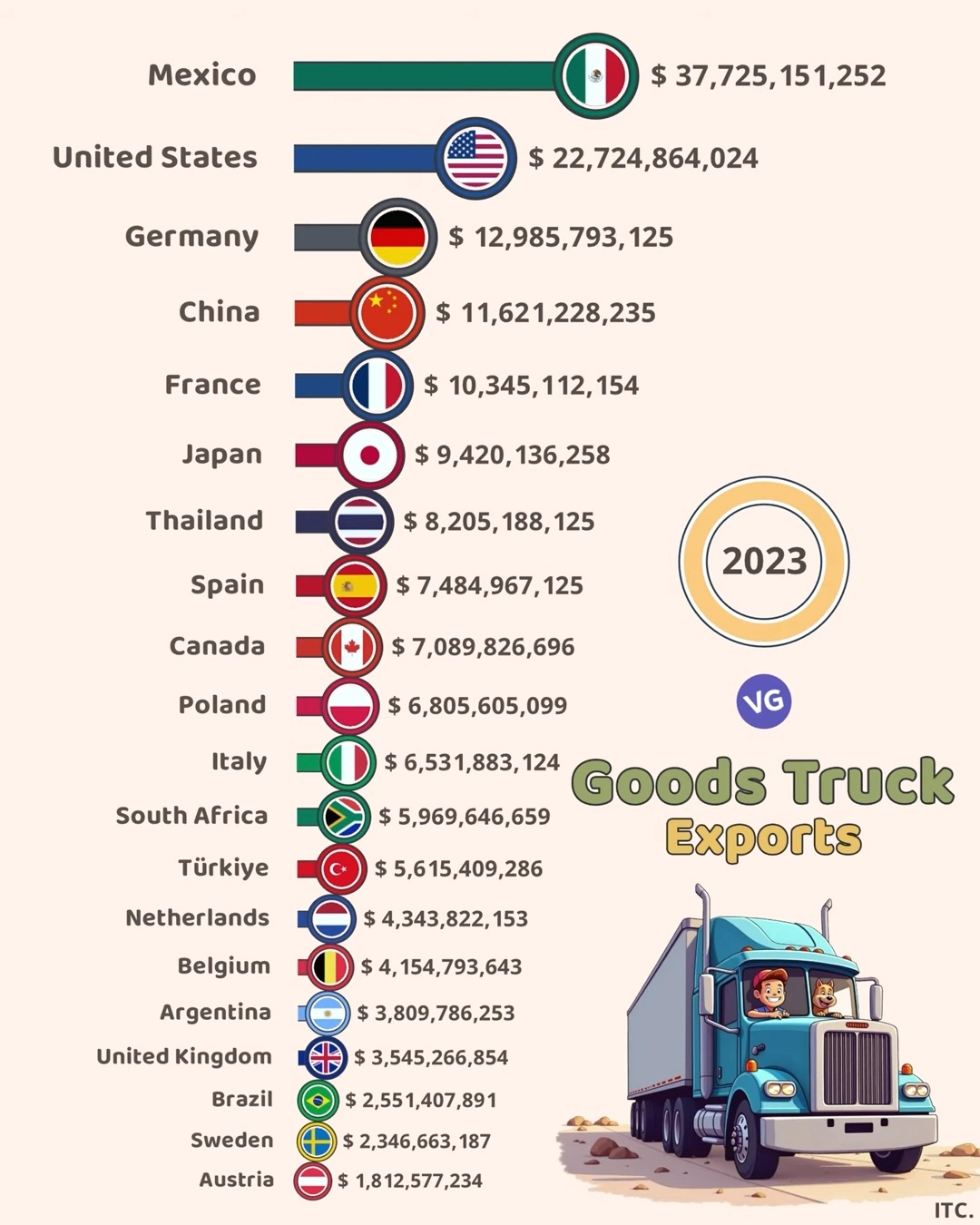

Based on ITC data for 2023, the global goods truck export market shows interesting patterns with significant regional variations and clear market leaders.

Top Goods Truck Exporting Countries (2023)

| Rank | Country & Flag | Truck Exports (USD) |

|---|---|---|

| 1 | 🇲🇽 Mexico | $37,725,151,252 |

| 2 | 🇺🇸 United States | $22,724,864,024 |

| 3 | 🇩🇪 Germany | $12,985,793,125 |

| 4 | 🇨🇳 China | $11,621,228,235 |

| 5 | 🇫🇷 France | $10,345,112,154 |

| 6 | 🇯🇵 Japan | $9,420,136,258 |

| 7 | 🇹🇭 Thailand | $8,205,188,125 |

| 8 | 🇪🇸 Spain | $7,484,967,125 |

| 9 | 🇨🇦 Canada | $7,089,826,696 |

| 10 | 🇵🇱 Poland | $6,805,605,099 |

| 11 | 🇮🇹 Italy | $6,531,883,124 |

| 12 | 🇿🇦 South Africa | $5,969,646,659 |

| 13 | 🇹🇷 Türkiye | $5,615,409,286 |

| 14 | 🇳🇱 Netherlands | $4,343,822,153 |

| 15 | 🇧🇪 Belgium | $4,154,793,643 |

| 16 | 🇦🇷 Argentina | $3,809,786,253 |

| 17 | 🇬🇧 United Kingdom | $3,545,266,854 |

| 18 | 🇧🇷 Brazil | $2,551,407,891 |

| 19 | 🇸🇪 Sweden | $2,346,663,187 |

| 20 | 🇦🇹 Austria | $1,812,577,234 |

Top-Tier Exporters

Dominant Players

- Mexico leads with an impressive $37.7 billion

- United States follows at $22.7 billion

- Germany ranks third with $13.0 billion

These three nations combined account for nearly half of the total exports among listed countries, with Mexico’s dominance being particularly noteworthy.

Regional Distribution

European Representation

Europe shows strong collective presence:

- Germany: $13.0 billion

- France: $10.3 billion

- Spain: $7.5 billion

- Poland: $6.8 billion

- Italy: $6.5 billion

- Netherlands: $4.3 billion

- Belgium: $4.2 billion

Asian Powers

Asian nations demonstrate significant market participation:

- China: $11.6 billion

- Japan: $9.4 billion

- Thailand: $8.2 billion

- Türkiye: $5.6 billion

Americas

The Americas show varying levels of participation:

- Mexico: $37.7 billion

- United States: $22.7 billion

- Canada: $7.1 billion

- Argentina: $3.8 billion

- Brazil: $2.6 billion

Market Implications

Economic Significance

- North American dominance in production

- Strong European manufacturing base

- Asian manufacturers’ competitive position

- Emerging market participation

Industry Trends

- Regional manufacturing hubs

- Trade relationship impacts

- Supply chain integration

- Technology adoption levels

- Manufacturing capability differences

Future Considerations

The data suggests several key trends:

- Continued strength of traditional manufacturing nations

- Mexico’s emergence as a global leader

- Balanced distribution across developed economies

- Important role of regional trade agreements

This comprehensive view of the global goods truck export market demonstrates the complex nature of automotive manufacturing and international trade in heavy vehicles.