The United States leads the world in national debt when counting in total dollars. In fact, its debt is over twice that of any other nation. However, Japan takes the crown for the highest debt-to-GDP ratio. In this ranking, the U.S. falls way back to 14th. The top 20 most indebted countries, compared to the size of their economies, include Lebanon, Japan, and Greece.1

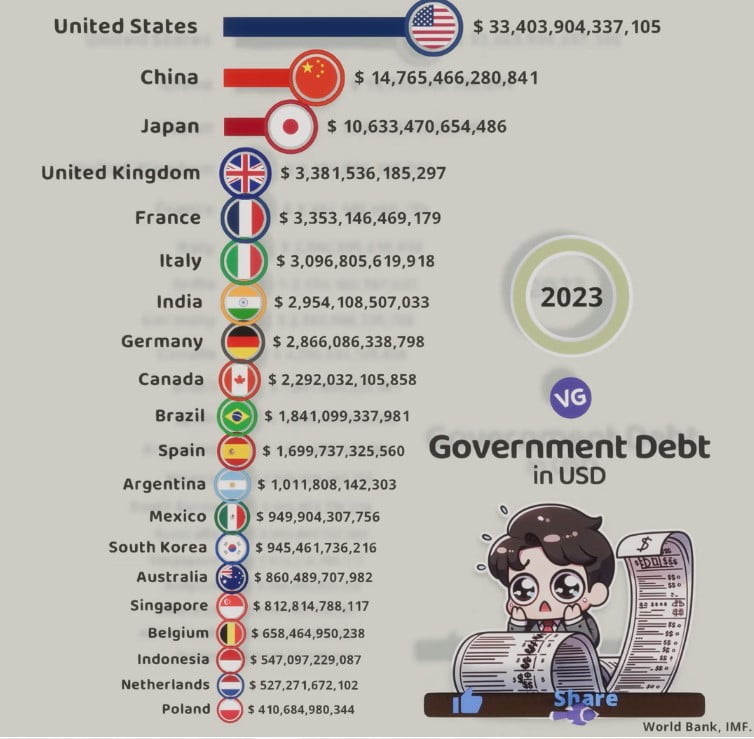

The U.S. carries the biggest debt of all, $30.89 trillion. China follows with a debt of $13.77 trillion, and then Japan with $12.78 trillion.1

Key Takeaways

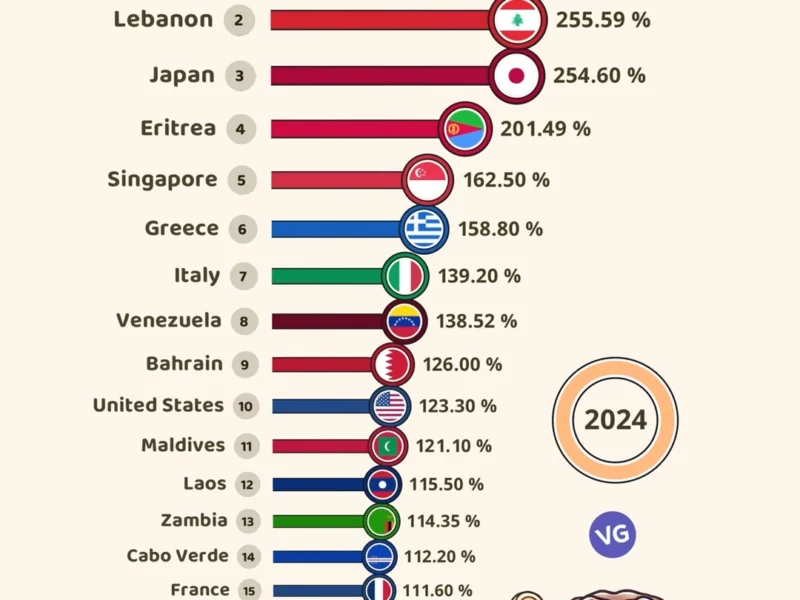

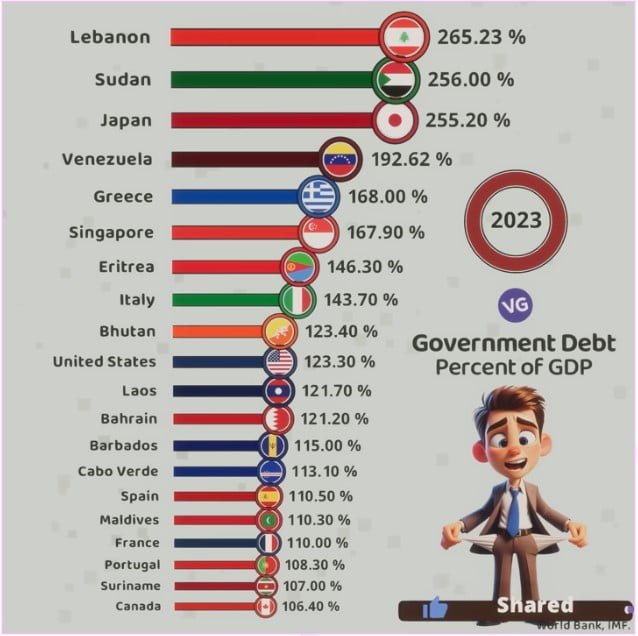

- The United States has the largest national debt in the world in terms of total dollars, but Japan has the highest debt-to-GDP ratio.

- Lebanon has the highest debt-to-GDP ratio in the world at 349.88%.

- Many countries, including Greece, Sudan, and Eritrea, have extremely high national debt burdens as a percentage of their GDP.

- China’s national debt has grown significantly in recent years, reaching 76.98% of its GDP.

- The Heavily Indebted Poor Countries (HIPC) initiative has provided debt relief for the world’s poorest nations.

Understanding National Debt

National debt is what a country’s government owes others. It could be to other governments, corporations, or people owning treasury bonds.2 This debt is figured against the country’s GDP. That shows how much it can pay back.2

What is National Debt?

Federal debt, or national debt, is all the money a government borrows. It comes from within the country and abroad.3 This debt grows over time with spending, budget gaps, and similar financial needs.3

How is National Debt Measured?

The debt-to-GDP ratio is key to sizing up national debt. It looks at a country’s debt against its yearly economic power.2 This ratio tells us if a country can pay its debts. It’s important for checking its financial health.2

Debt-to-GDP Ratio as a Key Indicator

When a country’s debt-to-GDP ratio tops 100%, this is seen as bad news. It means debt might be too big to handle easily, making financial troubles more likely.2 Policymakers, investors, and international groups use this ratio to judge a country’s fiscal health and trustworthiness with money.2

The Most Indebted Countries in the World

Japan leads the global debt race with a debt-to-GDP ratio of 259.43%.1 The U.S. has the largest national debt at $30.89 trillion but falls to 14th with a debt-to-GDP ratio of 128.13%.1 China’s owed amount is over $13.77 trillion, marking 76.98% of its GDP. This is a big jump since 2014, when their debt was 41.54% of the country’s GDP.1

Japan – The Highest Debt-to-GDP Ratio

Japan’s debt-to-GDP ratio is the highest globally, at 255.07%.1 This tells us Japan faces immense financial problems. They are finding it hard to handle their large public debt.

United States – Largest National Debt in Dollars

The U.S. carries the world’s biggest debt at $30.89 trillion. This figure is almost double that of China’s debt.1 Yet, with a debt-to-GDP ratio of 128.13%, the U.S. ranks 14th. It falls behind Japan, Lebanon, and Greece in this measure.

China – Rising National Debt

China’s debt has grown significantly, from 41.54% to 76.98% of GDP in recent years.1 This surge shows China’s big push to boost the economy and tackle economic issues head-on.

Factors Contributing to High National Debt

High national debt builds up for many countries because of several key factors.2 Economic downturns and crises often force governments to spend more. They do this to help their economy and support citizens2. Long-term spending on social programs and entitlements can also cause ongoing budget deficits. These deficits pile up the national debt over time2.

Economic Recessions and Financial Crises

When economies slow or crisis hits, governments can face more debt. They may need to borrow to stimulate the economy or save failing companies2. This extra borrowing increases the national debt. We saw this after the Great Recession and during COVID-192.

Government Spending and Deficit Financing

Overspending on programs like Social Security and Medicaid plays a big role in rising national debt2. If government spending surpasses what it earns, it causes budget deficits. These deficits are then covered by taking out loans, which grows the debt2.

Aging Populations and Social Security Obligations

Many developed countries face financial pressure because of their aging populations. They have to pay more for social security and healthcare benefits for retirees2. This has led to a bigger national debt in countries like the U.S. A report says the U.S. debt will likely grow to 195 percent of the GDP by 20532.

Consequences of High National Debt

High national debt affects countries in many negative ways, including the potential for economic instability. Nations with very high debt, like the U.S. at 115% of GDP in 20212, might have to pay more to borrow money. They may also find it harder to get credit. This makes them more sensitive to economic problems. It can lower their flexibility to manage finances and respond to crises or support important activities.

This debt often gets passed down to future generations, creating an intergenerational debt burden. For example, the U.S. debt is expected to keep growing, reaching up to 132% of GDP in 2033. The portion of the debt that the public holds could get to 118% by 2033 and 195% by 2053. Younger people could suffer from this, facing fewer chances and potentially a lower quality of life.

Also, servicing the debt means governments have less money to spend on other crucial areas. The U.S., for instance, might have to pay more than $1 trillion on interest each year by 2029. This would be more than what it spends on defense. It would limit what the government can do and weakens its financial flexibility to tackle important issues.

High national debt is linked to economic instability and financial troubles, highlighted by the world debt nearing $300 trillion in 2021, or 356% of global GDP4. Reasons like the COVID-19 outbreak have pushed debt higher. This massive debt can lead to severe problems, including financial crises, that can greatly affect a country’s economy and future costs.

It’s vital for governments to balance boosting the economy, which brings more tax money and helps lower debts, with handling debts responsibly. Good debt policies are key for fiscal sustainability over time and for keeping the economy safe from shocks.

Managing National Debt

Governments use several tools to handle high national debt. They aim to cut debt by growing the economy, saving money, or changing debt terms.2

Fiscal Consolidation and Austerity Measures

Fiscal consolidation means cutting spending and making more money. This process, also called austerity, can reduce costs but might include tax hikes. It works to balance the budget.25

Economic Growth and Revenue Generation

Helping the economy grow is key to lowering debt. Policies encouraging building, job creation, and more efficient work can lift a country’s economic output. This, in turn, can help reduce the debt compared to the whole economy.2 When businesses and incomes increase, so does tax money, helping the government’s finances.

Debt Restructuring and Renegotiation

If debts become too much, governments might need to talk to lenders. They can change how debt is paid back, lower interest, or forgive some debt.56 These steps can ease a country’s financial strain.

By mixing these methods, governments can aim to control and reduce their debt. This can avoid serious issues caused by borrowing too much.256

The Most Indebted Countries in the World

Besides Japan and the US, some countries face huge debt challenges. Lebanon leads the pack with a 349.88% debt-to-GDP ratio, the world’s highest.1 Sudan follows closely, with a debt-to-GDP ratio at 187.88%.1 After a tough debt crisis, Greece still struggles with a 172.6% debt-to-GDP ratio, showing the lasting effects of its fiscal problems.1

Lebanon – Highest Debt-to-GDP Ratio

Lebanon’s debt is a staggering 349.88% of its GDP, making it number one in debt-to-GDP globally.1 The country’s tough financial situation has hurt its economy and ability to improve infrastructure and social sectors.

Sudan – Among the Highest Debt Burdens

Sudan also faces a significant debt burden of 187.88% of its GDP.1 This debt has slowed economic growth and made it hard for the government to operate freely.

Greece – Debt Crisis and Austerity Measures

Back in the late 2000s, Greece dealt with a major debt crisis and still has a high debt-to-GDP ratio of 172.6%.1 The country worked hard on reforms and austerity to fix its finances. But, these efforts are still impacting Greece and its people today.

Regional Debt Profiles

Debt levels differ a lot worldwide. In Europe, many countries, including Greece, Italy, Portugal, and Spain, face high debt issues. For instance, Greece’s debt compared to its GDP is very high at 185%. Italy isn’t far behind with a debt of 134.1% of its GDP.7

Europe’s Debt Challenges

Europe is known for its debt problems. Countries like the United Kingdom, Germany, and France have large external debts. The United Kingdom’s debt is over $9.65 trillion, or 283.82% of its GDP.8

Germany’s debt is $6.1 trillion, around 65.33% of its GDP. France’s debt is $3.4 trillion, about 112.06% of its GDP.8

Latin America’s Debt Landscape

In Latin America, countries like Argentina, Brazil, and Venezuela face big debt challenges. For instance, Brazil’s external debt is $1.49 trillion, which is 71.59% of its GDP.8

Debt in Developing and Emerging Economies

Many countries in Africa and Asia also struggle with debt. They depend a lot on outside financial help. But, managing their debts is a big challenge.8

For example, Egypt’s debt is $165 billion, about 42.72% of its GDP. Sri Lanka and Algeria also have significant debts compared to their GDP. Sri Lanka’s debt is 68% of its GDP, while Algeria’s debt is 2% of its GDP.8

The Role of International Organizations

International organizations, such as the International Monetary Fund (IMF) and the World Bank Group, are key in dealing with debt problems worldwide.9 They offer vital help and guidance to countries in the grip of debt crises and struggles.

International Monetary Fund (IMF)

The IMF offers loans and financial aid to nations facing high debts and shaky economies.9 It does this by opening up its lending facilities and creating strategies to improve finances and grow the economy.

World Bank Group

Working with the IMF, the World Bank Group supports countries with financing, programs, and knowledge to tackle debt issues, especially in poorer nations.9 The World Bank’s financial help and advice are vital. They help in making economic changes and promote growth over time.

Debt Relief Initiatives

The IMF and the World Bank are leading in initiatives like the HIPC program for debt relief.9 These moves have greatly cut debt and reorganized it for the most indebted and poor nations. This has lightened their debt burden and helped start sustainable development.

Debt Sustainability and Future Outlook

Maintaining debt sustainability is tough for many countries. Governments need to grow their economies. This can bring in more taxes and lower the debt compared to what they make.

But they also must manage debts wisely.10

Balancing Economic Growth and Debt Management

When countries make big changes to increase how much they can do, that’s “structural reform”. These changes can make them more productive, honest, and careful with money. Doing so helps them handle their debts better.10

However, the world is full of risks. Things like changing interest rates, big economic problems, and fights between countries can throw a wrench into debt plans. These global issues can mess up a country’s efforts to keep their debts under control over the long haul.1011

Structural Reforms and Fiscal Responsibility

Poorer countries are really struggling to pay their outside debts, which hit $443.5 billion in 2022. The costs to service debts went up by 5% in a year. In the last ten years, the 75 poorest countries’ interest bills shot up to $23.6 billion in 2022.10

This shows they really need to make some big changes. They must handle money better and make big reforms to deal with these mounting debts.

The Impact of Global Factors

Debt issues for developing countries are getting riskier. Higher interest rates in wealthier places will make it hard for them to find new loans for their debts in foreign currencies.11

Also, big world issues like the war in Ukraine add to the problem. These kinds of events can make it even harder for countries to pay back what they owe.11

Dealing with these big global risks is key to keeping debts at a manageable level for the long term.

Conclusion

The challenge of national debt is global and complex. The United States carries the most debt, while Japan leads in debt compared to its economy size. This shows why debt levels should be looked at together with economic activity.6

Many things can make a nation’s debt high. This includes economic downturns, high government spending, and an aging population. These factors can lead to shake-ups in the economy, less budget room, and pass debts onto future generations.12

Countries use different methods to handle their debts. Some focus on bringing down their budget deficits, while others work to grow their economies. They also try cutting some of their debt. International groups help by offering advice and sometimes cancelling debts.2

To keep debt manageable in the long run, countries must balance their finances and economic activities. This is important because the world’s conditions keep changing.

This section sums up the article, showing the main points. It mentions the complex nature of national debt, the causes, effects, and ways countries tackle it. It integrates key search words to give a clear picture of what the article discussed.

This article highlights how debt is a worldwide issue with big effects on economies and societies. It stresses the need for a combined financial and growth approach. It also underlines the value of global teamwork and help in making debts sustainable, especially in less wealthy nations.

FAQ

What is the country with the highest national debt in the world in terms of raw dollars?

The United States holds the world record for the highest national debt. It’s more than twice any other country’s debt.

Which country has the highest debt-to-GDP ratio in the world?

Japan tops the list with a 259.43% debt-to-GDP ratio. This makes it the leader in this category.

What is the total national debt of the United States?

The U.S.’s total national debt is a whopping .89 trillion. This places a significant financial burden.

Which other countries have extremely high national debt burdens?

Apart from Japan and the U.S., Lebanon and Sudan face severe debt challenges. Lebanon’s ratio is 349.88%, topping the list. Sudan follows with a 187.88% ratio.

What factors can contribute to high national debt?

High national debt can arise from various factors. Economic downturns, heavy spending on social programs, and population aging in developed countries are key contributors.

What are some of the negative consequences of high national debt?

High national debt brings several problems. It increases economic instability, limits the government’s spending power, and burdens future generations with repayment.

How do governments manage high national debt?

Governments tackle high debt through various strategies. These include cutting spending, growing the economy, and negotiating debt terms with creditors.

What is the role of international organizations in addressing national debt issues?

The IMF and the World Bank Group are key in tackling debt on a global scale. They offer loans, aid, and debt relief to countries in crisis.

What is the key challenge in maintaining debt sustainability?

Balancing growth with debt management is a critical challenge. Global influences also heavily impact a country’s ability to maintain a sustainable debt level.

Source Links

- https://worldpopulationreview.com/country-rankings/countries-by-national-debt

- https://taxfoundation.org/blog/us-debt-compares-to-other-countries/

- https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

- https://carnegieendowment.org/chinafinancialmarkets/86397

- https://www.investopedia.com/articles/economics/10/sovereign-debt-default.asp

- https://www.worldbank.org/en/topic/debt/overview

- https://gfmag.com/data/economic-data/countries-most-addicted-debt/

- https://en.wikipedia.org/wiki/List_of_countries_by_external_debt

- https://www.csis.org/analysis/emerging-global-debt-crisis-and-role-international-aid

- https://www.worldbank.org/en/news/press-release/2023/12/13/developing-countries-paid-record-443-5-billion-on-public-debt-in-2022

- https://www.csis.org/analysis/next-wave-not-covid-19-wave-debt-sustainability-developing-countries

- https://www.icwa.in/show_content.php?lang=1&level=3&ls_id=10201&lid=6506