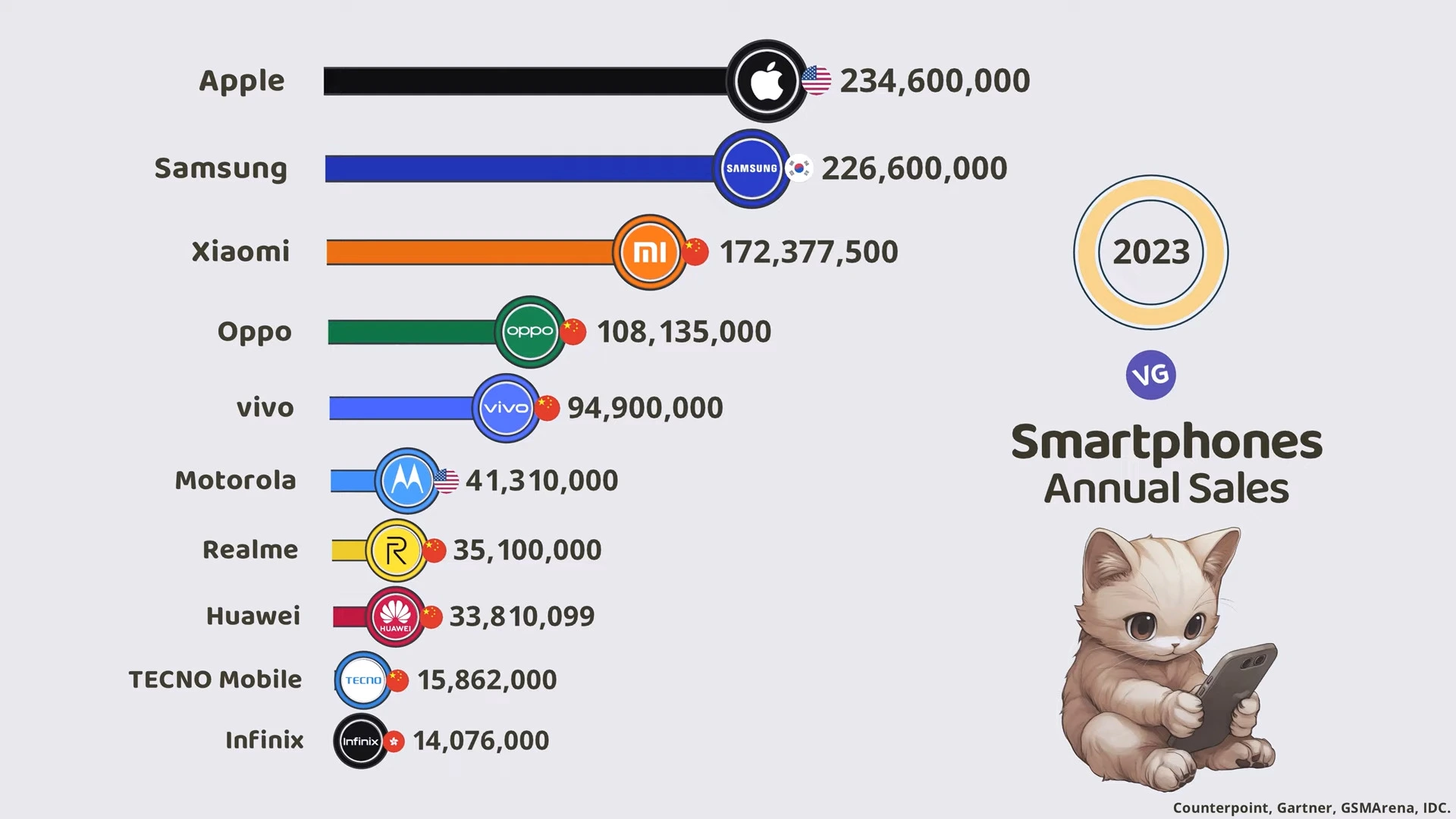

The smartphone industry continues to be one of the most competitive and innovative technology sectors globally. The 2023 annual sales figures reveal significant insights into consumer preferences, market dynamics, and the shifting balance of power among manufacturers. This year’s data shows some surprising trends that are reshaping the industry landscape.

Top Smartphone Brands by Annual Sales (2023)

| Brand | Country Flag | Units Sold |

|---|---|---|

| Xiaomi | 🇨🇳 China | 172,377,500 |

| Oppo | 🇨🇳 China | 108,135,000 |

| Vivo | 🇨🇳 China | 94,900,000 |

| Realme | 🇨🇳 China | 35,100,000 |

| Huawei | 🇨🇳 China | 33,810,099 |

| TECNO Mobile | 🇨🇳 China | 15,862,000 |

| Infinix | 🇨🇳 China | 14,076,000 |

| Samsung | 🇰🇷 South Korea | 226,600,000 |

| Apple | 🇺🇸 United States | 234,600,000 |

| Motorola | 🇺🇸 United States | 41,310,000 |

The Battle for Smartphone Supremacy

For the first time in several years, Apple has surpassed Samsung to claim the top position in annual smartphone sales. With 234,600,000 units sold in 2023, Apple demonstrated the enduring appeal of its iPhone lineup despite premium pricing. This achievement likely reflects the success of the iPhone 15 series and continued strong performance of previous models in the secondary market.

Samsung follows closely with 226,600,000 units, maintaining its position as a formidable competitor with just an 8 million unit gap separating it from Apple. The Korean giant’s diverse portfolio spanning premium Galaxy S and Z series to more affordable A-series devices continues to resonate with consumers across different market segments.

Chinese Manufacturers’ Growing Influence

Xiaomi secured a strong third position with 172,377,500 units sold, highlighting its successful strategy of offering feature-rich devices at competitive price points. The substantial gap between Xiaomi and the top two manufacturers has narrowed compared to previous years, signaling increased competitive pressure on the industry leaders.

Oppo and Vivo, with 108,135,000 and 94,900,000 units respectively, round out the top five. Together, these three Chinese brands account for over 375 million smartphones sold in 2023, demonstrating China’s significant influence in the global smartphone market.

Mid-Tier Players and Market Specialists

Motorola’s 41,310,000 units represent a respectable performance for a brand that has strategically positioned itself in the mid-range market, particularly in the Americas. The once-dominant brand continues to find its niche with practical, value-oriented devices.

Realme’s impressive showing of 35,100,000 units highlights the rapid rise of this relatively young brand, which has gained particular traction in emerging markets with its combination of modern design and affordable pricing.

Shifting Market Dynamics

Perhaps most notable is Huawei’s position, with 33,810,099 units sold. Once challenging for global leadership before facing international restrictions, Huawei’s current sales figures represent both a significant decline from its peak and a remarkable resilience given the challenges it has faced.

Emerging players TECNO Mobile (15,862,000 units) and Infinix (14,076,000 units) have successfully carved out growing market shares by focusing on specific regional markets, particularly in Africa and parts of Asia, with devices tailored to local needs and preferences.

Industry Implications

The total annual sales among these top ten manufacturers amount to approximately 976 million smartphones, reflecting the massive scale of the global smartphone market. This figure also indicates a maturing market where replacement cycles are lengthening as consumers hold onto devices longer.

The competitive landscape continues to evolve with innovation focused on camera capabilities, faster charging technologies, artificial intelligence features, and foldable displays. As manufacturers compete for market share in 2024, we can expect continued innovation and fierce competition that ultimately benefits consumers through improved technology at various price points.

Sources: Counterpoint, Gartner, GSMArena, IDC