The international trade of fresh oranges represents a significant segment of the global agricultural market, with certain countries establishing themselves as key players in this vibrant industry. According to 2023 data from the Food and Agriculture Organization (FAO), the global orange export market reveals interesting patterns of production specialization and trade dominance that reflect both geographical advantages and strategic agricultural development.

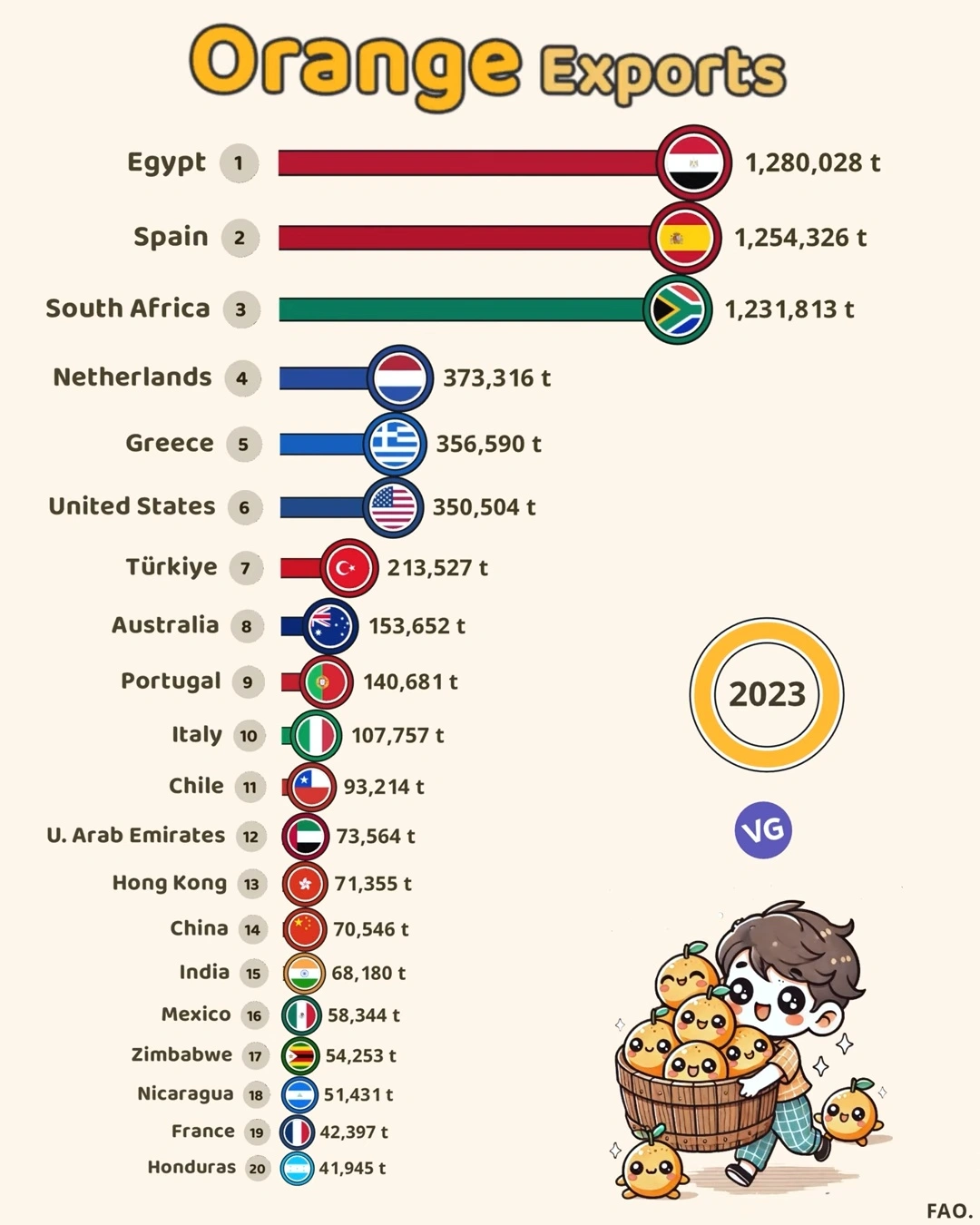

| Rank | Country | Orange Exports (tons) |

|---|---|---|

| 1 🇪🇬 | Egypt | 1,280,028 t |

| 2 🇪🇸 | Spain | 1,254,326 t |

| 3 🇿🇦 | South Africa | 1,231,813 t |

| 4 🇳🇱 | Netherlands | 373,316 t |

| 5 🇬🇷 | Greece | 356,590 t |

| 6 🇺🇸 | United States | 350,504 t |

| 7 🇹🇷 | Türkiye | 213,527 t |

| 8 🇦🇺 | Australia | 153,652 t |

| 9 🇵🇹 | Portugal | 140,681 t |

| 10 🇮🇹 | Italy | 107,757 t |

| 11 🇨🇱 | Chile | 93,214 t |

| 12 🇦🇪 | U. Arab Emirates | 73,564 t |

| 13 🇭🇰 | Hong Kong | 71,355 t |

| 14 🇨🇳 | China | 70,546 t |

| 15 🇮🇳 | India | 68,180 t |

| 16 🇲🇽 | Mexico | 58,344 t |

| 17 🇿🇼 | Zimbabwe | 54,253 t |

| 18 🇳🇮 | Nicaragua | 51,431 t |

| 19 🇫🇷 | France | 42,397 t |

| 20 🇭🇳 | Honduras | 41,945 t |

The Top Tier: A Three-Country Race

The most striking feature of the 2023 orange export data is the remarkable parity among the top three exporters. Egypt leads global orange exports with 1,280,028 tonnes, but this represents only a marginal advantage over Spain (1,254,326 tonnes) and South Africa (1,231,813 tonnes). The difference between the first and third positions is less than 50,000 tonnes—approximately 4% of Egypt’s total—creating essentially a three-way tie at the top of the market.

This trio of countries accounts for a substantial portion of global orange exports, demonstrating specialized expertise in citrus cultivation and international marketing. Their dominance is even more notable given that the fourth-place exporter, the Netherlands (373,316 tonnes), ships less than a third of South Africa’s volume.

Mediterranean Powerhouses

The Mediterranean region features prominently in the global orange trade:

- Egypt has leveraged its favorable climate, water access from the Nile, and proximity to European and Middle Eastern markets to become the world’s leading exporter.

- Spain, with its long tradition of citrus cultivation, maintains a strong second position, benefiting from high-quality produce and close integration with European Union markets.

- Greece (356,590 tonnes) ranks fifth globally, further emphasizing the Mediterranean’s importance in orange production.

- Türkiye (213,527 tonnes), Portugal (140,681 tonnes), and Italy (107,757 tonnes) all rank within the top 10, solidifying the Mediterranean basin as the world’s premier orange-growing region.

Southern Hemisphere Advantage

South Africa’s strong third-place showing (1,231,813 tonnes) highlights a key advantage for Southern Hemisphere producers: counter-seasonal production. South African oranges reach Northern Hemisphere markets during their summer months when domestic production is limited. This same advantage benefits other Southern Hemisphere exporters such as Australia (153,652 tonnes), Chile (93,214 tonnes), and Zimbabwe (54,253 tonnes).

Re-Exporters vs. Producers

An interesting phenomenon in the data is the strong presence of countries that serve primarily as trade hubs rather than major producers:

- The Netherlands ranks fourth with 373,316 tonnes despite having no significant domestic orange production. This reflects its role as Europe’s logistical center and re-exporter.

- Hong Kong (71,355 tonnes) similarly functions as an important trade gateway, particularly for Asian markets.

Regional Distribution Beyond Traditional Producers

Several regions have established significant orange export industries:

- North America is represented by the United States (350,504 tonnes) and Mexico (58,344 tonnes)

- Central America shows emerging participation with Nicaragua (51,431 tonnes) and Honduras (41,945 tonnes)

- South America contributes through Chile (93,214 tonnes)

- Asia makes a modest showing with China (70,546 tonnes) and India (68,180 tonnes)

Market Implications and Future Trends

The global orange export landscape reflects several key market dynamics:

- Climate dependency: The concentration of production in Mediterranean and subtropical regions highlights the specific climate requirements for commercial orange cultivation.

- Logistics and freshness challenges: The perishable nature of fresh oranges makes efficient supply chains essential, explaining the success of countries with advanced agricultural logistics.

- Market diversification: The presence of emerging exporters from diverse regions suggests ongoing market evolution and adaptation to changing consumer demands.

- Value-added opportunities: While this data covers fresh oranges, many of these countries also participate in the processed citrus market (juices, concentrates), adding value to their agricultural output.

As climate change, water scarcity, and shifting trade relationships continue to evolve, the global orange export landscape may see significant changes in the coming years, with implications for producers, traders, and consumers worldwide.

Source: Food and Agriculture Organization (FAO), 2023 data