The global refined sugar market represents a significant component of international agricultural trade. As shown in the comprehensive data from 2023, several countries dominate this sector, with interesting patterns emerging across different regions. Let’s dive into what this data reveals about global sugar trade dynamics.

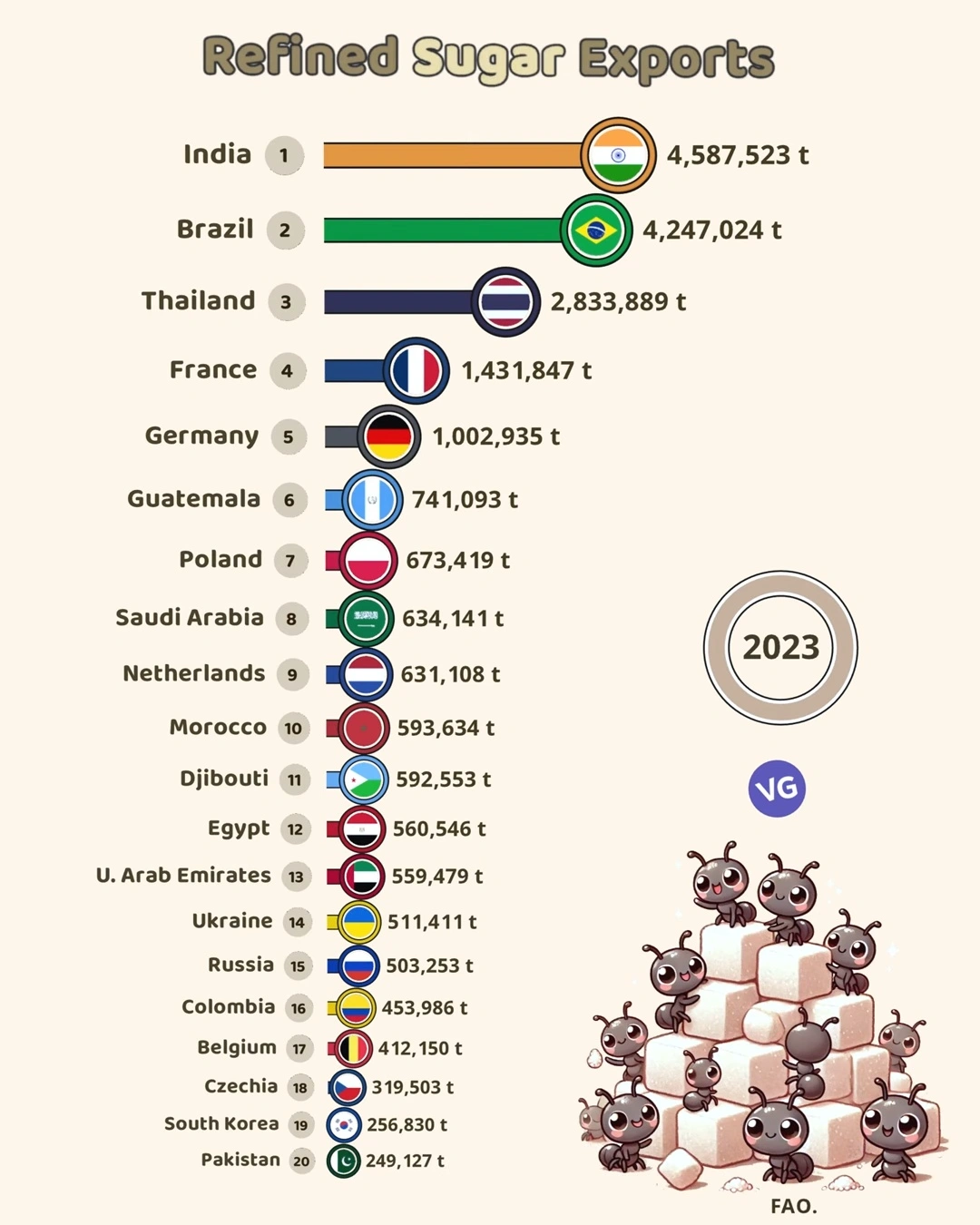

Refined Sugar Exports (2023)

| Rank | Country | Export (t) |

|---|---|---|

| 1 🇮🇳 | India | 4,587,523 |

| 2 🇧🇷 | Brazil | 4,247,024 |

| 3 🇹🇭 | Thailand | 2,833,889 |

| 4 🇫🇷 | France | 1,431,847 |

| 5 🇩🇪 | Germany | 1,002,935 |

| 6 🇬🇹 | Guatemala | 741,093 |

| 7 🇵🇱 | Poland | 673,419 |

| 8 🇸🇦 | Saudi Arabia | 634,141 |

| 9 🇳🇱 | Netherlands | 631,108 |

| 10 🇲🇦 | Morocco | 593,634 |

| 11 🇩🇯 | Djibouti | 592,553 |

| 12 🇪🇬 | Egypt | 560,546 |

| 13 🇦🇪 | U. Arab Emirates | 559,479 |

| 14 🇺🇦 | Ukraine | 511,411 |

| 15 🇷🇺 | Russia | 503,253 |

| 16 🇨🇴 | Colombia | 453,986 |

| 17 🇧🇪 | Belgium | 412,150 |

| 18 🇨🇿 | Czechia | 319,503 |

| 19 🇰🇷 | South Korea | 256,830 |

| 20 🇵🇰 | Pakistan | 249,127 |

Top Players in the Sugar Export Market

India leads the pack with an impressive 4,587,523 tonnes of refined sugar exports. This achievement underscores India’s agricultural prowess and strategic focus on sugar production. Brazil follows closely with 4,247,024 tonnes, reflecting its long-established dominance in sugarcane cultivation and processing.

Thailand, ranking third with 2,833,889 tonnes, has solidified its position as a major Asian exporter, while European nations France (1,431,847 tonnes) and Germany (1,002,935 tonnes) round out the top five, demonstrating that refined sugar production isn’t limited to tropical regions.

Regional Patterns

The data reveals interesting geographic distributions:

Asia: With India and Thailand in top positions, plus significant contributions from Saudi Arabia (634,141 tonnes), UAE (559,479 tonnes), South Korea (256,830 tonnes), and Pakistan (249,127 tonnes), Asia demonstrates strong representation.

Europe: Seven European nations feature in the top 20, with France and Germany leading, followed by Poland, Netherlands, Belgium, Czechia, and Ukraine. Together, they account for over 4.2 million tonnes of exports.

Americas: While Brazil stands tall as the second-largest exporter, Guatemala (741,093 tonnes) and Colombia (453,986 tonnes) also contribute significantly, showcasing Latin America’s agricultural strength.

Middle East and North Africa: This region shows surprising strength with Saudi Arabia, UAE, Morocco (593,634 tonnes), Egypt (560,546 tonnes), and Djibouti (592,553 tonnes) all appearing in the rankings.

Economic Implications

The substantial volume of sugar exports represents significant economic activity. For countries like India and Brazil, sugar exports contribute meaningfully to agricultural GDP and foreign exchange earnings. Even for smaller exporters like Djibouti, the nearly 600,000 tonnes likely constitute an important revenue stream.

Trends and Future Outlook

Several factors may influence future rankings:

- Climate change impacts: Changes in rainfall patterns and temperatures could affect traditional sugar-growing regions.

- Health consciousness: Growing global awareness about sugar consumption might impact demand.

- Alternative sweeteners: The rise of stevia and other substitutes could reshape the market.

- Trade agreements: Evolving international trade policies will continue to influence export patterns.

Conclusion

The 2023 refined sugar export data paints a picture of a diverse global market with strong representation across continents. While traditional powerhouses like India and Brazil maintain their leadership, the presence of countries from various regions demonstrates the widespread importance of this commodity.

As global dietary habits evolve and environmental factors shift, it will be fascinating to monitor how these rankings change in coming years. What remains clear is that refined sugar continues to be a vital component of international agricultural trade, supporting economies worldwide through production, processing, and export activities.

For policymakers, investors, and agricultural stakeholders, understanding these trade patterns provides valuable insights into global market dynamics and potential opportunities for growth or diversification in the sweet science of sugar production.