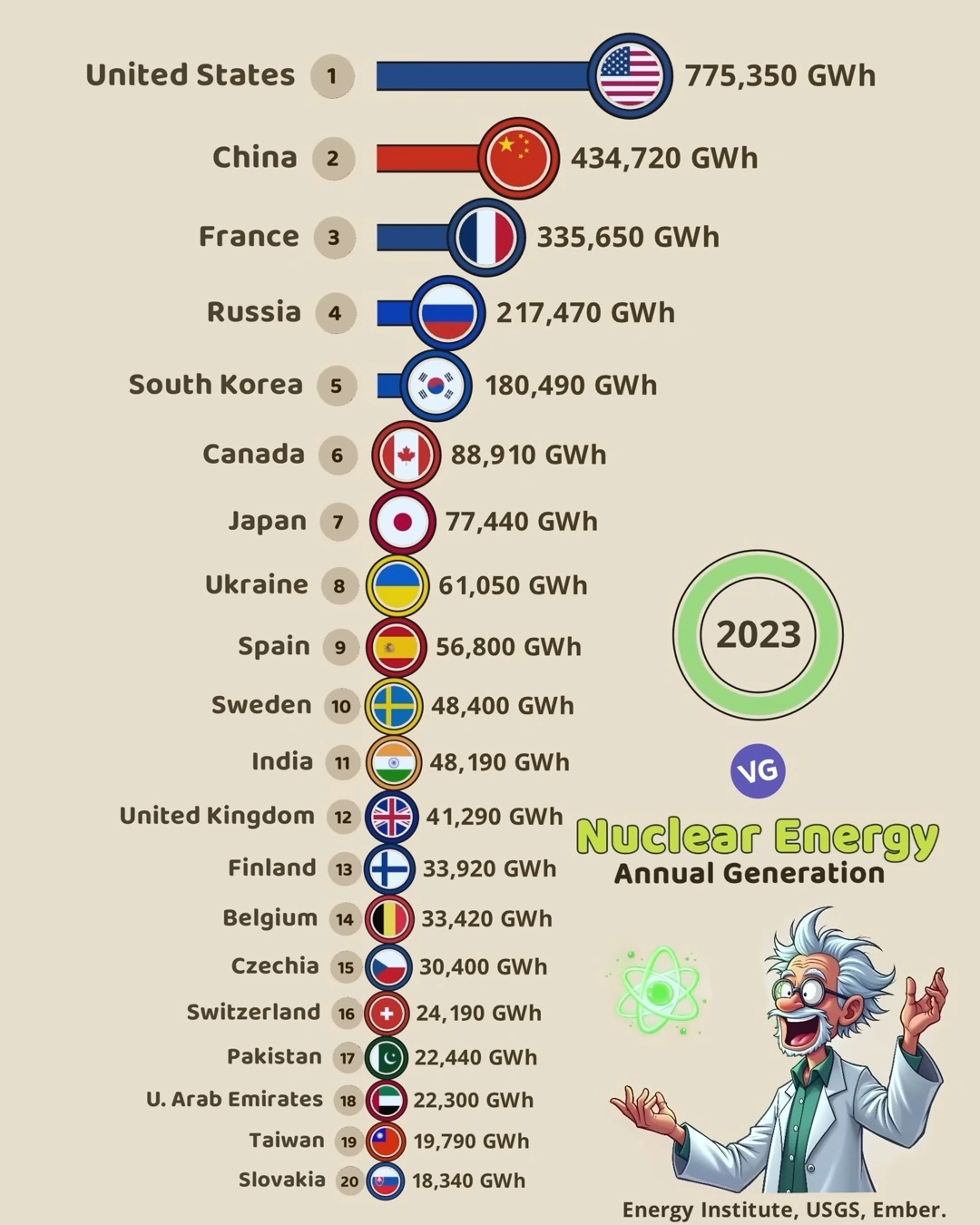

In an era of increasing climate concerns and energy security challenges, nuclear power has maintained its position as a significant contributor to the global energy mix. Data from 2023, compiled by the Energy Institute, USGS, and Ember, provides an illuminating snapshot of nuclear energy generation across the world, revealing which nations are at the forefront of this low-carbon power source.

Top Nuclear Energy Generating Countries (2023) 🔋⚛️

| Rank | Country | Nuclear Generation (GWh) |

|---|---|---|

| 1 🇺🇸 | United States | 775,350 GWh |

| 2 🇨🇳 | China | 434,720 GWh |

| 3 🇫🇷 | France | 335,650 GWh |

| 4 🇷🇺 | Russia | 217,470 GWh |

| 5 🇰🇷 | South Korea | 180,490 GWh |

| 6 🇨🇦 | Canada | 88,910 GWh |

| 7 🇯🇵 | Japan | 77,440 GWh |

| 8 🇺🇦 | Ukraine | 61,050 GWh |

| 9 🇪🇸 | Spain | 56,800 GWh |

| 10 🇸🇪 | Sweden | 48,400 GWh |

| 11 🇮🇳 | India | 48,190 GWh |

| 12 🇬🇧 | United Kingdom | 41,290 GWh |

| 13 🇫🇮 | Finland | 33,920 GWh |

| 14 🇧🇪 | Belgium | 33,420 GWh |

| 15 🇨🇿 | Czechia | 30,400 GWh |

| 16 🇨🇭 | Switzerland | 24,190 GWh |

| 17 🇵🇰 | Pakistan | 22,440 GWh |

| 18 🇦🇪 | UAE | 22,300 GWh |

| 19 🇹🇼 | Taiwan | 19,790 GWh |

| 20 🇸🇰 | Slovakia | 18,340 GWh |

The Global Nuclear Titans

The United States stands as the undisputed leader in nuclear energy production, generating a substantial 775,350 GWh in 2023. This impressive output is nearly twice that of China, which holds the second position with 434,720 GWh. France, long known for its commitment to nuclear power, secures third place with 335,650 GWh. Together, these three nations account for over 1.5 million GWh of nuclear electricity, demonstrating their outsized role in global nuclear generation.

Regional Nuclear Powers

Russia continues to be a major nuclear player, producing 217,470 GWh and claiming the fourth spot globally. South Korea follows with 180,490 GWh, highlighting East Asia’s growing reliance on nuclear technology for energy security and decarbonization.

North America’s nuclear footprint extends beyond the US, with Canada generating 88,910 GWh and securing sixth place in the rankings. This demonstrates the continent’s continued investment in nuclear as part of its diverse energy portfolio.

European Nuclear Landscape

Europe’s nuclear landscape is particularly diverse and well-developed. Beyond France’s dominant position, Ukraine (61,050 GWh), Spain (56,800 GWh), Sweden (48,400 GWh), the United Kingdom (41,290 GWh), Finland (33,920 GWh), Belgium (33,420 GWh), Czechia (30,400 GWh), and Switzerland (24,190 GWh) all feature in the top 20 global producers. This concentration reflects Europe’s historical investment in nuclear technology and its ongoing role in the continent’s energy security framework.

Asian Ambitions

While China ranks second globally, other Asian nations are making significant contributions to nuclear generation. Japan, despite its post-Fukushima challenges, remains the seventh-largest producer with 77,440 GWh. India (48,190 GWh), Pakistan (22,440 GWh), the United Arab Emirates (22,300 GWh), and Taiwan (19,790 GWh) demonstrate the growing adoption of nuclear technology across Asia, where rapidly developing economies seek reliable baseload power to support industrial growth while limiting carbon emissions.

Emerging Nuclear Nations

The presence of the United Arab Emirates at 18th place with 22,300 GWh is particularly noteworthy as a relatively new entrant to the nuclear club. This signals the successful execution of nuclear ambitions in the Middle East and potentially foreshadows further nuclear development in the region.

Production Disparities and Market Implications

The data reveals significant disparities in nuclear generation. The United States produces more than 42 times the nuclear energy of Slovakia, which occupies the 20th position with 18,340 GWh. These differences reflect varying national energy policies, historical investments, geographical sizes, and population demands.

Looking Forward

As nations worldwide grapple with the dual challenges of energy security and climate change mitigation, nuclear energy’s role appears increasingly significant. The substantial generation figures from established nuclear powers, alongside the emergence of new producing nations, suggest a potential nuclear renaissance may be underway.

Countries with existing nuclear infrastructure face decisions about extending plant lifespans, while emerging economies must weigh nuclear’s high capital costs against its low-carbon, reliable generation profile. Advanced nuclear technologies, including small modular reactors (SMRs), could potentially reshape this landscape in the coming decades.

This snapshot of 2023’s nuclear generation provides valuable context for understanding how this controversial yet crucial energy source continues to power significant portions of the global economy while contributing to decarbonization efforts.

Sources: Energy Institute, USGS, Ember (2023)