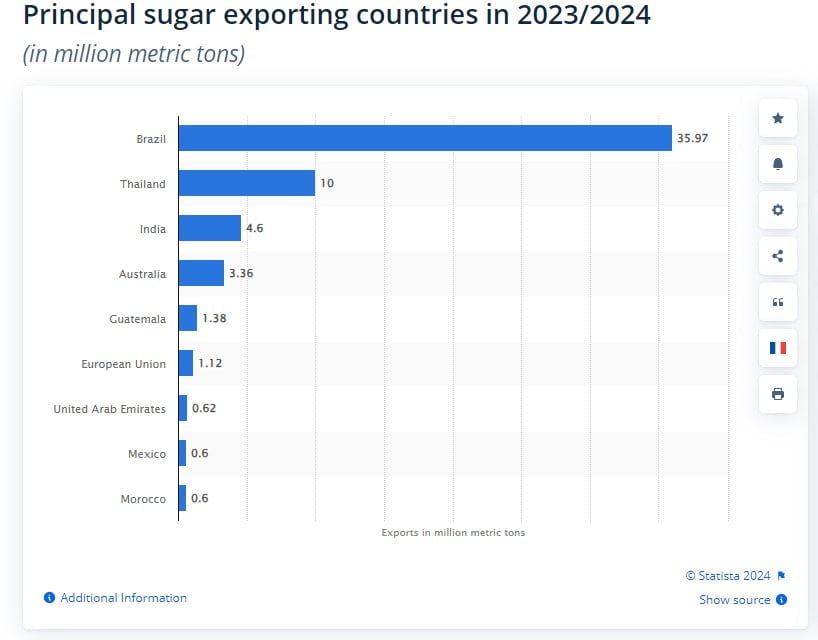

In 2022/2023, Brazil topped the list, exporting 28.2 million metric tons of sugar.2 Following Brazil were Thailand with 11 million metric tons and India with 7.7 million metric tons. Then, Australia exported 4.2 million metric tons and Colombia 3.7 million.2 Guatemala, Mexico, the Dominican Republic, Cuba, and France were also key exporters in the top 10, each sending out between 2.1 and 3.3 million metric tons.2 These countries are essential to meeting the world’s growing need for sugar, a crucial sweetener.

Brazil is the leading global sugar exporter, earning around $11.23 billion in 2022.1 In November 2023, its exports made $633 million in profits. This was a significant increase from the previous year as Brazil exported 174,266 metric tons daily.1 Nearly a quarter of all sugar worldwide comes from Brazil, and about half of its sugar production is exported.1

After Brazil, Thailand and India take the second and third places in exports, with 11 million and 7.7 million metric tons, respectively.2 The list goes on with Australia, Colombia, Guatemala, Mexico, the Dominican Republic, Cuba, and France rounding out the top 10 exporters.

These top exporters are crucial for meeting global sugar demands. Together, they keep a steady flow of sugar available for our growing need.

Sugarcane vs Sugar Beets: Contrasting Raw Materials

Sugar can be made from sugarcane or sugar beets. Global sugar production leans heavily on sugarcane, with a hefty13 77.1%. Sugar beets chip in for the rest, which is14 22.9%. Sugarcane loves hot, wet climates, while sugar beets grow best in cooler places. Because they need different conditions to grow, this affects how much sugar is grown and traded around the world.

Climate and Cultivation Requirements

Sugarcane thrives in places that are warm and wet with lots of rain or access to water for irrigation.15 In 2020, the U.S. harvested sugarcane from 903,400 acres. This land yielded an average 38 tons of sugarcane per acre.15 Sugar beets, on the other hand, prefer cooler spots with regular moisture. They get their water from the usual rainfall or from ground moisture. Sugarcane and sugar beets’ different needs shape where and how they are grown, affecting the sugar world market.

Africa’s Budding Sugar Industry

In 2014, Africa wasn’t a big player in the world’s sugar supply. It made 9.8 million tonnes on about 1.5 million hectares. Yet, it has some top [11] sugar producers. Uganda, Tanzania, Malawi, Zambia, Swaziland, and Egypt shine in this field.16

Major Producers and Exporters

South Africa leads the way in Africa’s [11] sugar industry and ranks 12th globally. It makes about 25% of African sugar.16 Egypt is also strong, making 1.8 million tons yearly.16 Eswatini’s (formerly Swaziland) production stands at about 500,000 tons each year, punching above its size.16 Tanzania is on the rise, with an annual production of 350,000 tons.16

Challenges and Opportunities

The African [11] sugar sector faces tough times. Challenges include bad weather, issues with land, and problems with infrastructure. But, there are chances to get ahead. Many countries here can grow sugar well at a low cost.17 Thanks to the EU, African countries have better access to rich markets. This deal could help African sugar exports [11] climb higher.17

Global Sugar Demand Trends

Sugar demand across the globe shows two key trends. It grows slowly overall but stays high in places like India and China.3 Even though people are eating less sugar per person because of health worries, more people are born every day. Also, more people in developing countries have money to spend. This is causing global sugar demand to go up by 1–1.4% each year.4 Despite the use of other sweeteners and efforts to promote healthier eating, sugar is still very important in our diets. The future will likely see changes because more people in the world are getting richer, but also becoming more aware of health.

Population Growth and Dietary Shifts

The world’s growing population and changing ways of eating in new markets are key reasons for more sugar demanded globally.3 As people in developing countries earn more, they eat more sugar, especially in their traditional dishes. So, sugar is playing a big part in their food. This also happens because more people are joining the middle class.4 With so many people in the world, this trend is likely to push sugar demand up steadily in the future.

Subsidies and Trade Policies

Many countries help their sugar farmers with money and other support. These include direct payments and tax breaks.18 In major economies, like those in the OECD, over half of the money made from sugar comes from these supports or from people buying sugar. This adds up to about $6.4 billion each year during 1999-2001.18 The top supporters are the E.U. ($2.7 billion), the U.S. ($1.3 billion), and Japan ($0.4 billion). Other countries like Mexico, Turkey, and Poland also help their sugar farmers.18

Impact on Global Sugar Market

These kinds of help can really change how much sugar is made and sold worldwide. For instance, Brazil gives about $2.5 billion in government help every year to its sugar industry. This is 7% of what Brazil sells in sugar and ethanol around the world.2 India also chipped in with aid, giving about 4,000 Indian rupees for every tonne of sugar they sold abroad. They did this to avoid having too much sugar on the market in 2014/15.2 South Africa protects its sugar prices from global competition by setting a floor price.2

18 If all countries stopped supporting their sugar markets, it’s thought the world as a whole would benefit by almost $4.7 billion annually.18 Importing sugar nations may need to buy 15 million tons more, which could mean jobs for almost one million people in countries needing development.18 Without the support, sugar prices could go up by 40%. But, in countries that heavily protect their sugar markets, prices might actually drop.18

18 The E.U. promised that by 2009, it would let 48 of the poorest countries sell sugar in its markets without extra fees. This could mean another 2.4 million tons of sugar entering the E.U.18 More sugar imports might also be allowed in places like the U.S., Japan, and the E.U. because of international rules. This pressure could make them change how they protect their sugar markets.18 In markets where sugar from beets is favored, fighting over who gets to sell sugar has been going on for 200 years. This has shaped who produces most of the world’s sugar.18

Sustainability and Ethical Concerns

The sugar industry is facing more worries about the planet and how it’s treating its workers. Growing sugarcane and sugar beets can harm the Earth in big ways. This includes using a lot of water, making the soil wash away, and making plants and animals disappear. About 5-6 million hectares of land lose their soil each year because of growing sugar. Fixing these problems by farming better, saving water, and using less trash is key for the sugar business to keep going.19

Environmental Footprint

The damage sugar farming causes to the environment is a big deal that needs fixing now. As mentioned before, a lot of land loses its soil due to growing sugar. This shows the urgent need for better, more Earth-friendly ways to farm sugar. Saving water, choosing organic farming, and cutting down on waste can all lessen the harm sugar farming does to our planet.

Labor Practices

The way sugar is made has also come under harsh light. Reports show some places aren’t paying their workers enough, and kids are working in some fields. Research says child or forced labor is used in making sugar in 20 countries. Brazil and India are among the top places where child labor is found. Making sure everyone who works in the sugar industry is treated fairly is very important. This is from the people who grow the sugar to those who process it. It’s crucial for keeping the industry’s good name and keeping up with the demand for sugar that’s made right.

About 6 out of 10 sugar brands don’t offer Fairtrade sugar. Even popular brands like Billington’s and Silver Spoon get a low rating for their choices. When shopping, support Fairtrade and organic sugar. This means farmers are paid well and the environment isn’t harmed as much. Choose Fairtrade sugar for fair wages and eco-friendly organic sugar to avoid harmful chemicals in your food. Use the Ethical Sugar Ratings Table to pick the best brands for fair trade and organic sugar options.

The Fairtrade label means the sugar is non-GMO and supports fair pay for farmers without using child or forced labor. Brands like Kirkland, Wholesome, and Florida Crystals that offer organic sugar help keep the soil healthy. But, they might not always ensure good labor conditions. For sweets like chocolate, look for Fairtrade products from Trader Joe’s and Tate and Lyle. A Bonsucro certification shows big brands are making an effort to produce sugar with care for people and the planet.

Emerging Markets and Future Prospects

The world is seeing a rise in people and their incomes, especially in developing areas. This means the need for sugar is also going up, especially in places like Asia.3 Almost 110 nations make sugar from cane or beets. The four biggest sugar makers are Brazil, India, China, and Thailand. They use sugarcane most of the time.

New markets like those in Africa are also growing in importance for the sugar business. They offer chances to sell more sugar and adapt to new ways of using it.3

To stay ahead in the sugar market, countries and companies need to do a few things. They should look for new places to sell their sugar. They should also offer a variety of sugar-based products. And it’s key to be eco-friendly.2

In 2014, Africa made nearly 10 million tonnes of sugar. Countries like South Africa, Malawi, and Zambia are leading the way. They produce a lot of sugar per hectare. For example, they make about 100 tonnes of sugar on every hectare they farm.2

South Africa is a big player in the sugar game. It makes about 2.5 million tonnes of sugar each year. But, a lot of that sugar, nearly 60%, is sold to other countries.2 Since 2002, many farmers in South Africa have stopped growing sugarcane. The area used for sugarcane farming has gone down by 15%. And the number of big sugar farms has dropped by 20% in the last ten years.

Conclusion

The sugar export market is always changing, influenced by how much sugar is made, what people want, and rules on trading.1 In 2022, Brazil sold the most sugar worldwide, worth $11.23 billion. They made up 40% of all global sugar sales.1 Countries like Brazil, Thailand, and India are key in meeting the world’s huge need for sugar.20

Brazil is number one in producing sugar. They plan to make over 41 million tonnes in a season. They will have around 30 million tonnes more than they need to keep.21 About 80% of the world’s sugar comes from sugarcane. And 30% of that is traded across countries, making sugar a top traded product worldwide.

The sugar industry is working to be more sustainable and keep up with what people care about. This includes fair trade and where sugar comes from.21 Some African countries are doing really well in the sugar business, like South Africa and Zambia. Others such as Côte d’Ivoire, Kenya, and Tanzania have found a way to do better at selling sugar over the years.

The sugar trade is always moving, thanks to how much sugar is made, what people need, and trade laws. This will keep changing the sugar world.1 Big sellers like Brazil, Thailand, and India, along with new players in Africa, have to cope with these changes. They want to make sure the sugar business keeps growing and going strong everywhere.

FAQ

What are the top sugar exporting countries in the world?

The most recent data highlights the lead sugar exporting countries. In 2022/2023, these countries topped the list: Brazil (28.2 million metric tons), Thailand (11 million), and India (7.7 million). Following closely were Australia, Colombia, and Guatemala with about 4.2 to 3.3 million metric tons each. The list also includes Mexico, the Dominican Republic, Cuba, and France with shipments ranging from 2.1 to 2.7 million metric tons.

How much sugar does Brazil export?

Brazil outshines all nations as the top sugar exporter. Its exports hit about 28.2 million metric tons in 2022/2023. This reflects its mighty position in the global sugar market.

What is Thailand’s role in the global sugar trade?

Thailand follows closely as the world’s second-largest sugar exporter. It sent out around 11 million metric tons in 2022/2023. This significant amount marks Thailand as a key player in the global sugar trade.

What is India’s position in the global sugar export market?

India is a major contender in the global sugar market, exporting 7.7 million metric tons in 2022/2023. This achievement ranks it as the third largest sugar exporter. India has put export limits to stabilize its domestic sugar prices and ensure food security for its citizens.

How does Australia perform in the global sugar export market?

Australia ranks as the fourth top sugar exporter. It shipped about 4.2 million metric tons in 2022/2023. Despite not matching the high levels of Brazil and Thailand, Australia stands out for its quality sugar produce.

This factor keeps it significant in the global market.

What are the main raw materials used for sugar production?

Sugarcane and sugar beets are the top raw materials for sugar making. Sugarcane leads the way, making up 77.1% of global sugar production. Sugar beets cover the rest, providing 22.9% of the supply.

What is the role of Africa in the global sugar supply?

Africa’s part in global sugar production is relatively modest. In 2014, it made 9.8 million tonnes on nearly 1.5 million hectares. Yet, some African countries are strong players, like Uganda, Tanzania, and South Africa, the largest producer in Africa.

South Africa ranks 12th globally with about a quarter of the African sugar output.

How is the global demand for sugar evolving?

The need for sugar grows slowly each year, yet remains high in key places like India and China. Despite health worries, more people and better incomes in developing areas will push demand up.

This should increase global sugar needs by 1–1.4% yearly.

How do government subsidies and trade policies impact the global sugar market?

Almost every sugar maker relies on government help in some form. These aids, from direct payments to export subsidies, greatly shape sugar trade and prices worldwide.

They play a crucial role in the market’s dynamics.

What are the sustainability and ethical concerns in the sugar industry?

The sugar industry is under pressure to be more eco-friendly and ethical. Growing sugarcane and sugar beets can seriously impact the environment. Stresses like water use and contribution to soil erosion are growing concerns.

Additionally, issues around labor exist, with some reports highlighting bad working conditions and child labor.

Source Links

- https://www.tradeimex.in/blogs/brazil-sugar-export

- https://www.gro-intelligence.com/insights/global-sugar-markets

- https://www.isosugar.org/sugarsector/sugar

- https://apps.fas.usda.gov/psdonline/circulars/sugar.pdf

- https://www.seair.co.in/blog/sugar-export-data.aspx

- https://www.ectp.com/2023/05/the-bittersweet-truth-what-motorbikes-mean-for-the-price-of-sugar/

- https://theisaanrecord.co/2019/09/11/sweetness-and-power-part-5/

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9012054/

- https://business.thedailyguardian.com/business-news/india-becomes-largest-producer-of-sugar/

- https://www.cnbc.com/2023/01/20/india-is-likely-to-keep-a-lid-on-sugar-exports-as-its-output-dips.html

- https://www.sugarnutritionresource.org/news-articles/sugar-in-australia-a-food-system-approach

- https://www.austrade.gov.au/en/news-and-analysis/analysis/additional-raw-sugar-access-into-the-us-for-australian-exporters-until-september-2023

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9519493/

- https://www.krungsri.com/en/research/industry/industry-outlook/agriculture/sugar/io/io-sugar-21

- https://www.agmrc.org/commodities-products/grains-oilseeds/sugarcane-profile

- https://www.linkedin.com/pulse/look-africas-sugar-industry-how-mazaohub-nqaef

- https://sacanegrowers.co.za/in-its-own-sweet-time-sustainability-and-innovation-in-south-africas-sugar-industry

- https://documents1.worldbank.org/curated/en/893951468781804752/pdf/wps3222sugar.pdf

- https://thegoodshoppingguide.com/ethical-sugar/

- https://www.czapp.com/analyst-insights/ask-the-analyst-where-did-brazil-export-sugar-to-in-2023/

- https://www.frontiersin.org/articles/10.3389/fsufs.2023.1304383