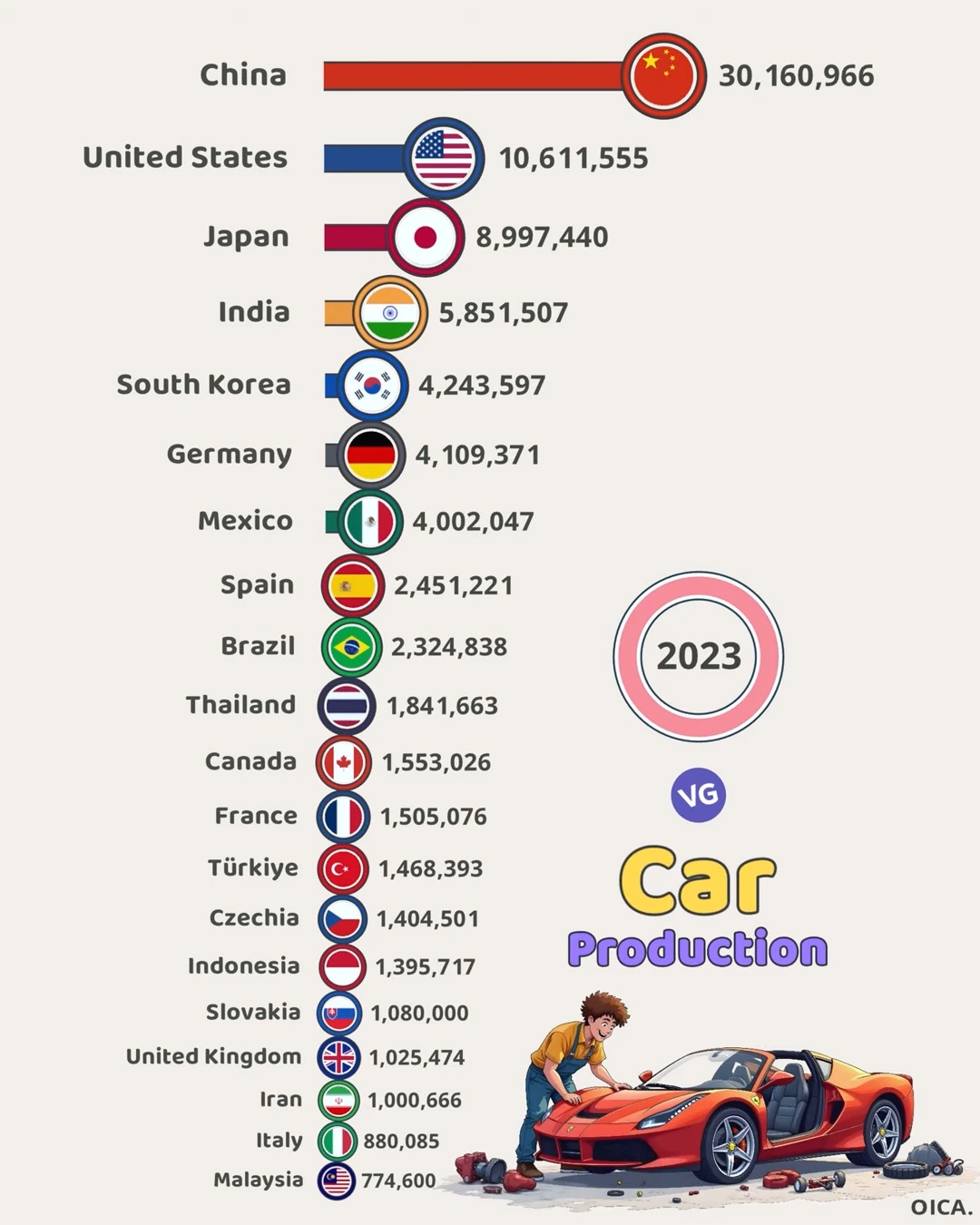

China’s Automotive Dominance

The 2023 global car production data reveals China’s overwhelming dominance in the automotive industry, with an impressive output of 30.16 million vehicles. This figure is nearly triple that of its closest competitor, the United States, demonstrating China’s massive manufacturing capabilities and its position as the world’s leading automotive producer.

Top 20 Car Producing Countries (2023)

| Rank | Country | Cars Produced |

|---|---|---|

| 1 | 🇨🇳 China | 30,160,966 |

| 2 | 🇺🇸 United States | 10,611,555 |

| 3 | 🇯🇵 Japan | 8,997,440 |

| 4 | 🇮🇳 India | 5,851,507 |

| 5 | 🇰🇷 South Korea | 4,243,597 |

| 6 | 🇩🇪 Germany | 4,109,371 |

| 7 | 🇲🇽 Mexico | 4,002,047 |

| 8 | 🇪🇸 Spain | 2,451,221 |

| 9 | 🇧🇷 Brazil | 2,324,838 |

| 10 | 🇹🇭 Thailand | 1,841,663 |

| 11 | 🇨🇦 Canada | 1,553,026 |

| 12 | 🇫🇷 France | 1,505,076 |

| 13 | 🇹🇷 Türkiye | 1,468,393 |

| 14 | 🇨🇿 Czechia | 1,404,501 |

| 15 | 🇮🇩 Indonesia | 1,395,717 |

| 16 | 🇸🇰 Slovakia | 1,080,000 |

| 17 | 🇬🇧 United Kingdom | 1,025,474 |

| 18 | 🇮🇷 Iran | 1,000,666 |

| 19 | 🇮🇹 Italy | 880,085 |

| 20 | 🇲🇾 Malaysia | 774,600 |

Traditional Automotive Powers

The United States maintains its position as the second-largest car producer globally, manufacturing 10.61 million vehicles. Japan, historically a powerhouse in automotive production, holds the third position with approximately 9 million vehicles. These three nations collectively account for a significant portion of global vehicle production, highlighting the concentration of automotive manufacturing capability among a few key players.

Asian Tigers and European Powerhouses

South Korea and India represent the next tier of production, with 4.24 million and 5.85 million vehicles respectively. Germany, Europe’s largest producer, maintains a strong position with 4.11 million vehicles, showcasing the continued strength of its renowned automotive industry. These nations demonstrate the global distribution of automotive manufacturing capabilities across Asia and Europe.

Emerging Producers and Traditional Markets

Mexico has emerged as a significant player, producing 4 million vehicles, likely benefiting from its proximity to the US market and various trade agreements. Spain and Brazil follow with productions of 2.45 and 2.32 million vehicles respectively, representing important regional manufacturing hubs.

Mid-Tier Manufacturers

The middle range of production includes several notable countries:

- Thailand: 1.84 million vehicles

- Canada: 1.55 million vehicles

- France: 1.51 million vehicles

- Türkiye: 1.47 million vehicles

- Czechia: 1.40 million vehicles

The Supporting Cast

The data also shows significant production numbers from:

- Indonesia: 1.40 million vehicles

- Slovakia: 1.08 million vehicles

- United Kingdom: 1.03 million vehicles

- Iran: 1.00 million vehicles

- Italy: 0.88 million vehicles

- Malaysia: 0.77 million vehicles

These figures illustrate the global nature of automotive manufacturing and the various regional hubs that have developed around the world. The distribution of production facilities across different continents reflects both historical manufacturing traditions and the emergence of new players in the global automotive industry.

This production landscape showcases the industry’s evolution from its traditional centers in North America, Europe, and Japan to a more globally distributed manufacturing network, with China emerging as the clear leader in volume production.