The Middle East’s economy is showing great strength, with a total nominal GDP of $5.2 trillion expected in 2024. This region’s economies are diverse and full of potential, changing how we see economic success.

The top economies in the Middle East are going through big changes. They have a population of 371 million and a GDP per capita of $32,000 in purchasing power parity. These economies are handling global market challenges with smart strategies.

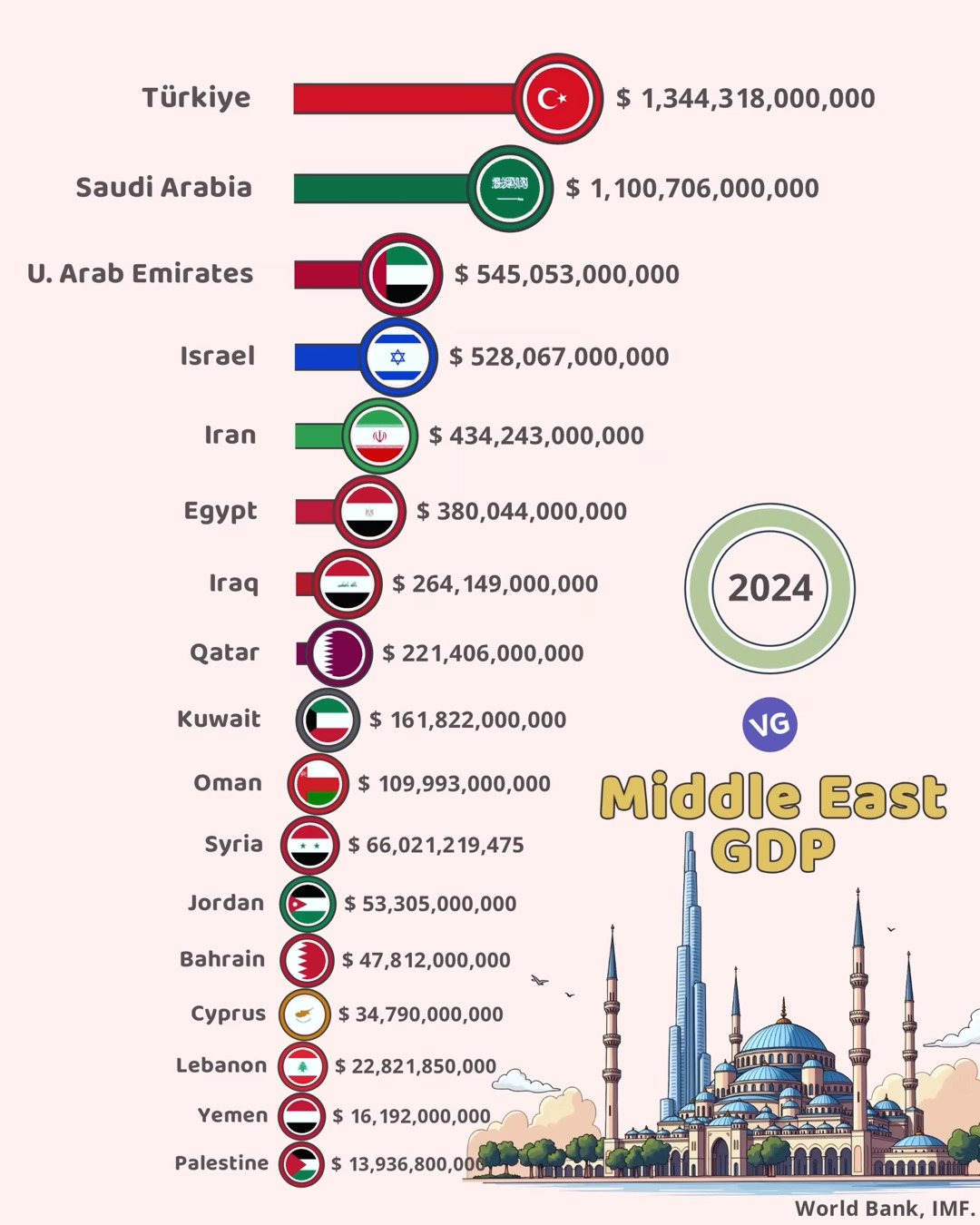

Middle East GDP (2024)

| Country | Flag | GDP |

|---|---|---|

| Türkiye | 🇹🇷 | $1,344,318,000,000 |

| Saudi Arabia | 🇸🇦 | $1,100,706,000,000 |

| U. Arab Emirates | 🇦🇪 | $545,053,000,000 |

| Israel | 🇮🇱 | $528,067,000,000 |

| Iran | 🇮🇷 | $434,243,000,000 |

| Egypt | 🇪🇬 | $380,044,000,000 |

| Iraq | 🇮🇶 | $264,149,000,000 |

| Qatar | 🇶🇦 | $221,406,000,000 |

| Kuwait | 🇰🇼 | $161,822,000,000 |

| Oman | 🇴🇲 | $109,993,000,000 |

| Syria | 🇸🇾 | $66,021,219,475 |

| Jordan | 🇯🇴 | $53,305,000,000 |

| Bahrain | 🇧🇭 | $47,812,000,000 |

| Cyprus | 🇨🇾 | $34,790,000,000 |

| Lebanon | 🇱🇧 | $22,821,850,000 |

| Yemen | 🇾🇪 | $16,192,000,000 |

| Palestine | 🇵🇸 | $13,936,800,000 |

Investors and economists are paying close attention to the region’s economic growth. The International Monetary Fund predicts a 2.2% growth rate in 2024. This shows a time of careful planning for the Middle East’s economies.

Looking at key economic signs, we see a detailed picture. Inflation rates are around 11.3%, and unemployment is a big issue at 10.6%. Yet, countries like Qatar, UAE, and Saudi Arabia are leading in economic innovation and strategic investment.

The most powerful middle economic plans now focus on diversifying beyond oil. This move aims to create a dynamic and lasting economic future for the region.

Economic Overview of the Middle East Region

The Middle East’s economy is changing fast in 2024. It shows great strength and smart planning. The region’s economy is growing, thanks to some of the strongest economies in the Middle East.

The Middle East is set for big economic changes in 2024. Economic signs look good:

- Growth forecast of 2.7% in 2024, up from 1.9% in 2023

- GDP per capita expected to grow by 1.3%

- Export growth anticipated to reach 3.8%

Current GDP and Growth Projections

Economic performance varies in the Middle East. GCC economies are growing faster than others. They are expected to grow by nearly a full percentage point more in 2024.

| Economic Indicator | 2024 Projection |

|---|---|

| Regional Growth Rate | 2.7% |

| GCC Economic Growth | 3.2% |

| Non-GCC Oil Importers | 2.1% |

Regional Economic Indicators

Strategic economic shifts are happening in the Middle East. The UAE saw a 14.4% increase in non-oil trade in the first half of 2023. This shows the region’s move towards diversifying its economy.

“The Middle East is transforming its economic strategy, moving beyond traditional oil-based models,” says a leading economic analyst.

Impact of Global Market Conditions

Global markets play a big role in the Middle East’s economy. Things like commodity prices, trade, and agreements matter a lot. About 63% of businesses say trade agreements help their supply chains.

- China remains the second most significant export market

- India has emerged as a crucial trading partner

- 45% of firms are building buffer times into supply chains

The Most Powerful Economies in the Middle East 2024

The Middle East is a vibrant economic area with many countries growing strong. In 2024, the top economies in the Middle East are diverse and focused on growth.

Key economic powerhouses for 2024 include:

- Saudi Arabia: Leading with a GDP (PPP) of $2,354 billion

- Turkey: Showing strong economic strength with $3,832 billion

- United Arab Emirates: Keeping up a strong economic pace

- Qatar: Highlighting high per capita economic output

The most powerful middle economies are known for their smart economic plans. They are moving away from just oil to build stronger economies.

“Economic power in the Middle East is no longer solely about oil wealth, but about innovation and strategic economic planning.” – Regional Economic Analyst

Looking at economic indicators gives us a peek into the region’s economic scene:

| Country | GDP (PPP) 2024 | Per Capita GDP (PPP) |

|---|---|---|

| Saudi Arabia | $2,354 billion | $71,370 |

| Turkey | $3,832 billion | $43,620 |

| UAE | $952 billion | $92,954 |

The Middle East’s economic future looks bright. It’s expected to grow 2.3% in 2024 and see exports grow 3.8%. These numbers show the region’s ongoing economic strength.

Oil Sector Dynamics and Economic Diversification

The Middle Eastern economies face a complex world of energy. They balance oil income with new ways to grow. The strongest economies in the region are planning for a future that goes beyond oil.

OPEC+ Strategic Decisions

In 2024, OPEC+ is making smart choices about oil. These decisions affect energy markets worldwide. The group plans to work together until 2025, making careful changes in oil production.

Here are some key facts about the region’s economy:

- Iranian oil exports estimated at 1.7 million barrels per day

- Oil prices stabilizing between $70 to $90 per Brent crude barrel

- Gulf states maintaining significant spare production capacity

Non-Oil Sector Development

The Middle East is working hard to change its economy. Saudi Arabia is leading the way with big plans:

- GDP growth projected at 2.4% for 2024

- Saudi Coffee Company expanding production from 300 to 2,500 tons annually

- US$500 billion investment in NEOM special economic zone

Investment in Future Technologies

The strongest Middle Eastern countries are investing in new technologies. The UAE is at the forefront with digital projects:

- Establishing Virtual Assets Regulatory Authority (VARA)

- Expanding financial markets beyond traditional asset classes

- Leveraging blockchain and financial technologies

“The future of Middle Eastern economies lies not just in oil, but in innovation and technological leadership.”

With about 50% of the GCC population under 25, the region is ready for a digital revolution. It’s moving from old models based on oil to new, tech-driven ones.

Regional Economic Challenges and Opportunities

The most powerful economies in the Middle East face tough economic challenges. They need new strategies to grow. The region is strong, but it must change to grow well in 2024 and later.

- High youth unemployment rates

- Income inequality

- Dependency on oil revenues

- Limited economic diversification

The Middle East’s economies are working hard to solve these problems. Governments are making big changes to reduce oil use and boost other sectors.

“Economic transformation requires bold vision and strategic investments in human capital and technology.” – IMF Regional Analyst

There are big chances for the region’s economy to grow:

- Investing more in technology

- Supporting new businesses

- Building more renewable energy

- Working together more economically

There are good signs for the economy:

| Indicator | 2024 Projection |

|---|---|

| GCC Non-Oil Sector Growth | 4% |

| Regional Fiscal Balance | 3.3% of GDP |

| Average Regional Inflation | 2.3% |

Strategic investments and policy reforms will be crucial in transforming economic challenges into sustainable growth opportunities for the region.

Conclusion

The Middle East is at a key economic turning point in 2024. The most powerful middle economies are showing great strength and smart changes. They are working hard to diversify and find new ways to grow.

Gulf Cooperation Council countries are leading the way. They are focusing on non-oil sectors to drive growth. The UAE, Qatar, and Saudi Arabia are managing their finances well, even making surpluses. They are investing in tech, especially AI and ICT, to prepare for the future.

Despite some hurdles like trade issues and economic doubts, the Middle East looks promising. It’s expected to see GDP growth of 2.8% in 2024 and 4.2% in 2025. Economic reforms, tech innovation, and improving gender employment could boost productivity by up to 45%.

The success of these powerful economies will depend on ongoing innovation and smart investments. They need to use their tech, diversify, and offer jobs to everyone. This will help them stand out on the global stage in the years ahead.

FAQ

Which countries are considered the most powerful economies in the Middle East in 2024?

The top economies in the Middle East include Saudi Arabia, United Arab Emirates, Israel, Turkey, and Qatar. These countries are ranked based on GDP size, economic diversification, technological innovation, and global economic influence.

How important is the oil sector to Middle Eastern economies in 2024?

The oil sector is still key, but countries are diversifying. The UAE and Saudi Arabia are investing in tech, tourism, and renewable energy. This helps reduce their oil dependence.

What are the main economic challenges facing Middle Eastern countries?

Challenges include high youth unemployment, income inequality, and the need for economic reforms. Countries aim to diversify their economies and move beyond oil.

How are Middle Eastern economies responding to global economic shifts?

Countries are investing in future technologies and innovation. They’re building smart cities and adopting flexible economic policies. They also focus on regional integration and attracting foreign investment.

What role do technological innovations play in the region’s economic development?

Tech innovations are crucial, with big investments in AI, renewable energy, and digital infrastructure. The UAE and Israel are becoming tech hubs, driving economic change through innovation.

How are Middle Eastern countries addressing economic diversification?

Countries are diversifying by developing non-oil sectors and creating special economic zones. They’re investing in education and supporting entrepreneurship and SMEs.

What impact do global market conditions have on Middle Eastern economies?

Global market conditions affect Middle Eastern economies, especially oil prices and international trade. The region is adapting by making its economy more resilient and flexible.

Are there opportunities for foreign investment in Middle Eastern economies?

Yes, many countries are making their investment environments attractive. They offer incentives, free trade zones, and economic reforms. Sectors like tech, renewable energy, tourism, and infrastructure are open to foreign investors.

Source Links

- Economy of the Middle East

- MENA Economic Update

- World Bank: Middle East and North Africa Economic Update — April 2024

- Trade in Transition 2024: Middle East regional insights

- The Oil Price-Risk Relationship in the Middle East | GJIA

- After the oil in the Middle East – Deutsche Bank

- Five GCC economic themes to watch in 2024

- 5 major risks confronting the global economy in 2024

- Middle East Economy Watch – September 2024

- Modest Growth Forecast for Economies in the Middle East and North Africa Amid Rising Uncertainty