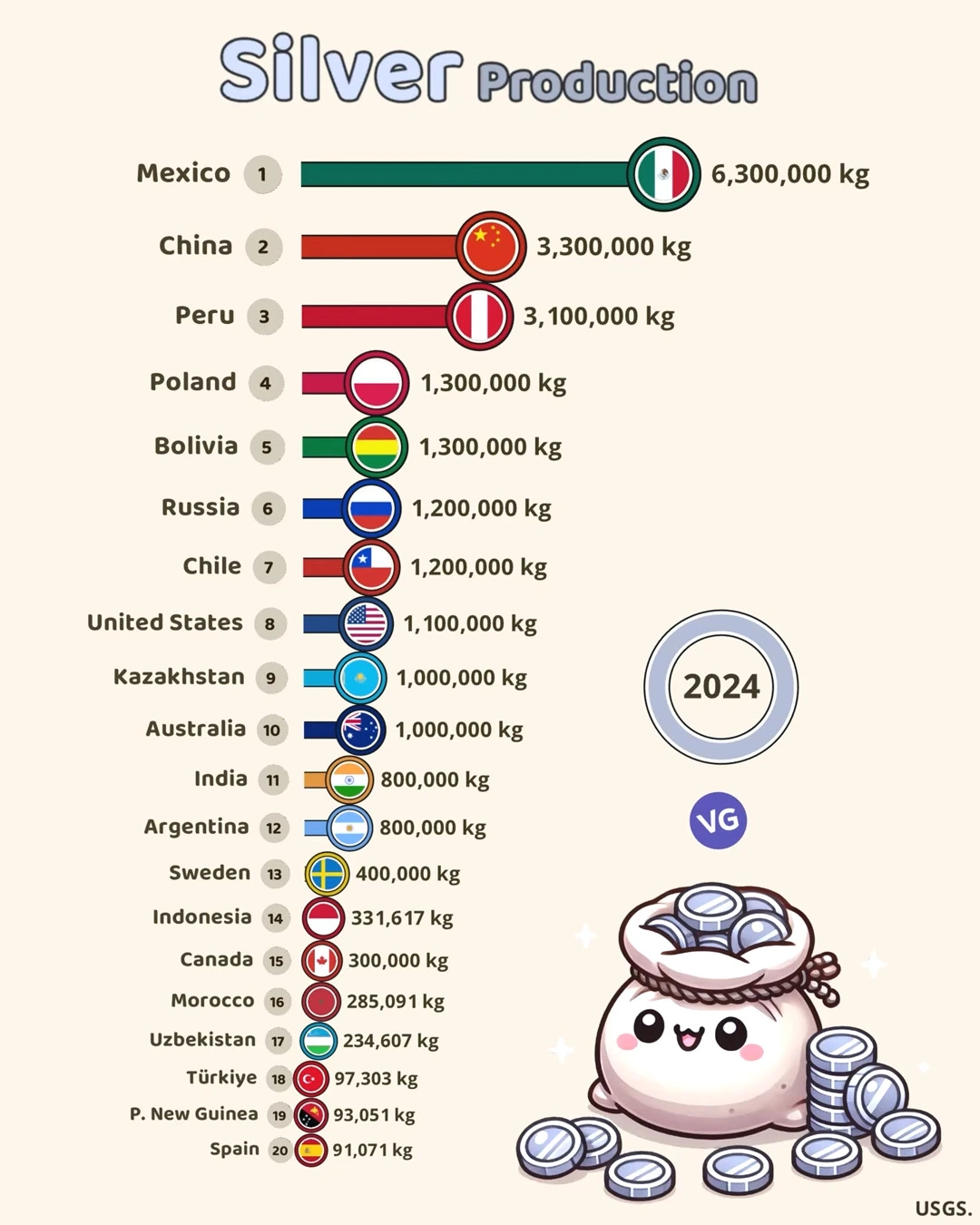

According to recent USGS data, the global silver production landscape in 2024 reveals interesting patterns of mining activity, with production concentrated among a few major players while smaller producers maintain significant roles in the global supply chain.

| Rank | Country | Production (kg) |

|---|---|---|

| 1 | 🇲🇽 Mexico | 6,300,000 |

| 2 | 🇨🇳 China | 3,300,000 |

| 3 | 🇵🇪 Peru | 3,100,000 |

| 4 | 🇵🇱 Poland | 1,300,000 |

| 5 | 🇧🇴 Bolivia | 1,300,000 |

| 6 | 🇷🇺 Russia | 1,200,000 |

| 7 | 🇨🇱 Chile | 1,200,000 |

| 8 | 🇺🇸 United States | 1,100,000 |

| 9 | 🇰🇿 Kazakhstan | 1,000,000 |

| 10 | 🇦🇺 Australia | 1,000,000 |

| 11 | 🇮🇳 India | 800,000 |

| 12 | 🇦🇷 Argentina | 800,000 |

| 13 | 🇸🇪 Sweden | 400,000 |

| 14 | 🇮🇩 Indonesia | 331,617 |

| 15 | 🇨🇦 Canada | 300,000 |

| 16 | 🇲🇦 Morocco | 285,091 |

| 17 | 🇺🇿 Uzbekistan | 234,607 |

| 18 | 🇹🇷 Türkiye | 97,303 |

| 19 | 🇵🇬 Papua N. Guinea | 93,051 |

| 20 | 🇪🇸 Spain | 91,071 |

Leading Producers

Mexico’s Dominance

Mexico stands as the undisputed leader in global silver production, outputting an impressive 6,300,000 kg annually. This figure is nearly double that of its closest competitor, demonstrating Mexico’s crucial role in global silver supply. The country’s leadership position is built on centuries of mining expertise and substantial silver deposits.

Asian Giants

China ranks second with 3,300,000 kg of silver production, closely followed by Peru at 3,100,000 kg. China’s high production reflects its vast mining infrastructure and technological capabilities, while Peru’s strong showing builds on its rich mineral resources and mining heritage.

Regional Distribution

Latin American Cluster

Latin American countries form a significant production bloc:

- Mexico (6,300,000 kg)

- Peru (3,100,000 kg)

- Bolivia (1,300,000 kg)

- Chile (1,200,000 kg)

- Argentina (800,000 kg)

Combined, these nations account for nearly half of the listed global production, highlighting the region’s importance in silver mining.

Eastern European and Central Asian Production

Poland stands out as Europe’s major producer with 1,300,000 kg, matching Bolivia’s output. Kazakhstan contributes 1,000,000 kg, while Russia produces 1,200,000 kg, showing significant production from the former Soviet region.

Emerging and Smaller Producers

Oceania and Asia

Australia maintains a steady production of 1,000,000 kg, while Indonesia produces 331,617 kg. Papua New Guinea, though smaller, still contributes 93,051 kg to global production.

Notable Smaller Producers

Countries like Morocco (285,091 kg), Uzbekistan (234,607 kg), and Türkiye (97,303 kg) demonstrate how silver production extends beyond the major mining nations, contributing to global supply diversity.

Future Implications

Supply Chain Considerations

The concentration of production among a few major producers raises important considerations:

- Supply chain resilience

- Price stability

- Market dependence on specific regions

- Environmental impact management

Development Potential

The presence of smaller producers suggests potential for:

- New mining development

- Technology transfer

- Market diversification

- Regional economic development

The data paints a picture of a global silver industry that remains heavily concentrated in traditional mining regions while showing potential for growth in emerging producers. This distribution has significant implications for market stability, pricing, and future industry development.