The smartphone landscape in the United States presents a fascinating picture of market dynamics, with Apple maintaining an extraordinarily dominant position while competitors vie for the remaining market share. Let’s dive into what the latest data reveals about this competitive space.

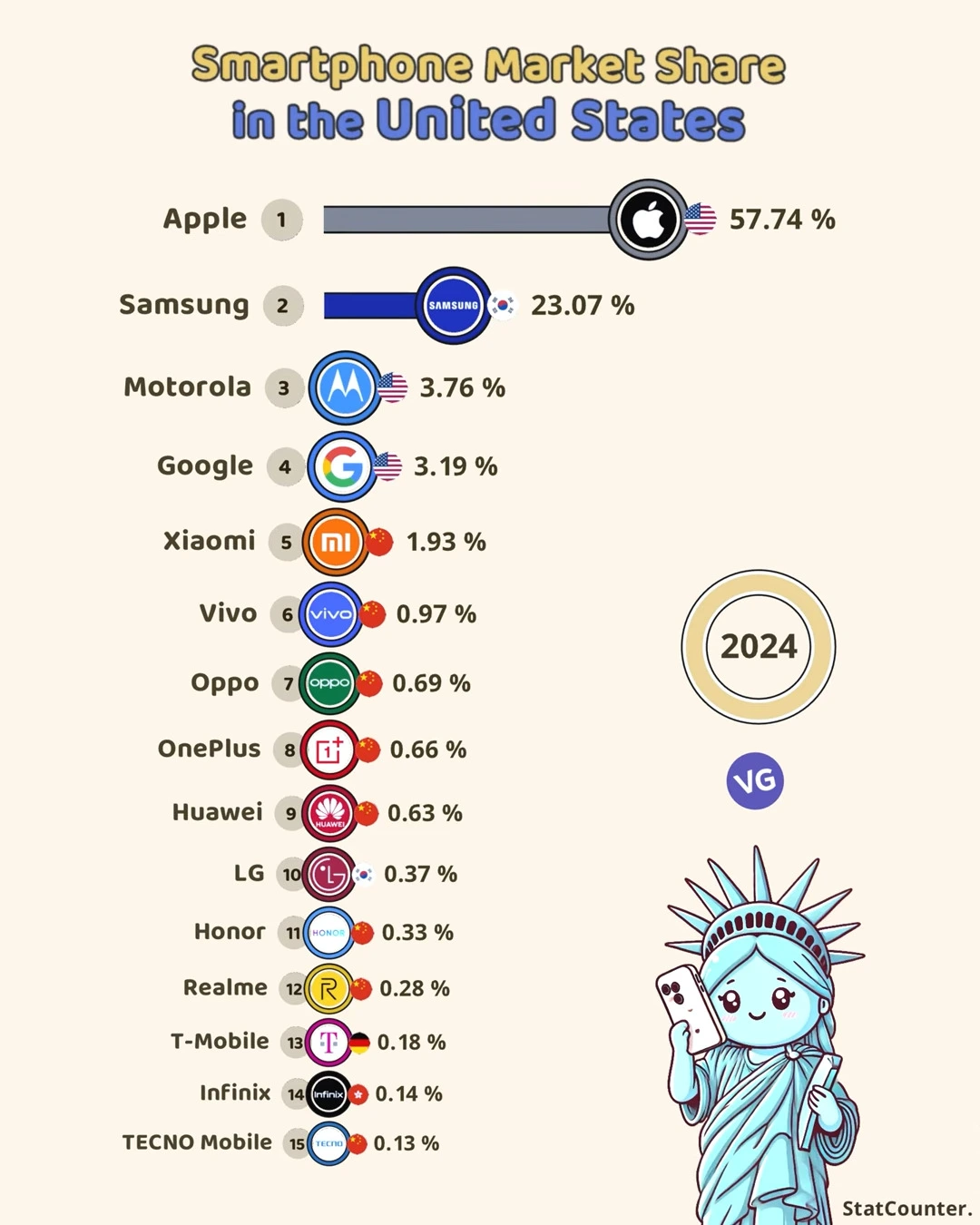

Smartphone Market Share in the U.S. (2024)

| Rank | Brand | Market Share (%) |

|---|---|---|

| 1️⃣ | 🍏 Apple | 57.74% |

| 2️⃣ | 📱 Samsung | 23.07% |

| 3️⃣ | 📞 Motorola | 3.76% |

| 4️⃣ | 3.19% | |

| 5️⃣ | 📱 Xiaomi | 1.93% |

| 6️⃣ | 📱 Vivo | 0.97% |

| 7️⃣ | 📱 Oppo | 0.69% |

| 8️⃣ | 📱 OnePlus | 0.66% |

| 9️⃣ | 📱 Huawei | 0.63% |

| 🔟 | 📱 LG | 0.37% |

| 11 | 📱 Honor | 0.33% |

| 12 | 📱 Realme | 0.28% |

| 13 | 📱 T-Mobile | 0.18% |

| 14 | 📱 Infinix | 0.14% |

| 15 | 📱 TECNO Mobile | 0.13% |

Apple’s Commanding Lead

The most striking aspect of the current market is Apple’s overwhelming dominance, commanding 57.74% of the U.S. smartphone market. This means that nearly six out of every ten smartphones in American pockets are iPhones. This remarkable achievement demonstrates Apple’s successful strategy of creating a premium ecosystem that resonates strongly with U.S. consumers.

Samsung’s Strong Second Position

While trailing significantly behind Apple, Samsung holds a respectable 23.07% market share, positioning itself as the clear second-place competitor. As the leading Android device manufacturer, Samsung’s presence is particularly notable given the competitive nature of the Android ecosystem. The significant gap between Samsung and the next competitor (Motorola at 3.76%) underscores the essentially duopolistic nature of the U.S. smartphone market.

The Android Fragmentation Challenge

Beyond the top two players, the market becomes highly fragmented among various Android manufacturers. Motorola, likely benefiting from its American heritage and long-standing presence in the market, holds third place with 3.76%. Google, despite being the creator of the Android operating system, captures only 3.19% of the market with its Pixel devices.

Chinese Manufacturers’ Market Position

An interesting phenomenon is the relatively modest presence of Chinese manufacturers in the U.S. market. Xiaomi, despite being a global powerhouse, only commands 1.93% of the market. Other major Chinese brands like Vivo (0.97%), Oppo (0.69%), OnePlus (0.66%), and Huawei (0.63%) collectively account for less than 5% of the market. This limited presence contrasts sharply with these brands’ stronger positions in other global markets.

The Decline of Traditional Players

The data also reveals the declining influence of traditional mobile phone manufacturers. LG, which has since exited the smartphone market, retains just 0.37% market share. This illustrates the challenging nature of the smartphone industry and how even established brands can struggle to maintain relevance.

Emerging Brands and Future Outlook

The bottom of the market share list includes newer entrants like Realme (0.28%), Infinix (0.14%), and TECNO Mobile (0.13%). While their current market share is minimal, their presence indicates the continuing evolution of the smartphone market and the persistent efforts of new players to gain a foothold in the U.S.

This market distribution poses interesting questions about the future of smartphone competition in the United States. Apple’s dominant position appears secure for now, but the dynamic nature of technology markets suggests that maintaining such a lead will require continued innovation and adaptation to changing consumer preferences.

For consumers, this market structure means that while they have numerous options to choose from, the reality is that most will likely continue to gravitate toward the two dominant players, Apple and Samsung, who together control over 80% of the market. This concentration of market power could have significant implications for innovation, pricing, and consumer choice in the years to come.