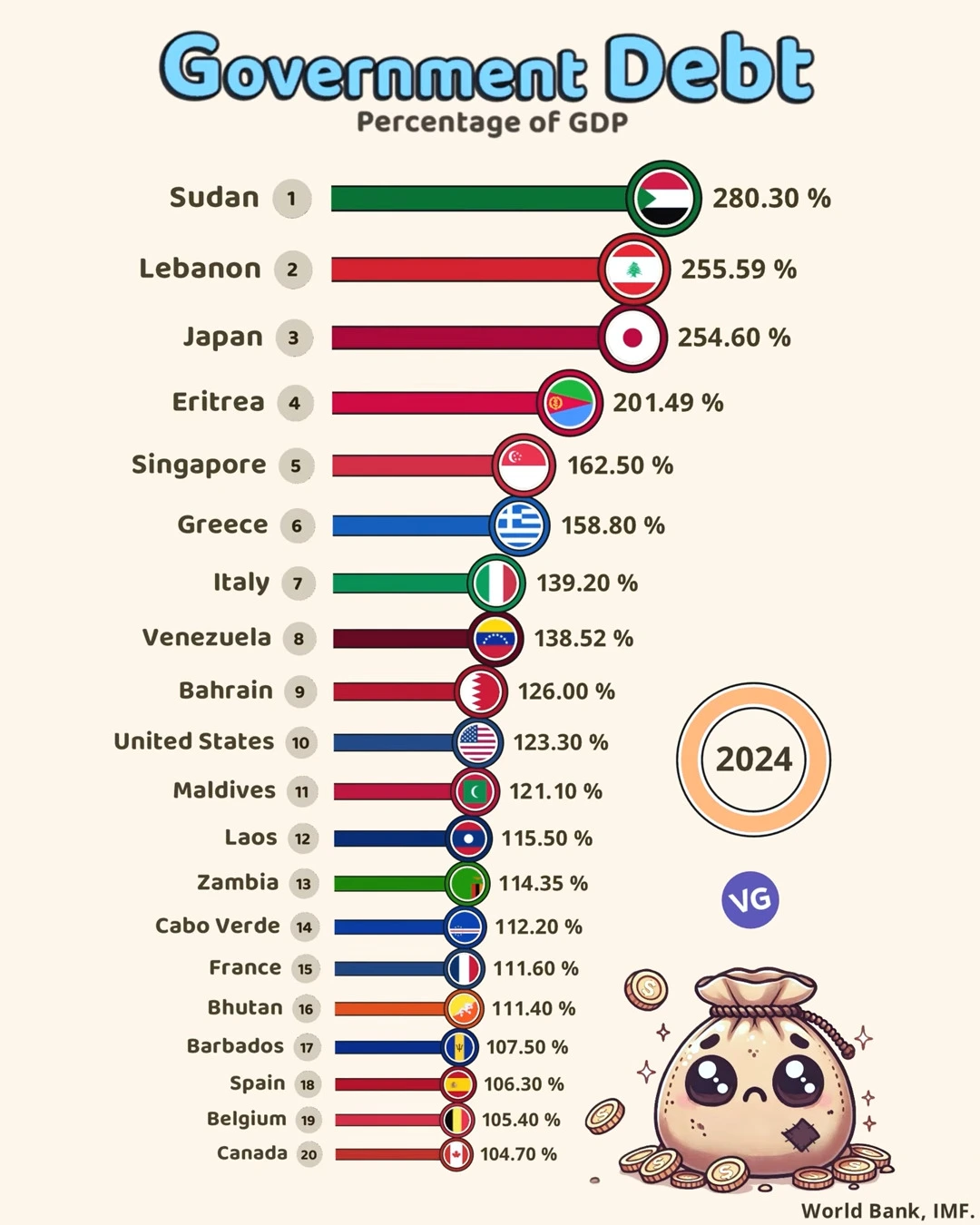

As nations continue to navigate complex economic challenges in the post-pandemic world, government debt levels have reached historic highs in many countries. Recent data from the World Bank and International Monetary Fund (IMF) for 2024 provides a revealing snapshot of which nations are carrying the heaviest debt burdens relative to the size of their economies.

💰 Top 20 Countries with Highest Government Debt (% of GDP) in 2024 📉

| Rank | Country | Debt (% of GDP) |

|---|---|---|

| 1️⃣ | Sudan 🇸🇩 | 280.30% |

| 2️⃣ | Lebanon 🇱🇧 | 255.59% |

| 3️⃣ | Japan 🇯🇵 | 254.60% |

| 4️⃣ | Eritrea 🇪🇷 | 201.49% |

| 5️⃣ | Singapore 🇸🇬 | 162.50% |

| 6️⃣ | Greece 🇬🇷 | 158.80% |

| 7️⃣ | Italy 🇮🇹 | 139.20% |

| 8️⃣ | Venezuela 🇻🇪 | 138.52% |

| 9️⃣ | Bahrain 🇧🇭 | 126.00% |

| 🔟 | United States 🇺🇸 | 123.30% |

| 1️⃣1️⃣ | Maldives 🇲🇻 | 121.10% |

| 1️⃣2️⃣ | Laos 🇱🇦 | 115.50% |

| 1️⃣3️⃣ | Zambia 🇿🇲 | 114.35% |

| 1️⃣4️⃣ | Cabo Verde 🇨🇻 | 112.20% |

| 1️⃣5️⃣ | France 🇫🇷 | 111.60% |

| 1️⃣6️⃣ | Bhutan 🇧🇹 | 111.40% |

| 1️⃣7️⃣ | Barbados 🇧🇧 | 107.50% |

| 1️⃣8️⃣ | Spain 🇪🇸 | 106.30% |

| 1️⃣9️⃣ | Belgium 🇧🇪 | 105.40% |

| 2️⃣0️⃣ | Canada 🇨🇦 | 104.70% |

Crisis Levels: Nations Exceeding 200% Debt-to-GDP

Sudan tops the global debt rankings with a staggering 280.30% debt-to-GDP ratio, reflecting the profound economic challenges facing this African nation amid political instability and conflict. Lebanon follows closely at 255.59%, a stark illustration of its ongoing financial crisis that began in 2019 and has been exacerbated by political paralysis and the devastating Beirut port explosion.

Japan, despite being the world’s third-largest economy, carries the third-highest debt burden at 254.60% of GDP. Unlike many other highly indebted nations, Japan’s situation is distinctive as most of its debt is held domestically rather than by foreign creditors, providing a degree of stability despite the eye-watering figures.

Eritrea rounds out the nations exceeding 200% with a debt-to-GDP ratio of 201.49%, demonstrating the immense financial challenges facing this small East African nation.

Developed Economies with High Debt Loads

Several advanced economies feature prominently among the most indebted nations. Singapore’s 162.50% ratio might surprise many given the city-state’s reputation for fiscal prudence, though its strong financial position and assets offer important context for this figure.

Greece (158.80%) continues to work through the aftermath of its sovereign debt crisis from the previous decade, while Italy’s 139.20% reflects its long-standing fiscal challenges within the Eurozone framework.

The United States appears at tenth position with a debt-to-GDP ratio of 123.30%, representing over $34 trillion in absolute terms—by far the largest nominal government debt in the world. Other developed nations in the top 20 include France (111.60%), Spain (106.30%), Belgium (105.40%), and Canada (104.70%).

Regional Patterns and Smaller Economies

The Middle East and North Africa region features several highly indebted nations, including Lebanon, Bahrain (126.00%), and Maldives (121.10%), reflecting diverse economic challenges from political instability to tourism dependency.

Several smaller economies appear on the list, including Cabo Verde (112.20%), Bhutan (111.40%), and Barbados (107.50%). These nations face unique challenges managing debt sustainability given their limited economic diversification and, in some cases, vulnerability to external shocks like climate events or tourism disruptions.

Venezuela’s presence at eighth position (138.52%) underscores the profound economic crisis that has affected the South American nation for years, driven by political instability, sanctions, and oil market volatility.

Debt Sustainability: Beyond the Numbers

While these percentages provide valuable comparative information, they tell only part of the story of debt sustainability. Economic growth prospects, interest rates, debt structure (domestic versus foreign currency), maturity profiles, and institutional strength all play crucial roles in determining how manageable these debt burdens actually are.

Japan, despite its towering debt figures, maintains relatively low borrowing costs and stable financial markets. Conversely, Lebanon’s smaller absolute debt has triggered a devastating financial collapse due to structural economic weaknesses and institutional challenges.

Future Outlook and Global Implications

As interest rates remain elevated compared to historical norms, debt servicing costs are consuming increasing portions of national budgets for many countries. The IMF and World Bank continue to express concerns about debt sustainability, particularly for emerging economies with significant foreign currency-denominated debt.

The global pattern of elevated government debt presents complex challenges for policymakers navigating potentially slower economic growth, demographic pressures in many developed nations, and the need for investments in climate adaptation and mitigation. How these highly indebted nations manage their fiscal positions will have significant implications for global economic stability in the coming decades.

Sources: World Bank, International Monetary Fund (IMF), 2024